Hoskinson Hits Garlinghouse Over CLARITY Act Support: Report

- Hoskinson targets Garlinghouse for backing the CLARITY Act in a new video message.

- Barron warns the CLARITY Act may enable wallet surveillance and “global doxxing” risks.

- Senate delays markup after Coinbase exit as Polymarket odds slip to 43% for 2026 bill.

Cardano founder Charles Hoskinson criticized Ripple CEO Brad Garlinghouse in a Sunday video. The comments centered on Garlinghouse’s support for the CLARITY Act, a crypto market structure bill discussed in the U.S. Senate. The remarks reignited debate over regulation and industry leadership. Coin Bureau later amplified the clip through an X post.

Regulatory trust was the core issue in Hoskinson’s message. In the video shared on X post, he said, “Elizabeth Warren wrote the bill, that’s leadership we can believe in.” The statement framed the draft as shaped by lawmakers known for strict crypto oversight.

Hoskinson Challenges Garlinghouse’s CLARITY Act Compromise

Garlinghouse’s “progress at any cost” argument drew sharper criticism. Hoskinson said, “You still got people like Brad saying, well, not perfect, but we just got to get something.” That line was used to question whether compromise is worth the tradeoffs.

Past enforcement actions also became part of Hoskinson’s argument. He warned against empowering agencies that previously targeted crypto companies. “Handed to the same people who sued us, who put us out of business, who subpoenaed us,” he said.

A different tone came from Garlinghouse in earlier remarks. He acknowledged flaws in the proposal while still backing forward movement. “Is it perfect? No. Certainly not. But is it better than nothing? Absolutely,” Garlinghouse said.

Continued negotiations were another theme in his position. “We shouldn’t give up now. We are so close,” he added. His comments emphasized working with lawmakers to reshape sections of the bill.

Other critics have attacked the bill from a civil liberties angle. Paul Barron described the CLARITY Act as a “dragnet,” rather than real regulatory clarity. He warned that some provisions could broaden oversight into everyday crypto activity.

Constitutional concerns were highlighted in Barron’s post. “Warrantless Search: ‘Real-time monitoring’ of every transaction bypasses the 4th Amendment,” he wrote. That view focused on surveillance risk and weak legal guardrails.

Related: Coinbase Warns It May Drop Support For CLARITY Act

Non-custodial wallets were another major concern raised by Barron. He argued that wallet users could face compliance burdens designed for intermediaries. He also warned that assets might be frozen based on “risk,” rather than formal legal charges.

Privacy Fears Rise as CLARITY Act Stalls

Privacy exposure was also flagged in the same critique. Barron said expanding Bank Secrecy Act rules to wallet users would remove cash-like privacy from digital assets. He also referenced “global doxxing,” citing mandatory data sharing with foreign banks.

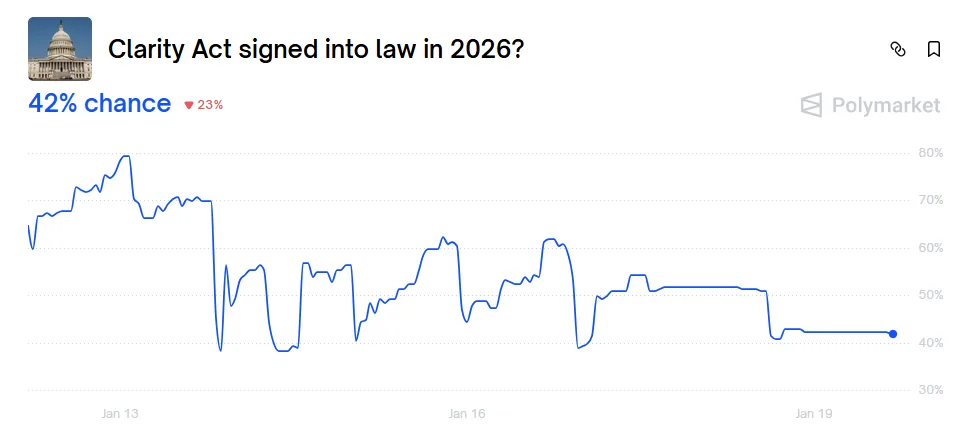

Legislative momentum then slowed. The Senate Banking Committee delayed the markup of the crypto market structure bill. That delay followed Coinbase’s decision to withdraw support on Wednesday, January 14.

Political support also came into concern after that shift. The report noted the White House is considering dropping support for the legislation. The development added pressure to the negotiation process.

Tim Scott, Chair of the Senate Banking Committee, said talks would continue despite the delay. He stated that he had conversations with leaders across the crypto industry and the financial sector. Bipartisan engagement was also mentioned as part of ongoing negotiations.

Comprehensive market rules remain the long-term aim of the draft. If enacted, it would become the first federal statute to define crypto market structure in full. The bill would reduce dependence on litigation and informal regulatory interpretation.

Uncertainty still surrounds the timeline and final outcome. At the time of writing, Polymarket traders priced the CLARITY Act’s 2026 passage odds at 42%.

Source: Polymarket

Hoskinson’s attack on Garlinghouse has turned the CLARITY Act debate into a public divide among top crypto leaders. With privacy concerns rising and political support wobbling, the bill’s path now depends on whether negotiators can fix disputed sections without losing industry and White House backing.