Smart Money Concept: The Key to Reading Market Movements

The price movements in forex follow patterns shaped by institutional activity rather than chance. Large financial entities such as banks, hedge funds, and investment firms influence liquidity and direction through their trading decisions.

The Smart Money Concept, known as SMC, helps traders recognize these institutional footprints. It focuses on reading market structure, liquidity shifts, and order flow to understand how professional capital moves.

Traders could use these patterns to position themselves on the side of the market with control. This technique eliminates the need for guesswork and promotes systematic trading based on facts and logic rather than emotions.

Core Understanding of the Smart Money Concept

The Smart Money Idea is heavily intertwined with market structure and liquidity analysis. It is premised on the belief that large institutions drive the market not with individual trades, but rather through orchestrated cycles of accumulation and distribution.

SMC is unlike most other indicator-based systems (of any kind) in that SMC is 100% pure price action. It shows that when and why prices change by studying order flow, liquidity grabs, and structural transitions. This allows traders to align their decisions with institutional strategy rather than reacting to retail market speculation.

Smart money does not chase prices; It creates movement. The concept teaches that understanding the purpose behind institutional actions is more effective than reacting to market outcomes.

Institutional Behavior and Market Mechanics

The rules of institutional trading are different from those of retail. Orders for large amounts of capital cannot simply be opened and closed on a whim with no disruption to the market balance. These positions are traded in multiple sizes across various price levels and time schedules to control impact and be as unobtrusive as possible.

Such activities leave specific structural imprints. By paying attention to them, anyone could find a clue about where they might be going next.

For instance, an explosive move after a length consolidation would often mark the end of institutional accumulation. Furthermore, a false breakout or liquidity sweep could hint at a reversal being prepared.

Core Components of the Smart Money Concept

SMC uses several analytical elements that form the foundation of its framework. Each component helps traders interpret market direction through the lens of institutional participation.

Order Blocks

An order block is a visible place on the chart where large (institutional) traders are placing buy or sell orders. It usually forms a consolidation before a significant market move. It tends to react strongly when the price comes back at an order block, and traders could have a chance to get in the direction of smart money.

Order blocks could also fail. Once price breaks through one, it turns into a breaker block indicating that institutional bias has changed. These zones often serve as future support or resistance.

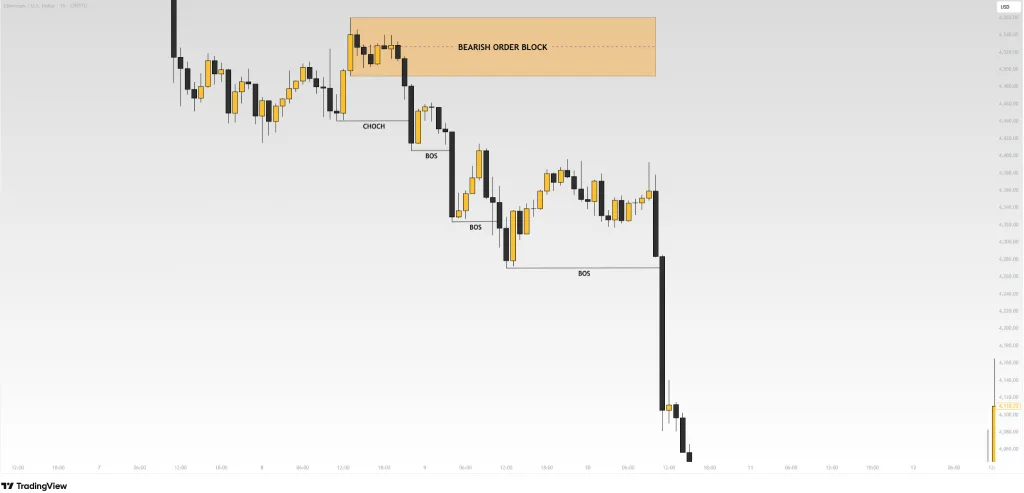

Break of Structure (BOS)

A Structure Break is when the market sends the price past the high or low of a previous swing, indicating a possible trend reversal. This gap signals new institutional participation in the market. It also serves as a useful tool for traders to assess whether the market is trending or reversing.

