India Tops Global Crypto Adoption Index for the Third Year

- India tops global crypto adoption for a third year, driven by grassroots participation.

- The U.S. climbs to second place, fueled by ETFs and strong institutional involvement.

- APAC emerges as the fastest-growing crypto hub, led by India, Pakistan, and Vietnam.

India has held the number one spot in global cryptocurrency adoption for three consecutive years. The country’s rise highlights the strength of grassroots participation, despite a heavy tax regime and uncertain regulations. Unlike developed markets that rely on institutional products, India’s crypto economy is powered by retail users, remittances, and small-scale investors.

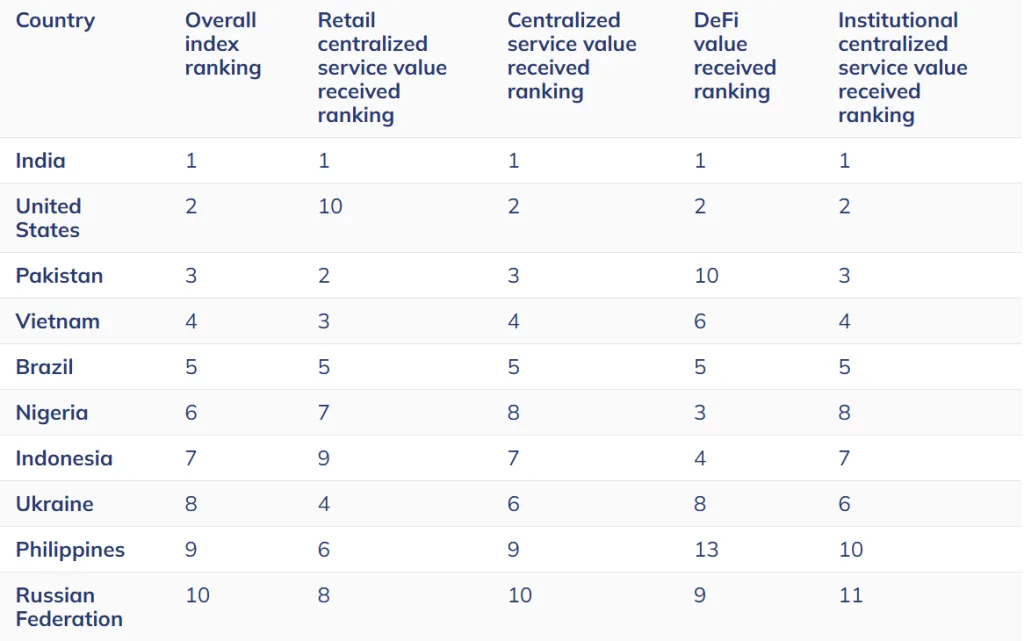

The 2025 Global Crypto Adoption Index by Chainalysis ranked 151 countries on retail activity, institutional engagement, and DeFi usage. India took the first position again, while the United States took the second, representing a different pattern of adoption.

Grassroots Strength in India

India ranked first across every key category: retail centralized service value, institutional value, and DeFi engagement. Peer-to-peer networks and decentralized platforms have been critical, especially after restrictions on offshore exchanges in 2023.

Grassroots users still used it, even though a $30% tax on gains and a 1% tax deductible at source (TDS). The resilience highlights the need-based and access-based adoption in India as opposed to policy support.

Experts note that India’s strength lies outside major financial hubs. Tier 2 and Tier 3 cities are driving usage, often tied to remittances and mobile-first services. These smaller communities rely on crypto for cheaper transfers and alternative savings, supporting consistent growth. Sumit Gupta, CEO of CoinDCX, called the ranking a sign of untapped potential. He said India’s community could achieve more with regulatory clarity.

Diverging Models of Adoption

The United States climbed from fourth to second place in 2025. Institutional activity powered its ascension, including the approval of spot Bitcoin and Ethereum ETFs. North America registered $2.2 trillion transactions, an increase of 49% year-over-year, with much activity routed via regulated mediums.

This contrasts sharply with India’s model. While in the U.S., adoption is led by financial institutions and ETFs, in India, small investors and decentralized access lead the pack. The two countries represent two different directions of growth in digital assets.

In addition to India and the U.S., Asia-Pacific (APAC) was the most rapidly growing region in terms of crypto adoption. On-chain transaction volume in the region increased 69% on a year-over-year basis, reaching between $1.4 trillion and $2.36 trillion. Pakistan and Vietnam contributed significantly, alongside the leading role of India.

Next came Latin America, at 63% growth, followed by Sub-Saharan Africa at 52%, which is powered by remittances and mobile-based transactions. These statistics point to how emerging economies use crypto in practice, and not in speculation.

Related: The Road Ahead for India’s Crypto Regulations and Growth

South Korea, however, dropped to 15th place in the rankings. Analysts point to stricter rules and reduced retail-friendly policies as reasons for the decline, despite the country’s advanced technology sector.

The report shows there is a split across the globe. The developed markets are influencing adoption using regulation and institutional means. Emerging economies, on the other hand, depend on daily needs such as remittances, savings, and payments.

The sustained leadership of India shows that adoption can succeed even in environments that are restrictive. Its grassroots power implies that, regardless of regulation, digital assets will continue to be part of the everyday financial activities of millions of people.

With Asia-Pacific emerging as the fastest-growing region, the center of crypto adoption is shifting further toward the Global South. The resilience of India’s community and the rise of peer-to-peer systems could shape global trends for years to come.