Fidelity FDIT Hits $200M, Rival BlackRock BUIDL Fund

- Fidelity crosses $200M as investors turn to tokenized Treasury assets for secure access.

- BlackRock BUIDL holds $2.2B, but Fidelity positions itself as a direct market competitor.

- Tokenized treasury funds exceed $5B, with asset managers adopting blockchain technology.

Fidelity’s Fidelity Digital Interest Token (FDIT) has surpassed $200 million in assets under management, a clear signal of accelerating institutional adoption of tokenized funds. The blockchain-based instrument, launched quietly in August, operates on Ethereum and functions as a tokenized share class of Fidelity’s Treasury Digital Fund (FYOXX).

The fund invests exclusively in U.S. Treasuries and cash, offering regulated exposure on-chain with Bank of New York Mellon acting as custodian. Based on the data released on rwa.xyz, the new milestone takes the total assets of FDIT above the $203 million mark. Fidelity applies an annual management fee of 0.20%, positioning the product competitively in the expanding tokenized Treasury market.

Portfolio Structure and Market Mechanics

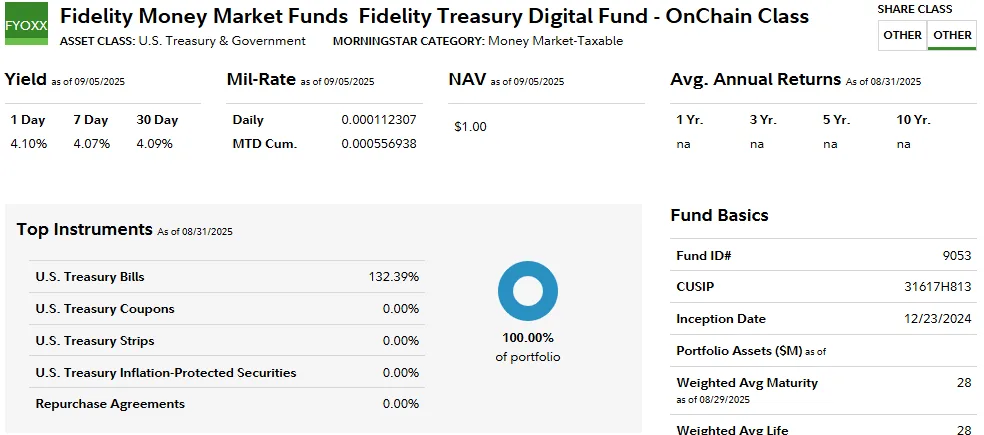

The portfolio structure and mechanics of FDIT mirror those of the Fidelity Treasury Digital Fund (FYOXX), which is fully invested in U.S. Treasuries and cash. As of September 5, 2025, the net asset value is 1.00, underpinned by a 1-day yield of 4.10%, a 7-day yield of 4.07%, and a 30-day yield of 4.09%.

Fidelity’s disclosures indicate a daily mil rate of 0.000112307 and a cumulative month-to-date figure of 0.000556938. The portfolio allocation consists entirely of U.S. Treasury Bills, totaling 132.39%.

The fund was started on December 23, 2024, and the weighted average maturity and life of 28 days mean the structure is liquid and stable, making the instrument an appropriate balance sheet tool in institutions.

These characteristics put FDIT at the crossroads between the conventional activities of the money market and blockchain innovation. The blend enables the investors to invest in safe government securities and take advantage of the Ethereum settlement efficacy.

Related: Grayscale Launches Ethereum ETF ETCO to Generate Income

The Widening Tokenized Treasury Market and Competition.

The development of fidelity occurs in the context of increased competition, particularly with the BUIDL fund of BlackRock. Formally named the BlackRock USD Institutional Digital Liquidity Fund, BUIDL has already expanded to exceed $2.2 billion in AUM and is available on various blockchains by way of Securitize administration.

Although BUIDL maintains a commanding lead, FDIT issued by Fidelity can be seen as a direct threat and an indicator that the traditional asset managers do not consider tokenized funds an experiment but a structural alteration. The question is, how fast will institutional adoption scale in this new asset class?

Industry data confirms the broader momentum. Tokenized U.S. Treasuries have now exceeded $5 billion in combined market size, driven by growing demand for efficient settlement, collateral use, and on-chain liquidity solutions. Institutions such as Goldman Sachs and BNY Mellon are also developing tokenized money market operations, demonstrating the systemic move toward blockchain-based infrastructure.

By embedding U.S. Treasury exposure directly on Ethereum, Fidelity is no longer simply testing blockchain applications but is actively building investment infrastructure. The development places the company directly alongside BlackRock in a race that will likely shape the future design of global capital markets.