SHIB Price Hits Key $0.000012 Level: A Buy Signal or Trap?

- SHIB retests $0.000012 as traders question whether key support will hold under pressure.

- Exchange reserves climb higher, pointing to heavier selling pressure from holders.

- Long liquidations surge as cautious traders exit losing positions to limit damage.

Shiba Inu (SHIB) has drifted back to a familiar line of defense near $0.000012, an area that traders are well familiar with. The zone has stopped several pullbacks in the past, and once again, the market is testing its strength.

Earlier this month, SHIB bounced from the same region and briefly touched $0.000013 before sellers stepped in around the 38.20% Fibonacci point. That pushback trimmed nearly seven percent from its value, leaving the token to hover just above support.

On the broader chart, the pattern appears heavy, resembling a descending triangle that suggests building pressure as the meme coin tests this base. Yet, the key question remains: Will this historical support zone hold and offer buy opportunities, or is it a bear trap?

Selling Pressure Builds, Testing the Bulls’ Patience

From a technical view, SHIB’s momentum has cooled, with the RSI hovering around 45, below the neutral line, and edging into bearish territory. While it’s not yet oversold, sellers appear to be gaining confidence with each market dip.

Should the RSI line break toward 40, it could signal that bears are tightening their grip. In that case, SHIB could slide deeper into the $0.000012 to $0.000011 range, where the 23.60% Fib level is located. A deeper push could drag the price closer to $0.000010, the same zone traders last saw in June.

A move like that would likely shake confidence in the short-term bullish setup. Even so, crypto has a way of flipping when sentiment turns. If buyers step up again, the price could bounce back toward the 38.20% Fib line, which has capped several rallies before.

A clean break above that point could lift SHIB toward $0.0000138, the 50% retracement, and possibly squeeze through the triangle’s upper edge. That outcome would mark a shift in tone for the market and position SHIB as a steady gainer over the near term.

Related: XRP Price Sheds 4% as Analysts Signal a Possible Rebound Ahead

Sellers Tighten Grip as SHIB Reserves Climb on Exchanges

The on-chain data tells a different story. Short sellers remain active, pushing harder despite already holding an edge. This is evident as exchange numbers reveal an apparent rise in SHIB reserves, which usually hints that some holders are moving their tokens in preparation to sell.

At press time, the supply on exchanges stands near 85.2T, up from 84.36T a few days ago. That shift reveals quiet movement beneath the surface, as traders prepare to cash out, a move that could weigh on prices in the near term.

Liquidation figures back that up. Long traders have taken most of the pain, losing around $135K in positions compared with only $5K from shorts. Such a move hints at a long squeeze forming, the type of setup where optimistic traders are forced to sell, adding pressure as they try to limit their losses.

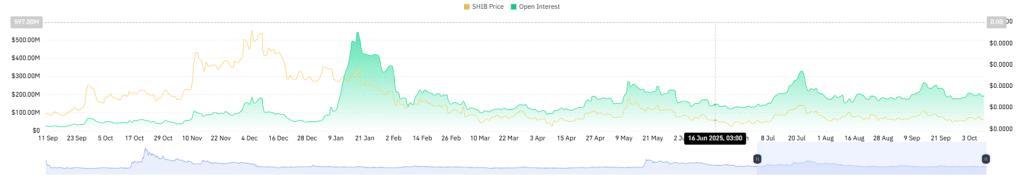

Even so, the market isn’t breaking apart. Open interest has remained flat for several sessions, a sign that traders are waiting rather than acting. For now, SHIB trades in a pocket of calm that could either turn into a breather before another drop or mark the start of a quiet consolidation phase.

In summary, SHIB is sitting at a crossroads. The chart shows pressure building, but the market hasn’t picked a side. Some traders are holding firm at support, while others look ready to sell into any bounce. Momentum feels slow, not broken, just uncertain. For now, the token drifts in that uneasy middle ground where one strong push, up or down, could set the tone for what comes next.