Ethereum Rebounds Above 2000 as BitMine Stock Jumps Today

- Tom Lee called Ethereum the future of finance during a volatile market period.

- BitMine shares surged then fell as unrealized ETH losses reached a billion-dollar level.

- Ethereum rebounded above 2000 even as trading volume declined sharply today. globally.

BitMine chairman and Fundstrat co-founder Thomas (Tom) Lee reaffirmed his bullish stance on Ethereum, calling it “the future of finance,” as both ETH prices and BitMine shares moved sharply this week. Lee’s comments followed remarks from Ethereum co-founder Vitalik Buterin, who described ETH as a store of value and a foundation for key blockchain applications.

Together, the statements drew renewed attention from investors and analysts during a period of heightened volatility across crypto-linked assets.

Ethereum Narrative Gains Attention

Lee’s endorsement came as discussions continued around Ethereum’s role in decentralized finance, non-fungible tokens, and institutional adoption. Traders reported higher activity on major exchanges following the public exchange between Lee and Buterin.

Market observers noted that the remarks reinforced confidence in Ethereum’s long-term positioning despite ongoing regulatory uncertainty. Ethereum’s price action reflected that backdrop. Over the past 24 hours, ETH rose 5.59% to $2,011.39, according to CoinMarketCap.

The move followed an early dip near $1,917 before buyers pushed prices toward the $2,100 level. Market capitalization climbed to $242.76 billion, while 24-hour trading volume fell 25.59% to $53.09 billion, signaling thinner turnover during the rebound.

BitMine Shares Swing With Treasury Exposure

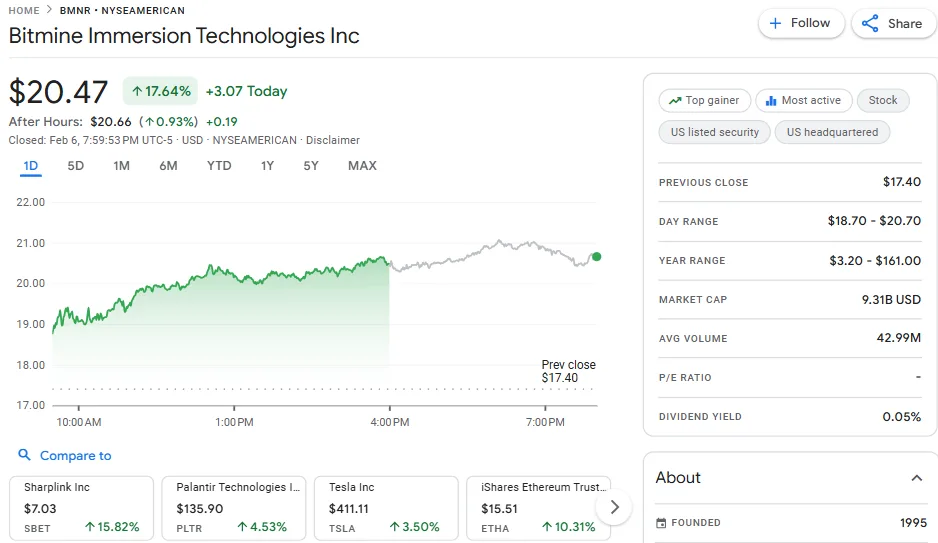

Shares of BitMine Immersion Technologies Inc surged 17.64% on Friday, closing at $20.47 on NYSE American data from Google Finance. The stock traded between $18.70 and $20.70, well above the prior close of $17.40.

Source: Google Finance

After-hours trading added to gains, with shares rising to $20.66, up another 0.93%. BitMine’s market capitalization now stands at $9.31 billion, supported by an average daily volume of 42.99 million shares.

Despite the rally, the stock remains far below its 52-week high of $161, though still above its $3.20 yearly low. The company reports no meaningful price-to-earnings ratio and offers a 0.05% dividend yield.

Unrealized ETH Losses Come Into Focus

Earlier in the week, BitMine shares fell 11% to around $18.05, marking a seven-month low after unrealized losses on ETH holdings approached $8 billion. The decline followed ETH’s drop toward $2,300, which reduced the value of BitMine’s treasury holdings.

The firm holds about 4,285,125 ETH, valued near $8.4 billion, and was down more than $6 billion on paper at one point. Responding on X, Lee said, “Crypto is in a downturn, so naturally, ETH is down.” “BMNR will see ‘unrealized’ losses on our holdings of ETH during these times,” he added. “It’s not a bug, it’s a feature.”

Based on BitMine’s reported cost basis from a November 10-Q filing and later purchases, analytics platform DropsTab estimates unrealized losses near $8.02 billion, or about 49% of the investment.

Related: BitMine Immersion Puts $200M Into MrBeast’s Beast Industries

Conclusion

Ethereum and BitMine remained tightly linked this week as market volatility tested long-term crypto strategies. Tom Lee repeated his view that short-term drawdowns reflect market cycles rather than structural weakness.

The market showed renewed buying interest towards Ethereum after its price increased, yet trading volumes remained lower than normal. The price movements of BitMine shares showed similar patterns to the changes in Ethereum prices, which proved that treasury-based holdings of crypto companies increased their financial results.

As ETH prices rose, market participants watched closely: Will sustained price recovery validate Lee’s long-term Ethereum thesis?