Ripple Strengthens EU Strategy With Luxembourg EMI License

- Ripple gains full EMI license in Luxembourg, enabling regulated payments across the EU.

- Approval strengthens Ripple Payments’ expansion and adds to its growing global license count.

- XRP trades lower as on-chain data shows rising illiquid supply despite market pressure.

Ripple secured full approval for an Electronic Money Institution license in Luxembourg on Monday, clearing a path to expand regulated payment services across the European Union. The authorization was granted by the country’s financial watchdog after all conditions were met, following preliminary clearance issued last month. The approval strengthens Ripple’s regulatory position in Europe and supports its cross-border payments business.

The license was issued by Luxembourg’s Commission de Surveillance du Secteur Financier. Ripple said it had satisfied every requirement set by the regulator. Final authorization allows the company to offer regulated electronic money services under EU passporting rules.

Ripple Confirms Full EMI Compliance After January Clearance

Ripple first disclosed preliminary approval in January. The company said the latest decision confirms full compliance with Luxembourg’s regulatory framework. This status enables Ripple to scale services across EU member states without seeking separate national licenses.

Cassie Craddock, Ripple’s Managing Director for the UK and Europe, said Europe remains a strategic focus for the company. She said the authorization supports Ripple’s goal of delivering compliant blockchain infrastructure. The company framed the move as a step toward more efficient digital payment systems for businesses.

Ripple said the Luxembourg license would support the expansion of Ripple Payments. This product focuses on cross-border transactions for banks, fintech firms, and enterprise clients. The company did not provide a rollout timeline or identify specific EU markets.

Luxembourg is widely used as a regulatory base for financial services operating across the EU. Firms licensed there could often scale faster under a single framework.

The development follows other regulatory gains in Europe. Ripple said it received an EMI license and cryptoasset registration from the UK Financial Conduct Authority last month. These approvals allow Ripple to provide payments and crypto-related services in the UK market.

Ripple said its total number of global licenses and registrations now exceeds 75. The company described this as positioning it among the more heavily licensed firms in the digital asset sector. The focus remains on institution-facing use cases.

The regulatory progress comes during a weak period for crypto markets. Digital asset prices continued to decline over the weekend. XRP also traded lower during the broader market pullback.

Related: Ripple Partners with Global Nonprofits to Revolutionize Humanitarian Aid

Ripple Dismisses Renewed Claims as XRP Faces Market Pressure

Market pressure coincided with renewed online circulation of old claims linking Ripple or early associates to the Jeffrey Epstein network. The claims resurfaced during the Jan. 31 to Feb. 1 period. They were widely shared across social media platforms.

Ripple’s former chief technology officer, David Schwartz, publicly rejected the claims. He described them as baseless misinformation. Schwartz said the rumors were being recycled during a period of heightened market stress.

Schwartz said the referenced emails were not endorsements of cryptocurrencies. He said they reflected Epstein’s hostile view toward certain blockchain projects. According to Schwartz, Epstein viewed supporters of XRP and XLM as adversaries, not allies.

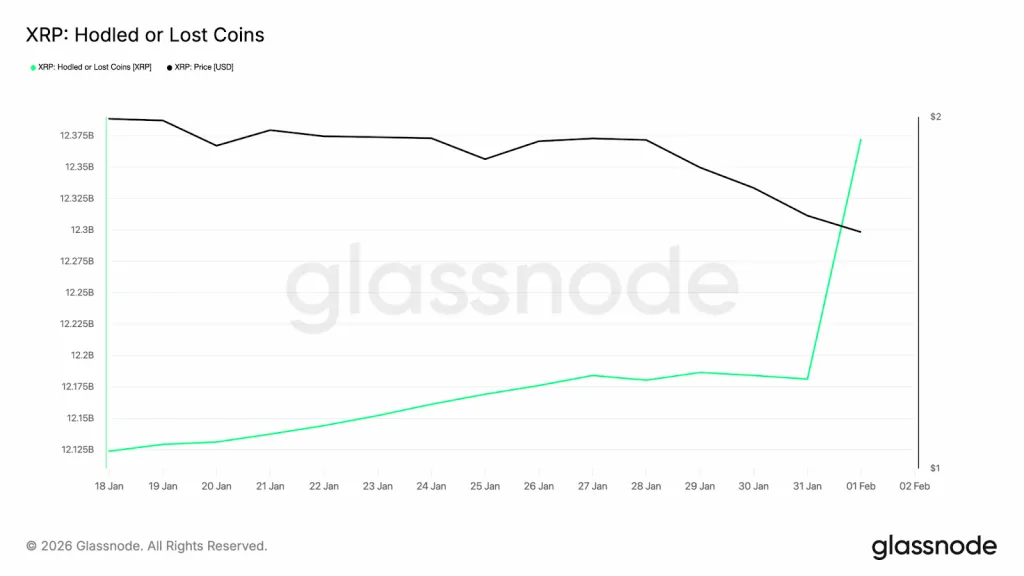

While the narrative circulated online, on-chain data showed notable supply changes. Glassnode data indicated a sharp rise in XRP classified as “hodled” or lost. This suggests more tokens are moving into long-term inactive wallets.

At the same time, XRP’s price trended lower. The token slipped below the $1.65 level. The divergence between rising inactive supply and falling price drew attention from analysts.

Historically, similar patterns have pointed to distribution exhaustion rather than panic selling. Fewer coins remain readily available for trading. Liquid supply appears to be tightening as price declines.

However, past cycles also show that such conditions do not guarantee an immediate rebound. XRP has previously consolidated for extended periods after similar supply shifts. Price responses have often taken weeks to develop.