Kyrgyzstan Pushes Global Financing With Bonds and Stablecoin

- Kyrgyzstan raises $700M debut eurobond, signals more sovereign and bank issuance.

- Corporate issuers gain access to global markets after a successful state bond sale.

- Gold-backed USDKG stablecoin adds a digital layer to Kyrgyzstan’s funding strategy overall.

Kyrgyzstan is expanding its reach in global finance after completing its first dollar bond sale and unveiling a gold-backed stablecoin. Officials say the approach blends sovereign borrowing, corporate market access, and digital assets. The strategy aims to diversify funding channels while drawing foreign investors.

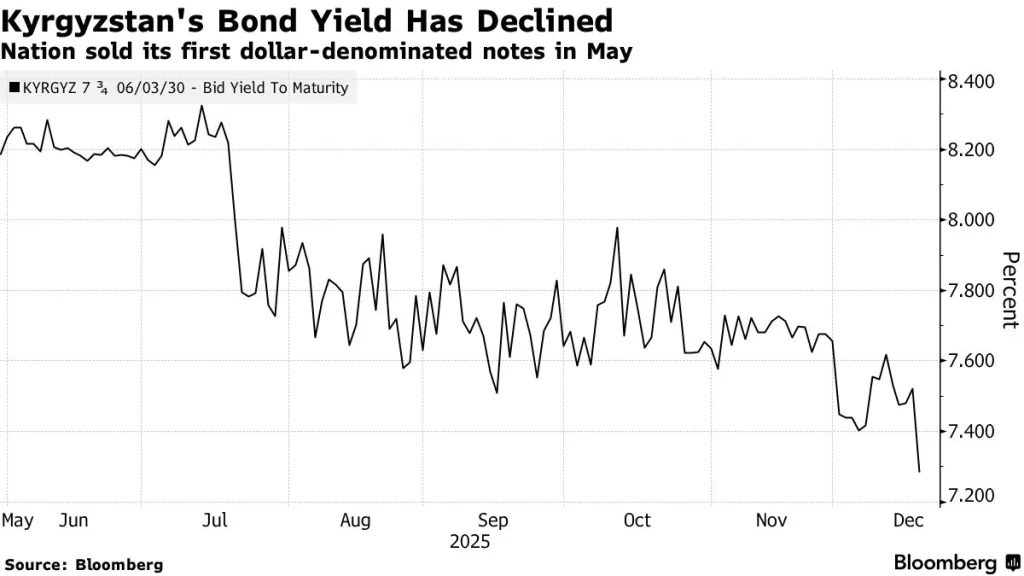

According to a report, the government raised $700 million in May through its debut eurobond sale. The transaction marked Kyrgyzstan’s first appearance in international bond markets. Officials said the deal placed the country alongside other Central Asian issuers seeking global capital.

Kyrgyzstan Plans More Debt as Eldik Bank Prepares Bond Sale

Authorities indicated that further sovereign issuance remains possible. Any return to the market would depend on external conditions. At the same time, wholly state-owned Eldik Bank Open Joint Stock Company (OJSC) is preparing its own inaugural bond sale. The bank expects to approach investors in February, according to the Finance Ministry.

Officials said Eldik Bank is finalizing contracts with arranging banks. The deal would represent the first international bond sale by a Kyrgyz lender. The Finance Ministry said the transaction follows the successful sovereign issuance.

The government said the eurobond sale opened access for the corporate sector. Officials stated that Kyrgyz companies could now approach global investors with greater credibility. Several state-linked entities are reviewing bond plans.

Another local bank may also explore a bond sale. The Finance Ministry said discussions are ongoing. Officials did not provide a timeline for these potential offerings. They noted that preparation would depend on market appetite and internal readiness.

Kyrgyzstan’s debut eurobond matures in 2030. S&P Global Ratings assigned the bond a rating four notches below investment grade. Despite the rating, investor demand exceeded $2.1 billion.

European investors accounted for a significant share of allocations. Continental Europe received 45% of the final offer. Investors from the United Kingdom and Ireland took 30%. Officials said the distribution reflected diversified international interest.

Growth Outlook Guides Kyrgyzstan Debt and Digital Finance Plans

The government linked its market entry to economic performance. Officials said Kyrgyzstan’s debt-to-GDP ratio stands at 42.7%. The ratio is projected to fall to 23% by the end of 2030. Authorities attributed the decline to economic growth and debt repayments.

Officials said growth prospects supported the decision to issue debt. They described economic momentum as a key factor in investor engagement. The Finance Ministry emphasized that borrowing remains within approved limits.

Related: Kyrgyzstan Backs New Digital Dollar Coin with Gold Reserves

The approved eurobond mandate totals $1.7 billion. The amount covers multiple currencies. Officials said future issuance timing would depend on market conditions. They added that flexibility remains central to the strategy.

Authorities are also evaluating alternative debt structures. Islamic finance instruments and green bonds are under consideration. Officials said these products require longer preparation. A traditional eurobond is expected to come first.

Proceeds from the debut bond were directed to Eldik Bank. The government added capital to the lender’s balance sheet. Eldik Bank is committed to financing energy projects. Officials said the bank is reviewing projects worth more than $1.5 billion.

Alongside bonds, Kyrgyzstan is expanding into digital finance. In November, Issuer of Virtual Assets OJSC launched the USDKG stablecoin. The token is backed by gold and pegged to the US dollar. The initial issuance totaled $50 million.

The stablecoin was issued on the Tron and Ethereum blockchains. The Finance Ministry supplied gold backing for the tokens. Officials said the ministry purchases gold alongside the central bank.

Issuer of Virtual Assets said the goal is cross-border utility. Management described USDKG as a transaction tool. Officials said it could support economic activity. They also noted potential interest in future market listings.

By combining bonds and digital assets, Kyrgyzstan is broadening its financing framework. Officials said the approach strengthens access to capital. The strategy reflects coordinated policy choices. Authorities framed the effort as a step toward sustained global market engagement.