Hyperliquid Labs Schedules January 6 as Team Vesting Kicks In

- Hyperliquid Labs starts its 24-month team unlock with 1.2M HYPE set for release on January 6.

- The team allocation fell by 30 percent as new vesting rules shifted the monthly unlock timing.

- A prior burn of 37M HYPE and steady buybacks help balance supply as vesting begins.

Hyperliquid Labs is set to open the first round of its team vesting cycle on January 6, releasing 1.2 million HYPE tokens after unstaking them late last week. The move marks the beginning of a two-year distribution plan that has been under discussion for months and is now set in motion with clearer monthly pacing.

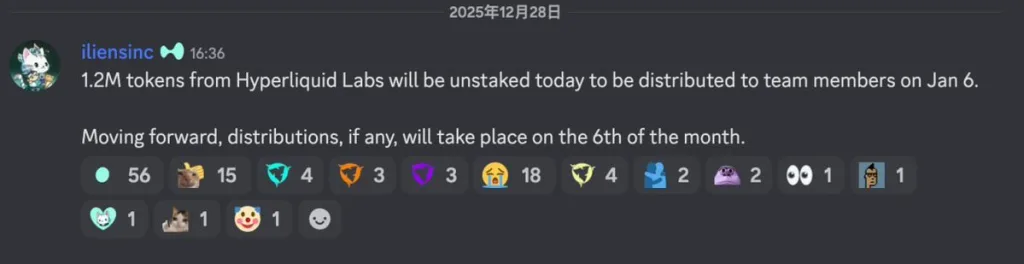

According to reports, the tokens were unstaked on December 28, though they will not reach team wallets until the scheduled date, leaving traders with a narrow window to gauge possible market shifts.

A Smaller Unlock and a New Monthly Rhythm

The January allocation comes with a notable adjustment. The protocol cut the team’s expected release from 1.7 million tokens to 1.2 million, trimming roughly 30% of what had initially been penciled in. The change accompanies a shift in the calendar as well.

Instead of the late-month unlocks, Hyperliquid Labs moved the process to the sixth day of every month, a steadier rhythm that reduces the scramble around end-of-month supply shocks. The team’s allocation represents about 23.8% of the total HYPE supply and will vest evenly across 24 months.

Each tranche accounts for roughly 0.3% of the protocol’s 420 million tokens, a relatively small slice, though the cumulative flow over two years keeps analysts attentive to how the project manages emissions alongside fresh supply. The revised schedule followed confirmation from co-founder Iliensinc, who shared the update through community channels.

Source: X

The earlier version of the plan had called for a December 29 unlock of roughly 9.9 million tokens, including the team’s share, an amount that would have carried a heavier footprint. However, that release is no longer expected under the updated framework.

Balancing Supply With Offsets and Burns

Hyperliquid’s token design has undergone several stress periods. In November, the protocol processed an unstaking wave of about 2.6 million tokens, including incentives. After restaking activity and treasury offsets, roughly 900,000 tokens were estimated to have entered circulation.

The period coincided with a price decline of around 17%. Even then, the project executed buybacks of nearly 1.9 million tokens, absorbing a large portion of the newly available float. One of the more notable structural adjustments came shortly after, when governance approved the burn of nearly 37 million HYPE tokens from the Assistance Fund.

The decision removed close to 13% of the circulating supply and changed long-term projections more sharply than previous policy steps. Day to day, the system sees modest net inflation.

Buybacks remove about 21,700 tokens, while staking emissions add roughly 26,700. The difference is not large, but monthly unlocks add another layer that markets now monitor more closely, given the set cadence and reduced amounts.

Market Reception and Trading Context

Following the announcement, market reaction has been tempered but noticeable. HYPE posted a brief uptick after the revised schedule was circulated, with daily gains of a little over 3% recorded on some trackers.

Most of the move appeared tied to clarity rather than speculative enthusiasm. With the January allocation valued between $30 million and $33 million at current prices, traders appear to be factoring the event into broader liquidity expectations rather than reacting to it as a standalone shock.

At press time, HYPE trades near $25.84, up 0.81% over the past 24 hours, with a market capitalization of roughly $8.77 billion. Those figures suggest a market that has absorbed several supply-related headlines without significant dislocation.

Related: Lummis Says Crypto Bill Will Split Securities and Commodities

Incentive Alignment and Structural Signals

Some analysts have viewed the reduced allocation as a nod to muted revenue trends during the fourth quarter. Steven of Yunt Capital questioned whether future unlock sizes could mirror revenue activity, though the project has not tied vesting amounts to protocol performance.

For now, only the timing is fixed, not the volume. The shift into a predictable monthly schedule changes the pacing around HYPE’s supply curve. With steady unlocks, periodic burns, and ongoing buybacks, the token’s structure now leans more heavily on transparent mechanisms than reactive interventions.