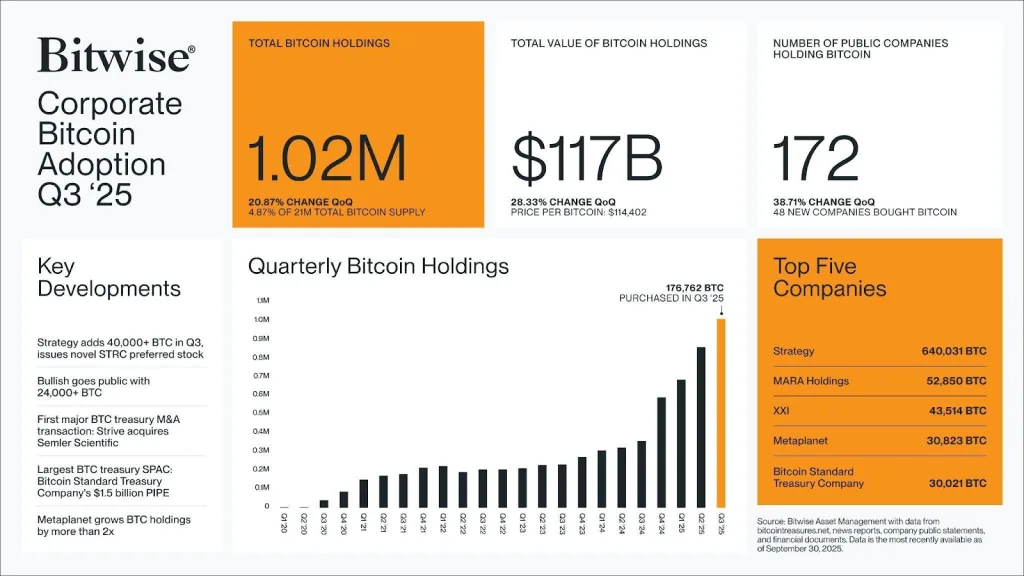

Corporate Bitcoin Holders Rise Nearly 40%, Adding 48 New Companies

- Bitcoin holdings among public firms reached 1.02 million BTC worth $117B in Q3 2025.

- A total of 172 companies now hold Bitcoin, showing more than 38% quarterly increase in adoption.

- Corporate treasuries added 176K BTC, marking their strongest quarter of accumulation.

Corporate Bitcoin adoption reached record levels in Q3 2025, according to Bitwise’s Corporate Bitcoin Adoption Report. The report revealed that public companies now hold 1.02 million BTC, equal to 4.87% of Bitcoin’s total supply. The combined value of these holdings hit $117 billion, a 28.33% quarter-over-quarter increase.

A total of 172 companies now hold Bitcoin, including 48 new entrants, a 38.71% increase from the previous quarter. Analysts interpret the trend as being indicative of increased institutional confidence and a developed financial environment.

Strategy Leads as Corporate Holdings Cross 1M BTC

Strategy, led by Michael Saylor, remains the top corporate holder with 640,031 BTC, setting a benchmark for treasury adoption. It was followed by MARA Holdings with 52,850 BTC, XXI with 43,514 BTC, and Metaplanet with 30,823 BTC. The Bitcoin Standard Treasury Company rounded out the top five with 30,021 BTC. Together, these firms represent a large portion of the total corporate Bitcoin pool.

According to Bitwise, the total Bitcoin holdings of companies surpassed 1 million BTC in Q3 2025, following an additional 176,762 BTC accumulated during the quarter. With Bitcoin averaging $114,402 over that period, corporate holdings saw their market value rise by more than $25 billion in just three months.

The strong buying pressure reflects the trust of corporate treasuries in the crypto market, with a 20.87% increase in total BTC holdings during the quarter. Given that almost 5% of the total Bitcoin supply is now owned by public companies, the digital currency is gradually being recognized as a mature investment option.

Key Developments and Institutional Expansion

The quarter featured major corporate activity around Bitcoin. Strategy added over 40,000 BTC and issued a novel STRC preferred stock, while Bullish went public with 24,000 BTC on its books. Meanwhile, Strive completed the first Bitcoin-treasury M&A by acquiring Semler Scientific.

Another highlight was the largest Bitcoin-focused SPAC deal to date, where Bitcoin Standard Treasury Company closed a $1.5 billion PIPE. Additionally, Metaplanet more than doubled its Bitcoin holdings in the same period.

Bitwise CEO Hunter Horsley described the surge as “absolutely remarkable,” adding that “people want to own Bitcoin, companies do too.” Bitget CEO Gracy Chen echoed this view, noting that firms are increasingly viewing Bitcoin “not just as a hedge against inflation but as a long-term reserve asset.”

Related: Coinbase Unveils Bitcoin-Themed Amex Card with BTC Cashback

Institutional demand remained strong throughout the quarter. Bitcoin-linked investment products recorded $2.67 billion in inflows last week alone, part of a broader $3.17 billion across digital asset funds. Year-to-date inflows reached a record $48.7 billion, according to CoinShares.

According to sources, Chen credited the momentum to supportive policies under the Trump administration, including the approval of U.S. Bitcoin Reserves and new SEC standards for commodity trust listings. She projected continued ETF inflows and adoption across balance sheets, suggesting Bitcoin could approach $160,000 in Q4.