ETH Whale Activity Signals Growing Investor Confidence

- Ethereum whales resume accumulation, buying back nearly one-sixth of coins sold in October.

- Stablecoin transfer volume on ETH jumps 400%, totaling $581B across 12.5M transactions.

- Rising exchange outflows indicate investors are moving ETH into long-term private holdings.

Ethereum whales are showing renewed confidence after weeks of selling. On-chain data signals a potential shift in investor sentiment as accumulation restarts. Ether’s price climbed slightly over the past week following a period of heavy profit-taking.

Santiment data shows wallets holding between 100 and 10,000 ETH have started buying again. These large holders sold about 1.36 million ETH between October 5 and 16. Since then, they have repurchased nearly one-sixth of the total sold amount. The return of these wallets to accumulation mode is being viewed as an early sign of confidence returning to Ethereum.

Whale Wallets Trigger Major ETH Movements Across Exchanges

Wallet data reveal specific movements that contribute to this trend. One such whale wallet, “0x395,” moved 12,000 ETH valued at $46.3 million from Binance on Oct. 23. The withdrawal occurred at an average price of $3,854 per coin, and the wallet currently contains 67,981 ETH.

The same wallet purchased Ethereum at an average price of $3,027 between June and mid-August and then sold the holdings at around $4,218 in September and early October.

Another whale wallet, labeled “0x86E,” withdrew 8,491 ETH from OKX on October 23. The transaction was worth approximately $32.5 million. The move aligned with other signs of increased whale accumulation across exchanges. On-chain analysts observed similar buying trends throughout late October as large investors re-entered the market.

Blockchain investigators tracked the RadiantCapital exploiter making a major transaction. The address swapped 9.7 million DAI for 2,550 WETH at an average price of $3,803. The funds were moved through Tornado Cash.

Exchange Flows Signal Renewed Ethereum Market Activity

Coinglass data added another layer of insight to exchange flows. Ethereum’s spot inflows and outflows from the middle of October show a surge of outflows from exchanges into personal wallets when compared to inflows into exchanges.

Ether’s price declined more than 11% over the last 60 days. The token briefly tested support around $3,738 before recovering modestly. As of press time, ETH is trading at an average price of $3,939 with a 24-hour trading volume of about $27.53 billion.

Related: Ethereum Whale Deposits $500M USDT Ahead of Stable Launch

Beyond price action, USDT’s activity on Ethereum has surged. Token Terminal data shows a 400% rise in transfer volume during the past 30 days. Total transaction volume reached $581 billion across over 12.5 million transfers. The total market capitalization of stablecoins on Ethereum stands at $163.10 billion. This growth reinforces Ethereum’s dominance in on-chain dollar settlements and payment infrastructure.

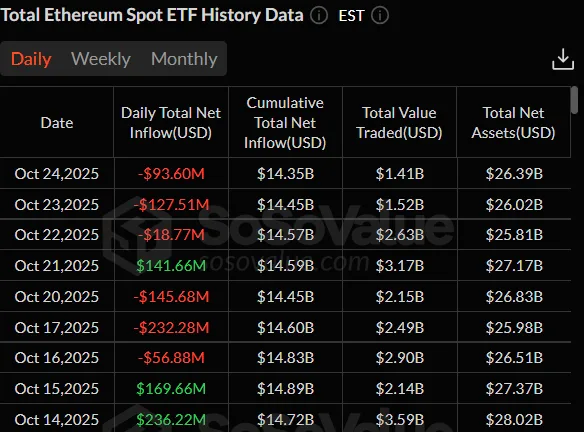

ETF data reflected a split in investor behavior. On October 24, Ethereum spot ETFs recorded $93.6 million in outflows. In contrast, Bitcoin ETFs saw $90.6 million in inflows the same day. It was the third straight session of ETH ETF outflows.

The latest whale movements, paired with a surge in on-chain activity, indicate that confidence in Ethereum is gradually returning despite recent ETF outflows. The growing stablecoin volume highlights sustained demand for Ethereum’s network as a settlement layer, suggesting that institutional and retail players still view it as a long-term cornerstone of the crypto economy. While short-term volatility persists, the shift from selling to accumulation among major holders could mark the early stages of renewed market optimism for ETH.