US Clears Path for Companies to Hold Bitcoin Tax-Free: Report

- Senate begins crypto tax review after Treasury and IRS issue interim guidance for companies.

- New IRS rules spare firms from paying CAMT on unrealized Bitcoin gains held at fair value.

- Guidance strengthens Bitcoin’s standing as a corporate reserve and boosts treasury adoption.

The U.S. Senate Finance Committee would review cryptocurrency taxation. The session follows new interim guidance from the Treasury Department and the Internal Revenue Service. Both agencies acted to address concerns about the Corporate Alternative Minimum Tax (CAMT). The rule was created under the Inflation Reduction Act of 2022 during former President Joe Biden’s administration.

The CAMT sets a 15% minimum tax on large corporations. It is calculated on financial statement income rather than taxable income. Digital asset companies warned that the law could force them to pay taxes on unrealized gains. This meant Bitcoin holdings would create tax bills even if no sale occurred.

IRS Guidance Eases CAMT Burden for Crypto Giants

To address this, the Treasury and IRS released Notices 2025-46 and 2025-49. These documents give temporary relief until full regulations are finalized. Notice 2025-49 explains how CAMT interacts with Adjusted Financial Statement Income. The key change is that companies could now exclude unrealized gains and losses on digital assets held at fair value.

Source: IRS

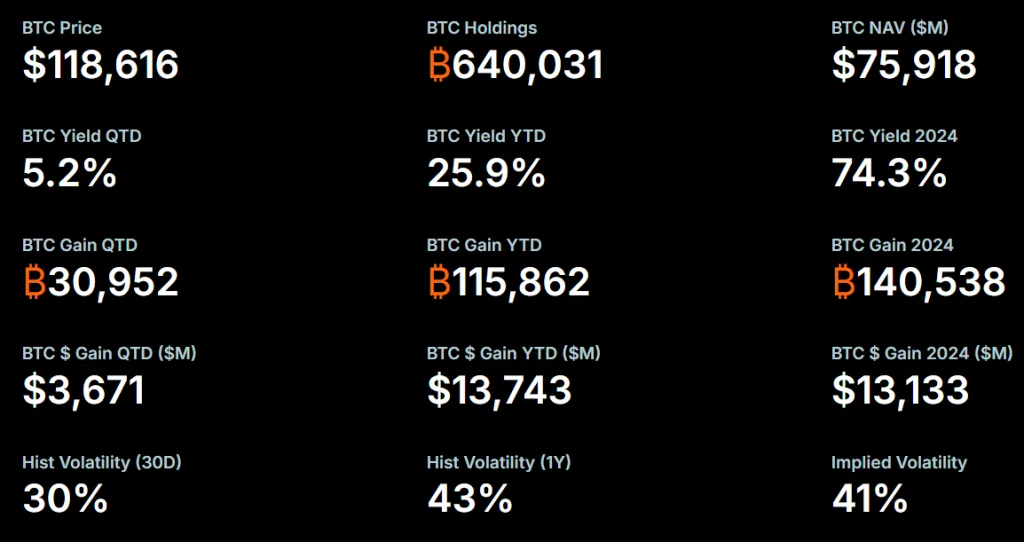

The decision has immediate effects on major crypto holders. Michael Saylor’s company Strategy owns over 640,031 Bitcoin. Those holdings carry about $13.7 billion in unrealized gains this year. Without relief, the firm faced billions in tax liability.

Source: Strategy

Journalist Eleanor Terrett noted the impact on Strategy. She reported that the company could continue its Bitcoin policy without fear of taxes on paper profits. The IRS adjustment means liability arises only when the assets are sold. That aligns with the long-term plans of firms that pledged never to sell their Bitcoin.

IRS Relief Sparks Confidence as Senate Weighs Crypto Tax Future

Earlier this year, analysts warned that Strategy could face billions in tax costs by 2026 under CAMT. This risk has now been removed. The change provides certainty to corporate treasuries. It also encourages more companies to adopt Bitcoin as a reserve asset. Supporters argue that the ruling validates the growing role of Bitcoin in corporate finance.

Investor Peter Duan said the clarification creates confidence. Firms now know they would not be taxed on unrealized gains. Jeff Walton of Strive Asset Management added that the decision removes fear and doubt that had clouded digital asset reporting. He expects companies to disclose gains more openly, knowing they would not face immediate tax consequences.

The Senate hearing would now consider how these rules should evolve. Finance Committee Chair Mike Crapo would lead the session. Testimony is expected from Coinbase vice president of tax Lawrence Zlatkin and Coin Center policy director Jason Somensatto. Lawmakers would concern how digital assets should be taxed under U.S. law and whether further reforms are needed.

This comes after recommendations released in July by the White House Digital Asset Working Group. The group urged lawmakers to classify crypto as a distinct asset class. It also called for tax rules to align digital assets with both securities and commodities. The guidance from the Treasury and the IRS sets the stage for Congress to take up those proposals.

Related: U.S. Government Shutdown Freezes SEC Crypto ETF Approvals

The IRS guidance is temporary but widely seen as durable. A reversal is unlikely though still possible. For now, companies could act on the relief while awaiting final rules. The combination of interim relief and Senate review marks a turning point for corporate crypto adoption.

The combination of interim relief and Senate review signals a critical moment for crypto taxation. Regulators have eased immediate pressures, while lawmakers weigh longer-term policies. The outcome of these actions would shape the role of Bitcoin and other digital assets in U.S. corporate finance for years to come.