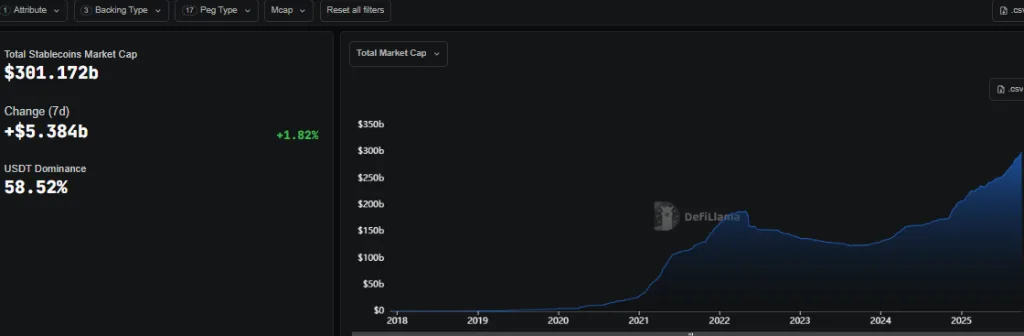

Stablecoin Market Hits $300 Billion as USDT Faces New Rivals

- Stablecoin supply crosses $301 billion with weekly inflows of $5.38 billion reported.

- USDT holds a 58.52 percent share, but rivals USDC, FDUSD, and others gain firm ground.

- Stablecoins now rival money market funds in scale and expand across global finance.

The global stablecoin market surpasses $301.17 billion according to DefiLlama, signaling a critical milestone for digital dollar adoption across crypto markets. The total value represents a 1.82% rise over one week, adding more than $5.38 billion in net inflows during that period. Stablecoins now operate as a central liquidity layer, powering trading, payments, and cross-border settlement.

They masquerade as off-chain cash equivalents, providing stability during turbulent market conditions. They are pegged against the U.S. dollar to enable unhindered capital flow, further supporting decentralized finance applications and exchange activities.

Tether’s USDT holds the largest share at 58.52%; however, its dominance is eroding due to the growing momentum of competitors. While in absolute terms, USDT is also growing, the evolution of its share signals that stablecoins are gradually shifting towards a diversified, multi-issuer structure.

Competition Increases as New Stablecoins Gain Market Share

Trailing behind $176.27 billion of USDT is Circle’s USDC, with $74 billion, a 24.5% market share. Circle claims its reserves are fully transparent and considered to be in close alignment with regulatory requirements; hence, it is the favored product of an institution inclined toward compliance exposure. USDC continues to gain traction among firms prioritizing audit standards and jurisdictional security.

With a valuation of $14.8 billion, Ethena’s USDe allows new entrants a foothold in the competitive market. In the meantime, MakerDAO’s DAI maintains its position with a $5.0 billion supply as a decentralized alternative backed by collateralized assets.

First Digital USD (FDUSD), issued by a Hong Kong custodian, is experiencing rapid growth as it benefits from regulatory alignment and bank custody models. Alongside this rise, several bank-backed tokens are emerging, offering investors a direct investment avenue in digital dollars regulated by law.

This action is a step towards the future, where it does not depend on a single issuer but instead has stablecoins as multi-vector liquidity stacks with multiple models and issuers coexisting in ecosystems. Institutional traders are currently trading USDT and USDC similarly, depending on specific jurisdictional regulatory narratives, and bank-anchored tokens are increasing as reliable points of access to regulated markets.

Related: Sui Group to Launch Two Stablecoins with Ethena Labs

Stablecoins Become Critical Financial Infrastructure

Stablecoins now rival money market funds and mid-sized banks in scale, indicating their systemic role within global finance. Their quarterly growth of nearly 20% in Q3 2025 outpaced several traditional asset classes. This expansion is partly supported by regulatory progress, including the U.S. GENIUS Act, which outlines more explicit rules for dollar-pegged tokens.

By offering payment finality and low-cost transfers, stablecoins now support diverse use cases: DeFi lending, remittances, tokenized asset settlement, and treasury management. They are essential for both retail adoption and institutional flows, making them the backbone of the digital dollar economy.

Yet risks remain, as supply fragments across issuers. Reserve transparency and regulatory oversight stand unevenly, thereby questioning the counterparty’s reliability. Bank-issued stablecoins and USDC apply much stricter audit regimes, while USDT is being pressured to sustain its credibility in its foreign territory of dominance.

As competitive pressure builds up while adoption accelerates, stablecoins are evolving into a systemic financial infrastructure. They are not only providing liquidity but also laying the structural foundation of digital finance, linking traditional markets with blockchain economies.