TWT Soars 70% on New Roadmap and CZ Endorsement as Profit Taking Looms

- TWT soared 70% based on the new roadmap and CZ endorsement, hitting a nine-month peak.

- Profit taking trimmed gains as resistance capped momentum with retracement levels in focus.

- On-chain data shows strong trader activity, and support levels may offer new entries.

The Trust Wallet Token, TWT, has delivered a stunning rebound, leaping more than 70% in just two days to hit a nine-month high. The price climbed from a low of $0.7640 to a peak of $1.3225 before easing to around $1.20 at press time.

Trust Wallet revealed a new litepaper detailing its roadmap, while Binance co-founder Changpeng “CZ” Zhao publicly endorsed the project. Together, these announcements reignited market confidence in a token that has been seeking direction since its 2022 peak.

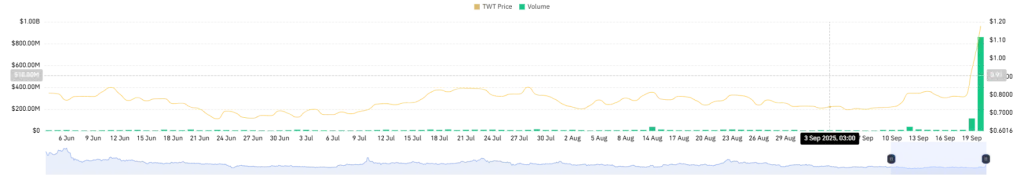

The bullish wave was visible across on-chain metrics. According to CoinGlass data, open interest in TWT futures reached a record $45 million, and trading volumes soared past $860 million, signaling an influx of traders chasing the rally.

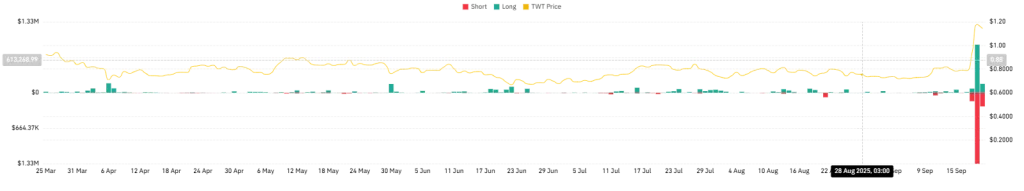

Liquidation data showed short sellers were squeezed, with $1.585 million in short positions liquidated against $1.068 million from longs. The imbalance forced bearish traders to cover losses, fueling additional upward pressure and intensifying the breakout.

Now, attention shifts to what comes next. With profit-taking already trimming some gains, the test is whether TWT can maintain momentum and push beyond resistance levels.

TWT Price Rally Explained: The Bold 2030 Roadmap

On September 18, the Trust Wallet team unveiled its litepaper, laying out an ambitious roadmap that stretches to 2030. The plan: scale the platform fivefold and reach one billion users, with Trust Wallet Token (TWT) positioned at the center of its expanding ecosystem.

The vision redefines Trust Wallet’s role from a simple storage app into a full-scale Web3 gateway. The roadmap is organized into four progressive layers:

- Layer 1: Everyday Finance — simplified cross-chain transactions, gas-free payments, the Trust Card, and seamless cash-in and cash-out options.

- Layer 2: Advanced Trading — tools such as limit orders, cross-chain swaps, leverage, and AI-driven insights.

- Layer 3: Earning and Discovery — staking, lending, airdrops, and a new “Trust Alpha” launchpad for emerging projects.

- Future Layers: Identity and Credit — features that integrate decentralized identity, credit services, and further DeFi innovations.

Currently, Trust Wallet commands a 35% share of the self-custody market, securing more than $30 billion in assets. If executed as planned, this roadmap could transform the app into a one-stop hub for Web3 activity.

Adding momentum, Binance co-founder Changpeng “CZ” Zhao weighed in on the litepaper’s release. He acknowledged that TWT originally launched as an experiment, with its Fully Diluted Value climbing too quickly in its early days.

Despite a massive 99% token burn, CZ noted that meaningful use cases were lacking until now. The litepaper, he suggested, signals a turning point where TWT becomes integral to unlocking features, participation, and rewards within the ecosystem.

TWT Price Action: Key Levels To Watch

On the daily chart, TWT has broken away from broader market trends, carving out a breakout-and-retest pattern from a descending triangle that had dominated since Q1. Typically, this formation signals bearish continuation.

Yet the cryptocurrency defied expectations, using the breakout to confirm bullish sentiment and spark a powerful rally. The surge carried the token to a peak of $1.32, but no rally comes without correction. After hitting resistance at that level, the altcoin retraced, a move that reflects profit-taking by early long traders.

This is further elaborated on the weekly chart, as TWT met a falling wedge resistance trendline that has capped upward momentum since November 2023, raising the possibility of history repeating itself. In the short term, a deeper retracement remains likely.

Key support sits at the 23.60% Fibonacci retracement zones, at around $0.90 on the daily price chart. This zone overlaps with former resistance turned support on the weekly chart, making it a critical area for potential bullish reversals and bargain long entries.

Related: SPX Soars 16% as Fed Slashes Rates, What Comes Next?

Derivatives data strengthen this outlook. The OI-weighted funding rate has slipped to -0.0166% at press time, a red-zone reading that shows short sellers paying longs to keep positions open. This reflects growing bearish conviction and expectations of near-term declines.

Moreover, TWT’s liquidation heatmap reveals a cluster worth more than $2.12 million between $1.10 and $1.09. Such liquidity pockets often act as magnets, suggesting the token may sweep this zone to flush out weaker hands before any sustained rebound.

Conclusion

Trust Wallet Token has delivered a strong rally fueled by a bold roadmap and CZ’s endorsement, but market signals point to a cooling phase. With resistance capping the surge and profit-taking underway, a short-term retracement appears likely.

Still, the broader outlook remains constructive, as solid fundamentals and on-chain momentum suggest that bulls may regain control once support levels are tested and market liquidity stabilizes.