PIPPIN Price Soars 50% to $0.28: Can the Bull Run Break Higher?

- PIPPIN price jumps over 50% after a strong rebound from the $0.16 to $0.13 support floor.

- A sharp rise in volume and liquidations shows real demand behind the sudden rally.

- Resistance near $0.28 remains critical as traders watch for a break toward higher Fib levels.

The PIPPIN price staged a sharp rebound over the past day, snapping out of a week-long lull and pulling traders back into a market that had looked increasingly fatigued. The move began quietly, then accelerated as bids stacked near the $0.16–$0.13 support band, an area that has held firm through several tests this month.

From that floor, the token vaulted roughly 52% to a brief peak near $0.29 before cooling to about $0.28 at press time. Even with that modest pullback, the daily gain still sits near 45%, a shift strong enough to reframe short-term sentiment. What stood out even more was the depth of participation behind the move.

Trading volume climbed to $94.34 million, a gain of 373.8% in a single session, signaling that buyers were not just leaning in but doing so with conviction. Moves of this scale rarely appear without clear liquidity support, and this one carried it in abundance.

Support Defense Reignites Momentum

The rebound began where many early buyers had expected: the familiar support zone that has steadied the PIPPIN price through earlier drawdowns. Once the area was held again last week, traders appeared more willing to step back in.

The sharp volume spike further suggested that capital did not trickle but rushed into the market, giving the rally a firmer foundation than flash reversals typically enjoy. Longer-term measures also add context.

The token remains up 943.8% year-on-year, a reminder that despite bouts of volatility, the broader trajectory still leans upward. That does not change the near-term risks, but it helps explain why the reaction from the base level was so aggressive.

Rotation Lifts Mid-Cap Altcoins

Notably, no project-specific announcement accompanied the rally. Instead, it unfolded alongside gains in several mid-cap names, including Warden and Humanity Protocol. The pattern resembles a rotation phase, with capital drifting into altcoins showing early signs of momentum.

Such periods tend to be narrative-light and data-heavy, driven more by liquidity pockets than by news cycles. In that setting, the PIPPIN price move fits neatly into the broader shift. Traders seeking volatility rotated toward assets already flashing signs of life, and the token’s rebound from support made it an easy target for momentum flows.

PIPPIN Technical Picture Tightens

On the chart, the token still sits inside a falling wedge pattern. The structure has narrowed over the past week, and the recent jump brought the PIPPIN price into contact with a familiar barrier: the 23.6% Fibonacci level near $0.28.

Once a dependable support area, it has now flipped into resistance. Price action around this level has been choppy, suggesting hesitation rather than exhaustion. However, a clear push above may open room toward the 38.2% retracement near $0.36, followed by the 50% marker around $0.42.

Source: TradingView

Failure to break cleanly could push the token back into the same support region that started the rally, a scenario traders will be watching closely as momentum cools. Meanwhile, the relative strength index, hovering near 51, remains neutral. Still, its climb from oversold territory hints at a shift in control. A break above the 60 region would strengthen the bullish argument, while slipping back toward 40 would weaken it.

Related: WLFI Drops 8% as Bearish Trend Deepens: What Comes Next?

Short Squeeze Fuels the Breakout

Derivatives data further helps explain the speed of the move. Per CoinGlass data, roughly $3.76 million in short positions were liquidated over the past day, compared with about $856.92K in long liquidations. The imbalance shows sellers caught offside as the rebound gathered pace.

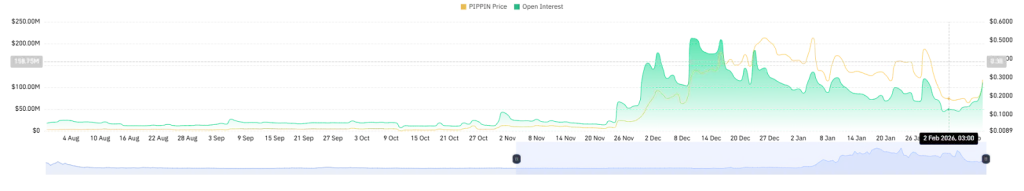

Source: CoinGlass

Open interest also surged 47.22% to about $111 million, pointing to new participants entering the market rather than old positions unwinding. Rising open interest in a rally often brings heavier swings, helpful for bulls when momentum is in their favor, but equally punishing if the tide shifts.

Source: CoinGlass

Overall, the surge highlights renewed strength in the token as volume and momentum return. Its next direction will depend on how it handles nearby resistance and broader shifts across the market.