- Polygon’s surge in transaction volumes and user base positions it as a leading Ethereum scaling solution, rivaling even established chains like Solana.

- The Inscriptions phenomenon has fueled Polygon’s rapid growth, particularly in NFT sales, signaling heightened user interest and market presence.

- Despite MATIC’s recent price increase and increased whale accumulation, mixed sentiment in the derivatives market suggests uncertainty about its future trajectory.

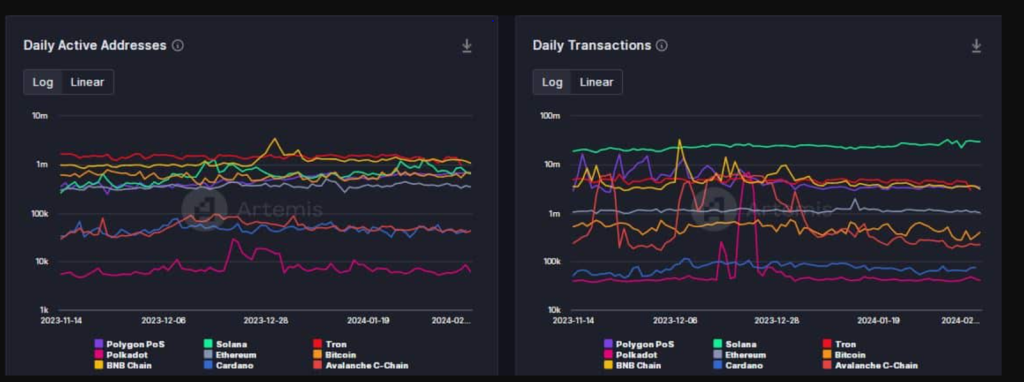

The Proof-of-Stake (PoS) network Polygon [MATIC] has experienced a significant increase in on-chain activities, emerging as a frontrunner in transaction volumes by recording an impressive 3.41 million transactions on February 10th alone. This figure not only surpassed that of BNB Chain but also positioned Polygon just behind Solana [SOL] in the ranking.

Furthermore, the network has maintained a daily transaction average of 3.5 million. This highlights its growing prominence as an Ethereum [ETH] scaling solution since the onset of February.

Source: Artemis

Moreover, Polygon’s user base has also expanded significantly. On the same day, the platform outdid Solana in terms of daily users, boasting over 672,000 unique active addresses compared to Solana’s 644,000.

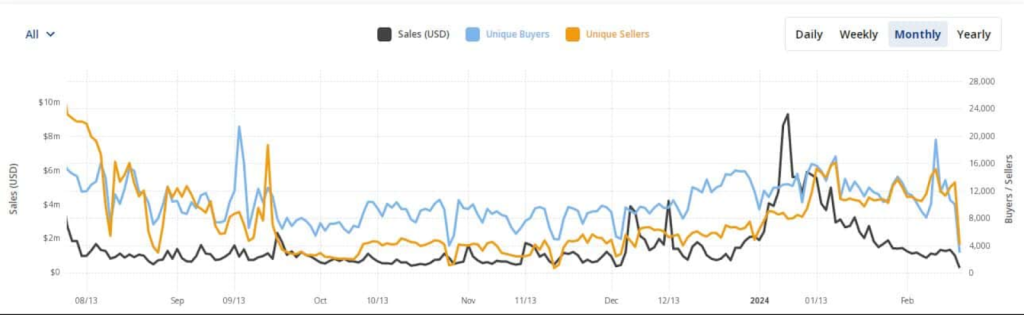

This 75% increase in daily active addresses over the last two months can largely be attributed to the Inscriptions phenomenon, which has not only captivated user interest but also invigorated Polygon’s NFT marketplace. Data from CryptoSlam reveals a nearly sixfold jump in Polygon’s monthly NFT sales from October to January, further underscoring the network’s escalating market presence.

Source: CryptoSlam

Interestingly, Polygon made headlines last month by eclipsing Ethereum in 24-hour NFT sales for the first time, marking a significant milestone in the network’s history. Currently, it ranks as the fourth-largest chain in NFT trading over the past week, with sales exceeding $8 million.

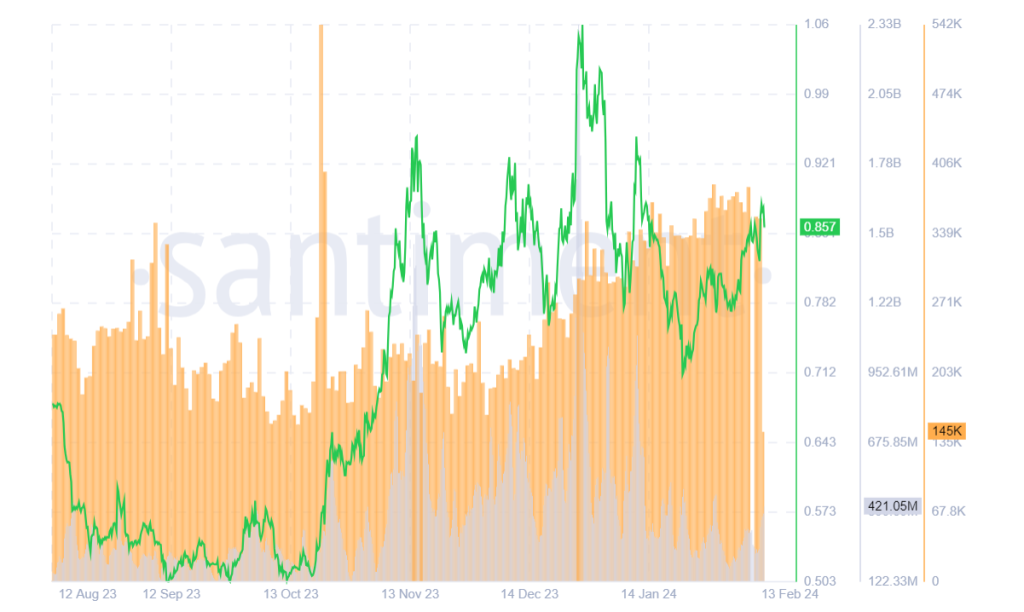

Despite these achievements, the ecosystem’s native token, MATIC, experienced a 1.31% increase at the time of writing, as per CoinMarketCap now trading at $0.8563. Nonetheless, the token has seen nearly a 7.89% increase on a weekly basis, although it has shed 26.82% since the start of the year and has struggled to regain the crucial $1 mark.

Amidst these market dynamics, whale investors have seized the opportunity to augment their MATIC holdings. Santiment data reveals a notable uptick in addresses holding between 1,000 and 10 million coins over the last month.

Source: Santiment

Conversely, the derivatives market has seen a predominance of bets against MATIC’s price, highlighting a mixed sentiment among traders regarding the token’s future trajectory. This complex interplay of factors underscores the vibrant and ever-evolving landscape of the cryptocurrency market, with Polygon standing out as a key player driving innovation and user engagement.