Fed Rate Cut Leads to Whale Moves in ETH, SOL, XRP, and BTC

- Ethereum whales bought and withdrew millions in ETH hours after the Fed’s 25-bp rate cut.

- FalconX withdrew $28.39M in SOL, showing institutional whale moves after the Fed decision.

- XRP saw $6.8M in liquidations as whale behavior impacted spot and derivatives positions.

The U.S. Federal Reserve cut interest rates by 25 basis points on Wednesday, September 17, 2025, responding to labor market concerns. The decision had an immediate effect on the crypto market as large holders of Ethereum, Solana, Bitcoin, and XRP executed sizable transactions. The activity showed how U.S. monetary policy directly impacts crypto liquidity through whale behavior and on-chain capital flows.

Ethereum Whales React Accumulation

Within hours of the Fed announcement, Ethereum whales initiated notable moves. According to Lookonchain, a whale spent $112.34 million USDC to acquire 25,000 ETH at $4,493. The aggressive purchase followed renewed expectations that lower borrowing costs and a weakened dollar could support risk assets like digital assets.

Another large Ethereum address, 0x96F4, separately withdrew 15,200 ETH worth $70.44 million from Binance. This fast accumulation suggested increased confidence among whales.

CryptoQuant shows that unrealized profit among Ethereum whales holding 10,000 to 100,000 ETH has reached levels last seen in 2021. These levels often align with periods when whales reassess positions and consider partial profit taking. Higher unrealized gains historically lead to either distribution or short-term selling pressure.

Solana Sees Institutional Withdrawals

Solana also recorded notable whale transactions following the Fed’s rate cut. Institutional brokerage FalconX withdrew 193,458 SOL worth $47.67 million from Binance, OKX, and Bybit, indicating continued institutional interest in the network. The withdrawal occurred within the same trading window as Ethereum’s accumulation, showing coordinated reactions across major layer-1 ecosystems.

Still, broader whale activity across chains was mixed. Onchain Lens reported one whale transferring 5,000 ETH, valued at $22.84 million, into Binance for potential liquidation. Historical patterns indicate that such transfers to exchanges often precede profit-taking phases, even as other whales accumulate.

Related: Forward Industries Secures $1.65B to Lead Institutional Solana Growth

XRP Liquidations Amid Whale Activity

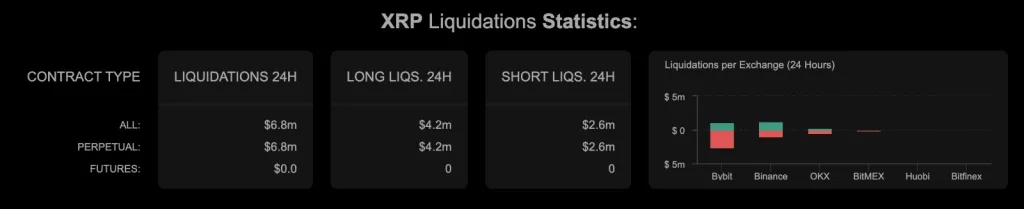

XRP’s derivatives market showed immediate stress during the same period. Coinalyze data shows total liquidations of $6.8 million within 24 hours, with Bybit accounting for $2.8 million and Binance $2.6 million.

OKX recorded $1.2 million, with BitMEX reporting a minimal $0.1 million. The liquidations occurred as whales adjusted supply positions.

While Ethereum and Solana recorded net withdrawals and accumulation, XRP markets saw leveraged traders forced out of positions. This shows that whale behavior not only affects spot transactions but also interacts with derivatives exposure, amplifying volatility.

Bitcoin flows during the surrounding weeks show similarities with the other assets. Between August 24 and early September, BTC experienced heavy net outflows, with multiple spikes below negative $200 million.

Those periods aligned with price dips toward $105,000 to $110,000. However, by mid-September, inflows began balancing outflows, supporting a climb toward $117,000 to $118,000 by September 18. This balance indicated a reduction in selling pressure, allowing prices to stabilize.

The Fed’s 25 basis point rate cut led to immediate and notable responses across crypto markets. Ethereum whales accumulated aggressively, Solana saw institutional withdrawals, and XRP recorded sharp liquidations.

Meanwhile, Bitcoin flows moved toward equilibrium, indicating reduced selling pressure. Together, these moves show how macroeconomic policy decisions quickly change into whale transactions, influencing liquidity across leading digital assets.