Hackers Lose $13.4M After Ethereum Panic-Selling Frenzy

- Hacker wallets lost millions after panic-selling ETH during intense market turbulence.

- Fear dominated crypto and equities as sentiment indices plunged to deep bearish levels.

- On-chain data exposed poor timing that magnified losses across Ethereum transactions.

Six hacker-controlled wallets have lost more than $13.4 million after panic-selling large Ethereum holdings during Friday’s sharp market decline, according to blockchain analytics firm Lookonchain. The wallets collectively sold 7,816 ETH, worth approximately $29.14 million, at an average price of $3,728, locking in losses exceeding $3.37 million. Earlier in the week, the same wallets sold 8,638 ETH for $32.5 million at around $3,764 per coin, compounding their losses as Ethereum prices continued to fall.

This trading pattern reveals that even major actors with access to ample on-chain resources remain vulnerable to volatility and poor timing. The hackers’ trading missteps—buying near highs and selling into weakness—created cascading losses within a few days, amplifying stress across decentralized exchanges.

Ill-Timed Trades Trigger Millions in Losses

Lookonchain’s transaction data confirms that the group had earlier purchased 9,240 ETH valued at $39.45 million when Ethereum traded around $4,269. As markets reversed late Tuesday, they dumped 8,638 ETH worth $32.5 million, realizing a $5.5 million loss before attempting to reenter positions at higher prices. These repeated sell-offs and repurchases left the wallets deeply in the red.

Additional investigations reveal that the hacker’s wallets carried out considerable operations on decentralized exchanges like CoW Protocol, their movements totaling between $3.8 million and $6.9 million in just 15 hours. An account got more than 6.9 million DAI and then a combined swap of 1,815 ETH in a transaction meant for settlements. Such fast actions suggest a move to reduce the losses; however, it turned out to be the opposite and the situation escalated.

Investigations by pseudonymous analysts Specter Analyst and ZachXBT linked one of the losing wallets to a prior Coinbase funds theft involving 400 Bitcoin, then valued at about $35 million. Their findings suggest that part of the stolen Bitcoin was converted into Ethereum earlier this month, only to suffer the same fate amid the recent downturn.

Fear Dominates as Market Sentiment Deteriorates

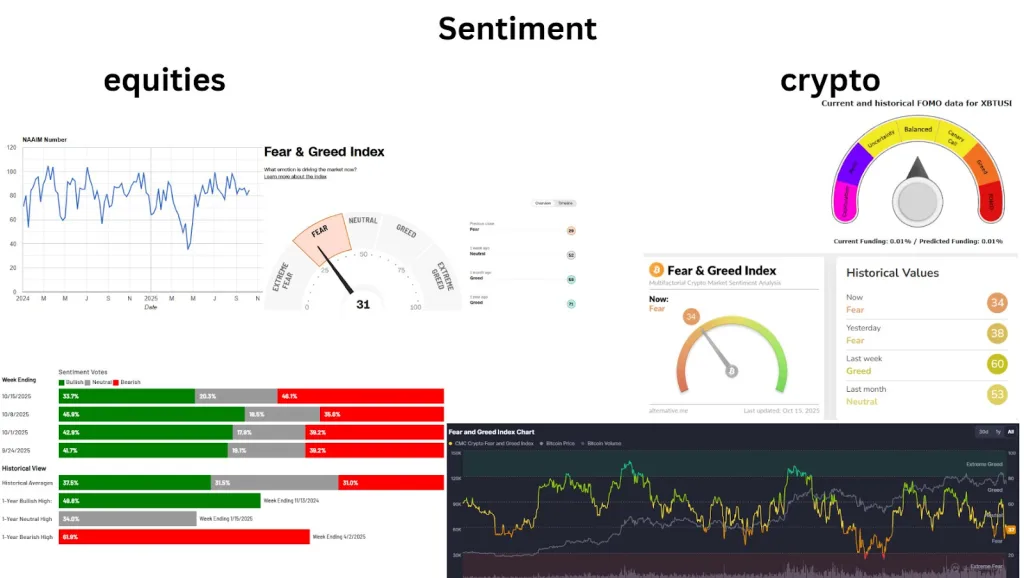

While the hackers’ missteps drew attention, broader sentiment across markets showed deepening fear. Sonny Mulder, an analyst, disclosed information on X, indicating that the stock market is on the verge of depletion, whereas crypto is still in a state of indecision. The equities Fear & Greed Index noted 31 (Fear) as the institutional bullish sentiment plummeted sharply—from 48.9% to 33.7%—while the bearish sentiment escalated above 46%, which is one of the most defensive stances of the year 2025.

Source: X

On the other hand, the crypto Fear & Greed Index was at a reading of 34 (Fear), which is a decrease from 60, which was the case just a week ago. The sentiment chart of Bitcoin showed the liquidity getting thinner and volatility going up because traders were quitting their risky positions. Mulder pointed out, “Blow-off tops or cycle ends take place in euphoric phases, but this current move is being done through fear, which is at least partially optimistic.”

Also, the decrease in prices coincided with the liquidation of more than $269 million and a single day of ETH long positions, which in turn meant that the leverage of the market was being unwound and there was stress in the ecosystem. The panic selling led to large liquidations that in turn, deepened the declines in prices, thereby intensifying the feedback loops that already weakened the technical support levels on the exchanges.

Cautionary Lessons from Market Volatility

The total amount that the hackers lost points out essential things for the traders to learn in the case of the volatile market. Timing is always the most important factor in the trading of digital assets such as Ethereum, where if a trader buys right at the top and then sells at the bottom, he will most likely face big losses. On the other hand, the liquidity shocks and the algorithmic trades may cause the price to drop rapidly. At the same time, the on-chain data that is easily accessible allows the public to scrutinize the big transactions.

Related: Charles Schwab to Offer Spot Bitcoin & Ethereum in 2026

Stolen assets are, however, not protected from market risks. The wallets were, nevertheless, always in control of millions, but their activities were like the actions of retail traders in panic—reactive, emotional, and poorly timed. Their losses reflect a general truth: big size and high-tech do not imply that one will be totally alienated from market psychology and structural volatility. As seen in Lookonchain’s data and Mulder’s sentiment analysis, both the institutional and illicit traders are still colluding to take advantage of the already stressed market.