Crypto Leverage Falls as Coinbase Reports Strong Market Reset

- Leverage transitions from high summer peaks to the steady four to five percent zone.

- ETF flows shift as billions exit Bitcoin and Ethereum, and traders unwind heavy risk.

- Coinbase states the market stands on firmer ground after wide speculative clearing.

The crypto market enters December with reduced leverage after Coinbase reported a major decline in speculative activity. The systemic leverage ratio dropped from a summer peak near 10% to a 4–5% zone. The firm linked the shift to November’s positioning reset, which included a 16% fall in open interest across BTC, ETH, and SOL perpetual futures. U.S. spot ETFs also recorded $3.5 billion in Bitcoin outflows and $1.4 billion in Ethereum outflows.

Funding rates on BTC perpetual futures fell two standard deviations below their 90-day average before recovering. As the market adjusts, one question forms at the center of institutional discussions: Does a cleaner leverage base create room for steadier conditions as year-end approaches?

Leverage Trends Shift After Months of Speculation

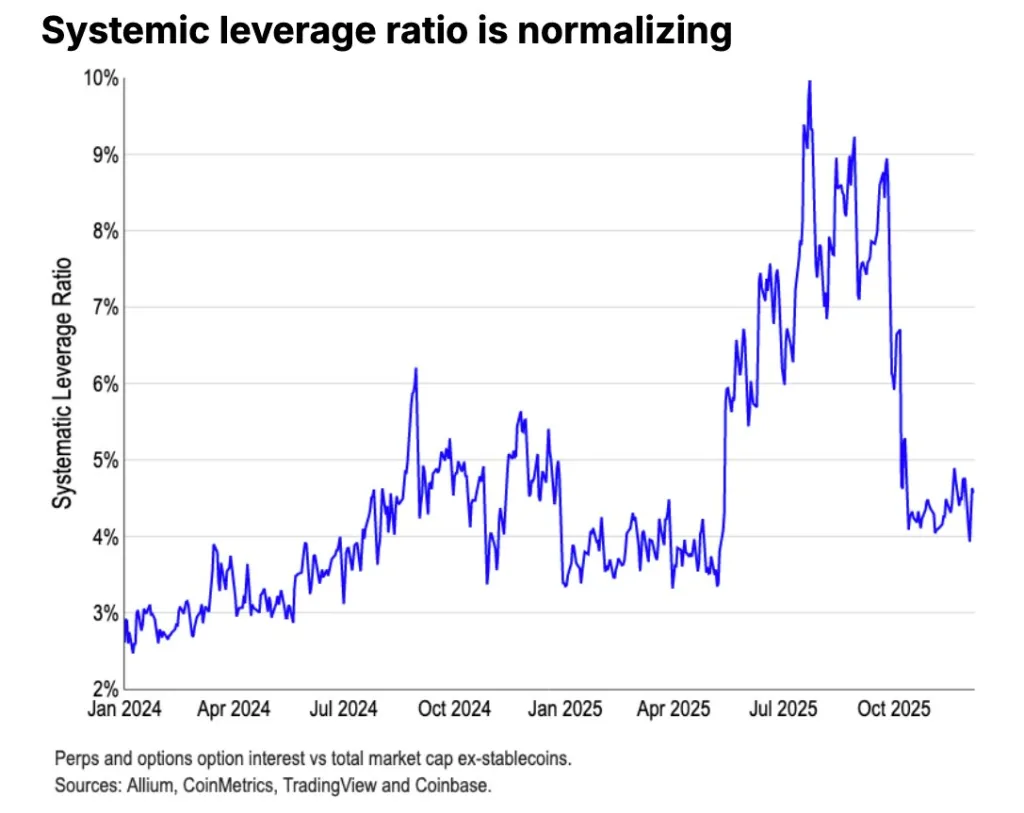

The chart posted by Coinbase on X tracks the systemic leverage ratio from January 2024 through late 2025. It records leverage near 2.8% at the start of 2024 before showing rising activity through spring. It then reveals a move above 4% during mid-2024 as derivative positions increased. The ratio later touched the 6% area in early October 2024.

Next, the data shows a brief cooldown in early 2025. Conditions changed again as the metric surged above 7% in mid-2025. It then reached its highest level near 9–10% during the summer. This shift reflected a buildup of speculative positions that shaped market behavior through the season.

The sharp reversal appears from August to October 2025. The ratio fell quickly from the extreme band and returned to the 4–5% area. Coinbase stated that the reduction confirmed a meaningful flush-out of speculative exposure. The firm said the leveled zone steadied at about half the summer peak.

Market Reset Driven by Derivatives and ETF Outflows

Coinbase said the November reset played a central role in normalizing leverage. Open interest across BTC, ETH, and SOL perpetuals fell 16% month-over-month. This change reduced speculative load across major trading pairs. Funding rates also shifted as BTC perpetuals dropped well below their 90-day average. Rates later recovered as the market recalibrated.

ETF flows added another factor. Coinbase stated that U.S. spot ETFs saw $3.5 billion exit BTC holdings and $1.4 billion exit ETH holdings. These outflows removed additional market exposure. As a result, leveraged traders closed positions or reduced risk. This process cleared speculative layers that fueled earlier volatility.

Coinbase said the combined moves produced a healthier structural base. The firm described the development as a return to steadier conditions after months of elevated leverage. This view rested solely on observed data rather than market sentiment.

Related: Coinbase Reopens in India as Asia Crypto Demand Increases

Outlook Stabilizes as Speculative Excess Clears

The systemic leverage ratio now stands between 4% and 5% of total market cap excluding stablecoins. Coinbase said this level aligns with a normalized market environment. The firm added that reduced leverage lowers vulnerability to sharp declines. This change creates space for calmer activity as December progresses.

Analysts cited by Coinbase now describe the mood as cautiously optimistic. This tone reflects the removal of extreme leverage rather than new bullish pressure. The market holds less concentrated risk, and prior liquidation threats have eased.

Yet the direction ahead depends on new catalysts. ETF flows may shift again. Macro events can shape short-term demand. Regulatory news can influence asset behavior. Derivatives traders may also increase positions if market conditions improve. Coinbase said the market sits on steadier ground for now, due to the notable reduction in speculative exposure.