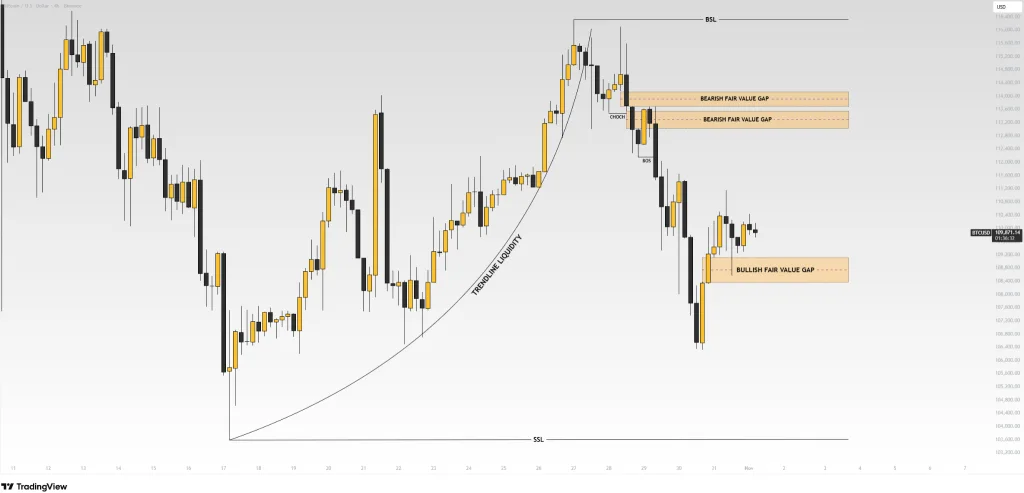

Change of Character (ChoCH)

A Change of Character usually occurs before a BOS and serves as a confirmation for the reversal. It represents a change in momentum and could be characterized by volatility geared up or change of direction. Finding a ChoCH could help traders verify if the institutions have flipped their bias in the market.

Fair Value Gaps (FVG)

A Fair Value Gap exists when markets quickly move away and there are not enough buyers or sellers available. Institutions re-enter these zones to complete unexecuted orders. That break tends to get filled and that price after stalling does what the larger trend would have been doing.

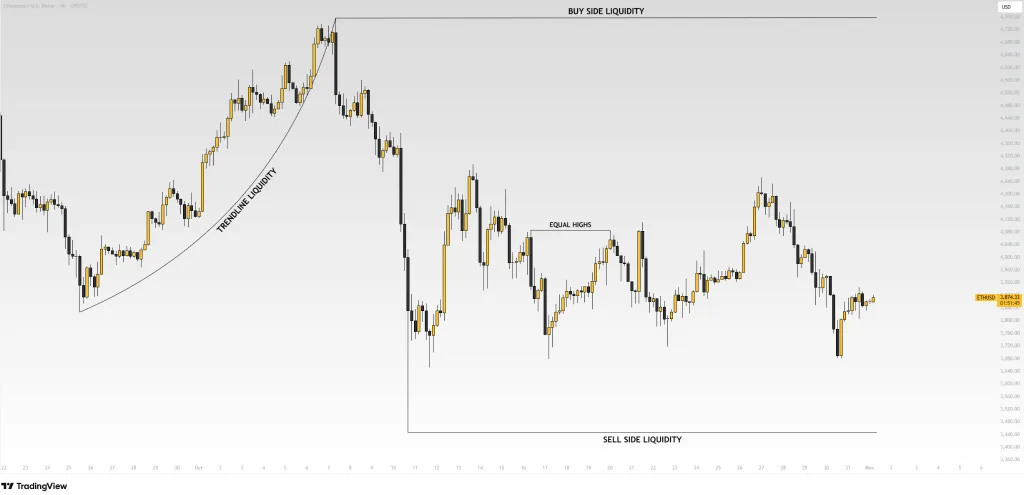

Liquidity Zones

Liquidity areas are zones that have a lot of order density where price congestion happens such as equal highs, equal lows and strong trendlines liquidity. With such areas, it is possible to perform a large position efficiently. Price often gravitates towards these liquidity pools, running the retail stop orders and creating enough volume to create a large move.

