Ethena Explains Oracle Rules After USDe Depeg Incident

- Guy Young said over $9B in collateral stayed redeemable despite Binance mispricing.

- Liquidity pools on Curve, Uniswap, and Fluid showed under 30 bps deviation overall.

- Analysts blamed unified collateral systems and isolated feeds for heavy forced sales.

A sudden pricing collapse on Binance during the October 10 market crash led to renewed scrutiny over how synthetic dollar assets are priced and protected during volatility. The incident happened as liquidations swept digital assets across exchanges late on Friday.

This led to a sharp difference between Binance’s internal oracle feed and deeper on-chain liquidity sources. Ethena Labs founder Guy Young said the event involved no collateral failure and confirmed that over $9B in backing remained accessible during the stress period.

Public Address Follows Oracle Mispricing

Guy Young released a detailed breakdown of Ethena’s oracle logic, stating that private guidance provided to DeFi and CeFi partners would now be surfaced publicly. He said the protocol distinguishes between two scenarios: temporary price dislocation and permanent collateral impairment.

According to him, USDe has never experienced impairment, while short-term deviations are common across collateralized assets. Young defended DeFi platforms that hardcode USDe to USDT during volatility, noting that it prevents unnecessary liquidations when secondary markets drift briefly.

He argued that all major liquidity pools, including Curve, Uniswap, and Fluid, saw pricing remain within a 30 basis point deviation during the crash. He also said no user would have faced liquidation if oracle systems had referenced the deepest liquidity instead of isolated index feeds.

However, the venue that priced USDe near $0.65 relied on its own orderbook rather than broader market data. Binance reportedly restricted deposits and withdrawals during the event, preventing market makers from closing spreads. That created a feedback loop, as unified collateral systems on the exchange treated the distorted feed as accurate.

$2B Withdrawn in 24 Hours Without Interruptions

Young stated that Ethena’s mint and redemption systems processed more than $1 billion in withdrawals over several hours and $2 billion across a single day. He added that $9 billion in collateral was available for redemption and that only a fraction was used.

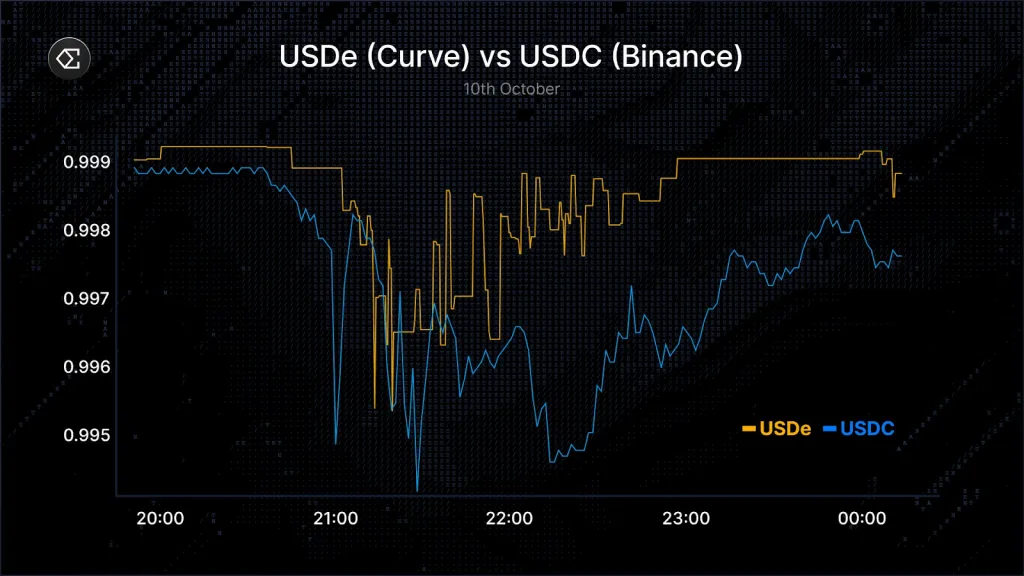

He described USDe during the event as a wrapper on USDC and USDT, saying no basis positions needed to be unwound for redemptions. Similar pricing on Curve showed USDe move from roughly 0.999 to 0.996 around 21:00 UTC before returning near 0.998 by midnight.

Binance’s USDC, not USDe, showed a sharper drop to about 0.995 before recovering toward 0.998. Young shared a chart comparing Curve prices for USDe against Binance pricing for USDC, noting a roughly 0.3% gap over a four-hour span.

He said that external oracle providers, including Chainlink and Chaos Labs, have access to Ethena’s on-chain proof-of-reserves data. Platforms that want real-time confirmation of backing through read API keys can request access, Young noted. He added that this allows oracle operators to quickly determine whether a price drop shows a lasting impairment or a temporary move.

Related: Binance Reviews User Losses After USDe, BNSOL, and WBETH Depeg

Analysts Split on Impact but Agree on Cause

Researcher Pavel Altukhov pointed to Binance’s unified collateral structure as a driver of the sell-off. He said traders faced margin calls across assets like wBETH and USDe, which amplified forced sales when the internal oracle mispriced them. ElonTrades claimed someone may have exploited those pricing mechanics by manipulating venue-specific feeds.

Notably, Tether CEO Paolo Ardoino used the incident to promote USDT as a safer source of collateral. He said that low liquidity assets cannot withstand fast market changes, referencing obscure tokens to illustrate his criticism.

Ethena outlined several mechanisms in its risk framework. These include multiple price sources across centralized exchanges and DeFi pools, real-time failover to alternative feeds, proof-of-reserves monitoring, and collateral rebalancing. The protocol said it will continue advising partners to distinguish between dislocation and impairment rather than rely on a single feed.

Meanwhile, the October disruption exposed how a single exchange’s pricing system can lead to wider stress despite intact collateral. Ethena reported uninterrupted redemptions, billions in accessible backing, and no deviation on major liquidity pools beyond normal basis ranges. Publicly outlining its oracle logic, the firm said future coordination with exchanges and providers will determine whether similar incidents recur.