Nations Accelerate State-Funded Bitcoin Mining Expansion

- More governments now finance Bitcoin mining through national energy programs and projects.

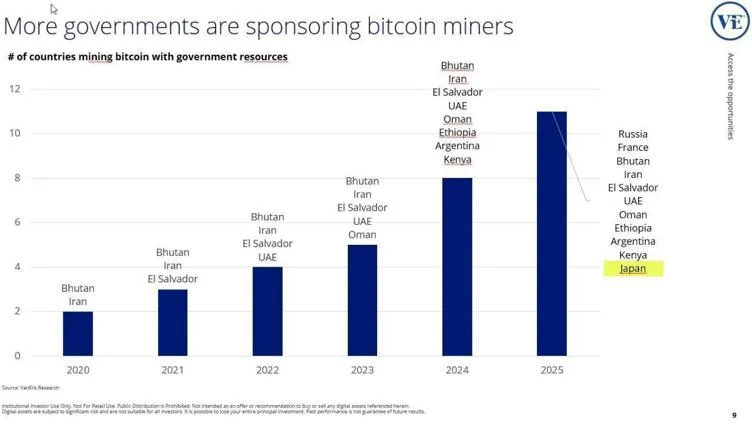

- VanEck reports show state involvement rising from two to eleven within five years.

- The growth signals expanding trust in Bitcoin’s potential for economic transformation.

A growing number of governments are investing directly in Bitcoin mining, marking a structural shift in how states engage with digital assets. Data published on CoinMarketCap by analyst CryptoPM, citing VanEck Research, reveals that the number of countries funding Bitcoin mining with public resources surged from two in 2020 to a projected eleven by 2025.

Source: CoinMarketCap

The Global Expansion of State-Backed Mining

In 2020, only Bhutan and Iran mined Bitcoin with direct government support. Bhutan used hydroelectric energy, while Iran relied on oil and gas power. By 2021, El Salvador became the third nation to join, following its adoption of Bitcoin as legal tender.

The advancement continued in 2022 when the UAE became the fourth country to initiate government-supported mining operations. The year 2023 saw Oman come into the platform, thereby increasing the number to five.

The entry of each country made it clear that there was an expanding government engagement, as the countries that introduced Bitcoin mining were no longer considering it a risky project but rather a legitimate industrial and energy-related activity. The fastest growth in the mining industry was in 2024, when Ethiopia, Argentina, and Kenya entered the race.

The total number of countries participating that year was eight, which indicated a diversification of mining across different continents. African and Latin American countries have begun using Bitcoin mining as their national energy policies, intending to turn excess power into cash while improving their digital infrastructure at the same time. By 2025, the projected number climbs to eleven, with new additions such as Russia, France, and Japan.

Japan’s state-linked initiative, according to VanEck’s dataset, features a 4.5-megawatt project developed with a national utility and Canaan Inc., a mining hardware firm. The project uses hydro-cooled rigs powered by renewable energy sources to enhance grid stability and economic efficiency.

Governments See Bitcoin as a Strategic Resource

The report by VanEck Research suggests governments are increasingly confident in Bitcoin’s long-term economic and geopolitical potential. The rapid expansion from two to eleven nations in just five years demonstrates that countries now perceive mining as a state-level opportunity for innovation and energy optimization.

According to VanEck’s findings, these programs are not uniform. Some are fully state-operated, while others function as public-private partnerships or rely on state-owned utilities. Although the dataset lists eleven nations, analysts note the real number may be higher, as several governments do not disclose their involvement publicly.

The underlying motivation varies. Different governments have taken different approaches to cryptocurrency mining, with some viewing it as a means to add value from surplus energy and others as an anti-inflation measure to achieve digital sovereignty. VanEck’s view is that “mining has changed from being solely a production process for digital coins to being an innovation enabler, energy optimizer, and a powerful magnet for investment.”

Diverging Global Attitudes Toward Bitcoin Mining

Some countries are embracing mining as a source of income, while others are making it harder to mine. In 2021, China completely ended crypto mining and trading operations taking place within its territory due to environmental and energy demand reasons. Many of them have since been processed to more welcoming places.

Similar bans have been imposed in Algeria, Egypt, and Bangladesh, with the authorities claiming that the restrictions are necessary to maintain financial stability and limit energy consumption. In Kuwait, due to power cuts, regulatory raids have been conducted on unlicensed operations even without a formal ban.

On the other hand, Europe and the U.S. are still divided on the issue. The E.U. is contemplating limiting Proof-of-Work mining due to its environmental impact. In the U.S., mining companies are facing either outright bans or heavy taxation in certain states that have imposed temporary moratoriums or new taxes on large-scale mining operations. The market is left wondering whether the regulation will thus shift from control to competition as more governments start to mine Bitcoin on their own.