Accumulation and Distribution

From Wyckoff theory, accumulation is in bringing building positions at low prices before a markup. Distribution” is selling or shorting near market tops before the drop.

Interpreting Market Structure Through SMC

The study of market structure lies at the core of SMC. It provides the framework for understanding how institutions transition between phases of accumulation, expansion, distribution, and decline.

In an uptrend, price forms higher highs and higher lows. In a downtrend, it forms lower highs and lower lows. Identifying a BOS or ChoCH within these sequences helps traders determine whether the existing trend would continue or reverse.

After a good structural surge happens, traders search for order blocks or fair value gaps that move with the new trend. Liquidity is conclusive around these areas, solidifying the signal even more. With such organized observation, SMC investors could track the footsteps of institutional investors much more reliably.

Developing Strategic Entries and Exits

The use of SMC is a fusion between structural analysis and timing. After a valid zone has been detected, traders patiently wait for the price to break out in the desired direction before entering. It may appear as a decisive price move, a candlestick reversal pattern, or a lower timeframe break of structure.

For some traders, they set limit orders at the zone’s boundary, while others prefer price confirming reversal. Occasionally, Fibonacci retracements, volume analysis, and time-based confluence are employed to help manage entries.

Risk management remains central. Stops are placed above liquid zones, or outside of invalidation areas/blocks, and targets are defined towards opposing liquidity. The objective is to find opportunity and not get run over.

Smart Money Concept and Price Action: A Comparative View

Both SMC and price action trading analyze the stock price directly, but they have a different emphasis. Price action trading is about developing patterns and identifying trends at face value, using features such as support, resistance, and candlestick patterns.

Related: What Is Inner Circle Trader (ICT) Strategy? The Complete Guide

SMC, on the other hand, analyzes the meaning of those movements. It’s about what institutions do — the cause of the movement — not their visible effect.

Both methods could be used in combination to gain a broader understanding. Price action offers simplicity and clarity. Smart Money Concept adds depth by revealing the reasoning behind market behavior.

Common Challenges and Mistakes

However, while SMC gives structure and expresses clarity, it could also be interpreted as imprecision. This is where the majority of traders would either mistake structural change or jump on incomplete signals too soon. Differentiating between a retracement and true reversal is crucial for accuracy.

Overleveraging is another frequent issue. SMC traders must avoid using excessive position sizes that amplify both profit and loss. The goal is consistency, not high-risk speculation.

Neglecting fundamental context could also lead to errors. While SMC focuses on technical structure, institutional behavior is often influenced by macroeconomic events such as central bank policy or economic releases.

| Common Mistake | Correct Smart Money Approach |

|---|---|

| Entering a breakout too early without a liquidity sweep | Wait for liquidity to be collected and confirm direction with a BOS or ChoCH before entering |

| Setting stop-loss levels inside the order block | Place stop-loss beyond the order block to allow for normal market volatility |

| Ignoring the higher timeframe market bias | Align all trade entries with the dominant higher timeframe trend |

| Using multiple indicators for confirmation | Focus on structure, liquidity, and volume instead of stacking several indicators |

| Chasing price after a strong displacement | Wait for price to return to a clean order block or fair value gap before entering a trade |

Final Words

The Smart Money Concept shows traders how to perceive the market as a professional entity. This changes the way price is viewed. Trading is no longer about the emotional swings of price, but rather follows the footprints left behind by institutional order flow.

This method requires discipline, accountability, and the making of evidence-based decisions. It is about trading with the market flow, rather than against it. The SMC links retail and institutional trading, showing how major investors influence price action. It turns trading into a process-oriented analysis, based on comprehension rather than emotion