Litecoin (LTC) Holds $100 Support as Buyers Regain Control

- Litecoin shows renewed momentum as investor confidence strengthens across the crypto market.

- Trading volumes rise, funding rates turn positive, and large holders continue accumulation.

- Technical indicators signal a potential short-term bullish reversal as momentum builds.

Litecoin showed renewed momentum on Tuesday, trading near $103 amid growing confidence in the broader crypto market. Data from on-chain and derivatives platforms reflected growing investor interest. Trading volumes rose, funding rates turned positive, and large holders continued steady accumulation. Technical indicators also pointed toward the potential for a short-term bullish reversal as momentum gained traction.

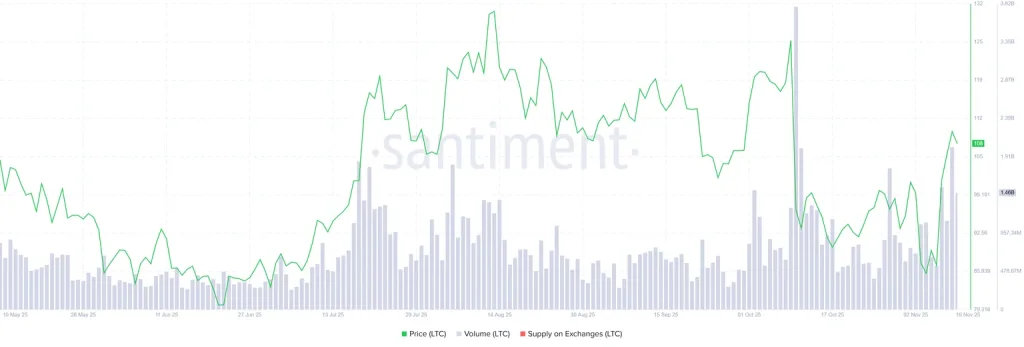

Trading volume, as reported by Santiment, spiked to $2.03 billion on Sunday – the highest level since mid-October. The number had eased to $1.46 billion by Tuesday, but still demonstrated strong participation and liquidity. The increase in volume indicated traders were coming back, which is an optimistic signal for Litecoin’s recovery sentiment.

Source: Santiment

Funding Rate Turns Positive as Traders Eye $112 Breakout

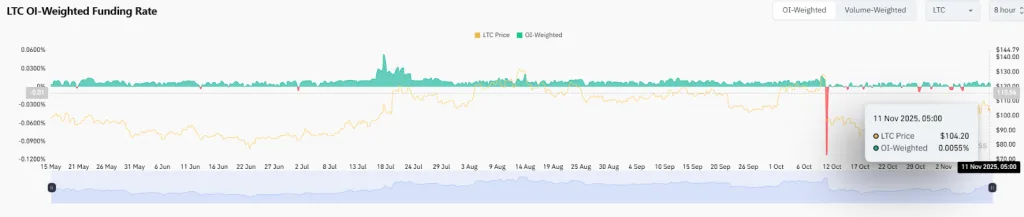

CoinGlass data provided further evidence of improving sentiment among derivatives traders. The OI-Weighted Funding Rate turned positive at 0.0055%, indicating that long traders were paying shorts.

This change represents more people expecting prices to go up than to go down, a significant contrast with the cautious mood of recent weeks. A positive funding rate typically indicates increased confidence and aggressive positioning toward the upside of the price.

Source: Coinglass

Analyst Crypto WZRD noted that LTC closed Monday’s session with a bearish tone after forming a double-top on Bitcoin. The analyst added that a strong bounce off the $101.50 support zone is required to confirm an uptrend reversal. Breaking above the $112.25 level would place Litecoin in a clear bullish territory that may open the door for more upside.

Source: X

Litecoin Holds $100 Support Amid Consolidation Phase

Litecoin’s range for the day was from $101.90 to $106.99, showing that the cryptocurrency has entered a consolidation phase. Price action has held near critical exponential moving averages, indicating equilibrium between buyers and sellers.

The 20-day EMA was sitting at $97.88, the 50-day EMA at $102.96, the 100-day EMA at $104.81, and the 200-day EMA at $102.88. The narrow gaps of these layers are a reflection of tranquility, but with low confidence in the market structure, which typically occurs ahead of strong directional plays.

Source: TradingView

After a sharp dump in mid-October, Litecoin went into extended consolidation, struggling to move back above the 100 EMA and 200 EMA areas. The $100 has clearly acted as a strong support area and has seen several bounces, which indicate significant demand. This area remains a critical support for future tables on bullish moves.

The MACD line is at -2.69, and the signal line is at -3.39. Histogram lightens red bars, indicating loss of downside momentum. A bullish crossover would confirm short-term momentum strength and add a bid back to the market.

Related: The SEC Delays Canary Litecoin ETF: What’s the Real Cause?

The near-term price action of Litecoin depends on how it reacts to critical technical levels. A continued close above the $105 level would indicate that bulls are once again in control and could pave the way for a move towards $110. On the contrary, a dip below $100 is likely to bring things back down towards $95.

The market sentiment has been slowly getting better from a recent low at the moment. The increase in participation, unchanged funding rates, and deteriorating bearish signals suggest momentum has flipped back to the recovery side.

In general, Litecoin’s formation indicates that the market is gearing up for a big move. In the event that buying pressure persists and resistance levels break, the price may continue to increase. A rise in investor confidence could help continue the short-term move upward.