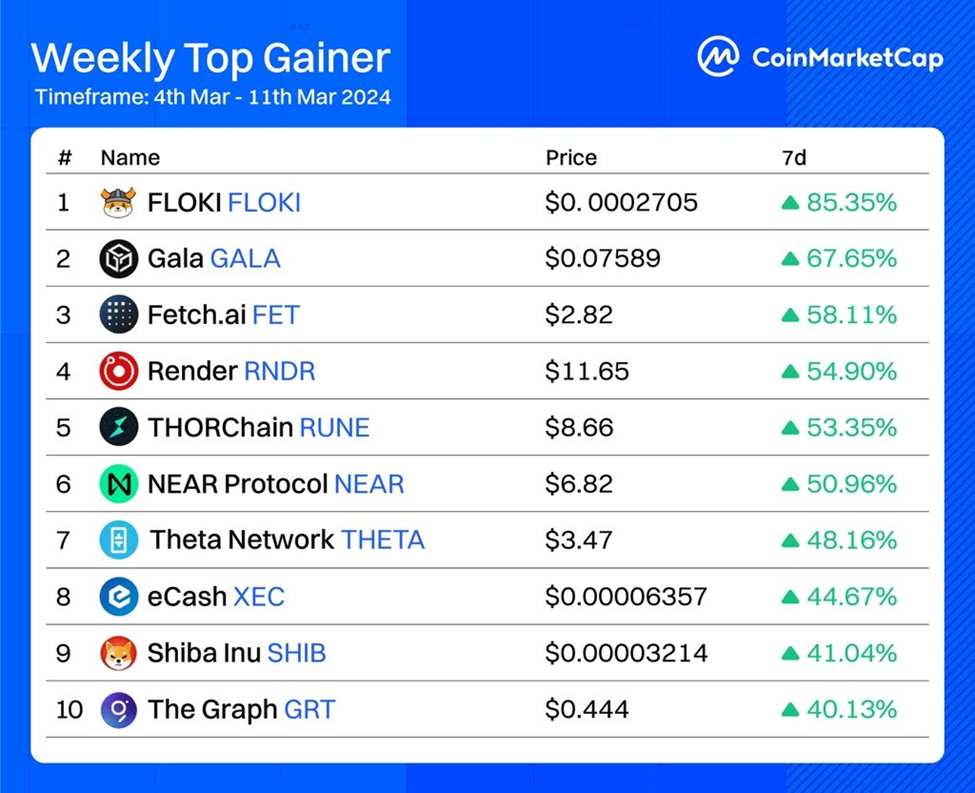

CoinMarketCap's latest report showcases FLOKI's remarkable surge of 85.35%, establishing its dominance and outpacing competitors by a considerable margin.

FLOKI's surge highlights the dynamic nature of crypto markets, with an 85% surge in 7 days, alongside a robust trading volume of $983.08 million.

Indicators signal strong momentum with a potential for further rallies amidst a broader market rally fueled by increasing Bitcoin ETF volumes.

- CoinMarketCap’s latest report showcases FLOKI’s remarkable surge of 85.35%, establishing its dominance and outpacing competitors by a considerable margin.

- FLOKI’s surge highlights the dynamic nature of crypto markets, with an 85% surge in 7 days, alongside a robust trading volume of $983.08 million.

- Indicators signal strong momentum with a potential for further rallies amidst a broader market rally fueled by increasing Bitcoin ETF volumes.

In a recent development, renowned analytical platform CoinMarketCap unveiled its latest findings on the top gainers in the cryptocurrency market this week. In a recent X post, the platform revealed that Floki Inu (FLOKI) emerged as the front-runner, experiencing a staggering 85.35% surge in value, leaving other contenders behind.

FLOKI’s meteoric rise has captured the attention of crypto enthusiasts and investors alike, as it outpaces its competitors by a significant margin. This surge underscores the dynamic nature of the cryptocurrency market and highlights the potential for substantial returns within a short span of time.

As of press time, FLOKI is trading at $0.0002717, marking a 1.22% surge in the last 24 hours and an impressive 85% surge over the past 7 days. The cryptocurrency has witnessed a robust trading volume of $983.08 million within the last 24 hours, reflecting heightened investor interest and activity in the market.

According to platform findings, following closely behind FLOKI are many other digital assets, including GALA, FET, RNDR, RUNE, NEAR, THETA, XEC, SHIB, and GRT. While not reaching the same heights as FLOKI, these cryptocurrencies have also experienced notable gains, contributing to the overall bullish sentiment in the market.

Floki’s journey into rapid price discovery is unfolding, hinting at potential further rallies in the near term within the crypto realm. With its indicators signaling robust momentum, Floki’s Relative Strength Index (RSI) is currently hovering around 80, slightly retreating from 90 but showing signs of resurgence. The trajectory of Floki’s 30-day average (yellow) soaring significantly above the 200-day (blue) suggests a bullish sentiment, indicating the potential for continued upward movement.

Despite fluctuations, the token’s price remains relatively stable amid whale activity, where notable investors have been accumulating Floki in recent weeks. This surge in interest occurs against the backdrop of a broader market rally, fueled by increasing Bitcoin ETF volumes and anticipation surrounding the upcoming Bitcoin halving.

As the crypto market continues to evolve and expand, it remains essential for investors to conduct thorough research and exercise caution when navigating the volatile landscape. While significant gains are possible, they are also accompanied by inherent risks, underscoring the importance of diligence and prudence in investment strategies.

FLOKI’s remarkable surge highlights the dynamic nature of the crypto market, with other contenders closely trailing behind. As investors navigate this volatile landscape, staying informed and vigilant is paramount to capitalizing on emerging opportunities and mitigating risks in pursuing financial growth.