IRS Clears Path for Crypto ETPs to Stake Digital Assets

- The IRS created a safe harbor letting crypto ETPs stake assets without losing compliance.

- This marks a shift in linking TradFi with blockchain yield-based investment models.

- Institutional and retail investors may now earn staking rewards through regulated ETPs.

The U.S. Treasury and Internal Revenue Service (IRS) have released new guidance creating a safe harbor for exchange-traded products (ETPs) to stake digital assets and share staking rewards with retail investors. The directive, announced Monday by Treasury Secretary Scott Bessent on X, is widely viewed as a turning point for institutional participation in cryptocurrency markets.

A New Framework for Staking

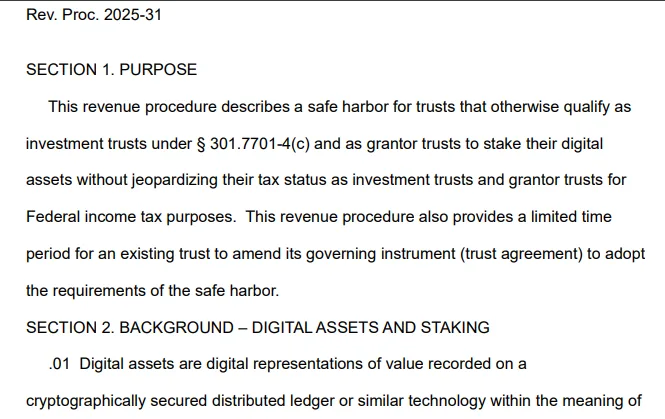

According to the 18-page document, identified as Revenue Procedure 2025-31, the IRS established a framework that allows ETPs and trusts to stake digital assets while keeping their tax-qualified status. The move follows the Securities and Exchange Commission’s earlier statement this year confirming that proof-of-stake (PoS) activities do not qualify as securities transactions.

Source: Revenue Procedure 2025-31

Bessent said the update provides ETPs “a clear path to stake digital assets and share staking rewards with their retail investors.” He added that the policy “increases investor benefits, boosts innovation, and keeps America the global leader in digital asset and blockchain technology.”

The IRS issued the clarification after receiving multiple inquiries about whether staking activities disqualified trusts from federal income tax eligibility.

The new guidelines formally address those concerns by introducing explicit safe harbor language and compliance parameters for regulated investment vehicles.

Defining the Rules and Institutional Impact

Within the confines of the agreement, both trusts and ETPs have the privilege of staking their assets on open PoS networks, say Ethereum or Solana, and thus giving the investors their share of the staking rewards. However, to be eligible, the financial instrument must have one single digital asset and cash, employ a custodian that is approved, and be traded on a national securities exchange.

The IRS also made clear that staking rewards earned by these funds are taxable as ordinary income at the time of receipt. Each ETP must report earnings accordingly, ensuring investors receive transparent documentation of staking income.

Bill Hughes, senior counsel at Consensys, said on X that “the impact on staking adoption should be significant.” He noted that the safe harbor “provides long-awaited regulatory and tax clarity for institutional vehicles such as crypto ETFs and trusts.” Hughes added that the policy “transforms staking from a compliance risk into a tax-recognized, institutionally viable activity.”

Industry analysts said the guidance removes one of the largest legal barriers to staking adoption by institutional players. Asset managers and custodians previously avoided staking within ETPs due to tax uncertainty and the potential risk of losing qualified status.

A Catalyst for Mainstream and Retail Participation

Market observers anticipate that the decision to accelerate approval timelines for Ethereum and other staking-based ETPs in the U.S. will lead several financial institutions to explore staking structures that are operationally secure and meet audit standards. The framework may also pave the way for diversified staking products linked to networks like Solana, Avalanche, and Cosmos.

Related: Bessent and Wong Discuss Dollar Stablecoin at APEC Summit

At the same time, the IRS’s crypto office underwent a leadership change this year following staff reductions during the Trump administration, which raised doubts about its ability to function effectively. The IRS has not yet confirmed whether these shifts would have any impact on the execution of the policies.