USDT’s $187B Market Cap Scale Signals Capital on Standby, Not in Retreat

- USDT hit $187B market cap as traders held capital in stable form instead of risk assets.

- Crypto ETF outflows showed a cautious market, while stablecoin use kept rising.

- Tether’s USDT user activity climbed to 24.8M as regulators pushed for tighter oversight.

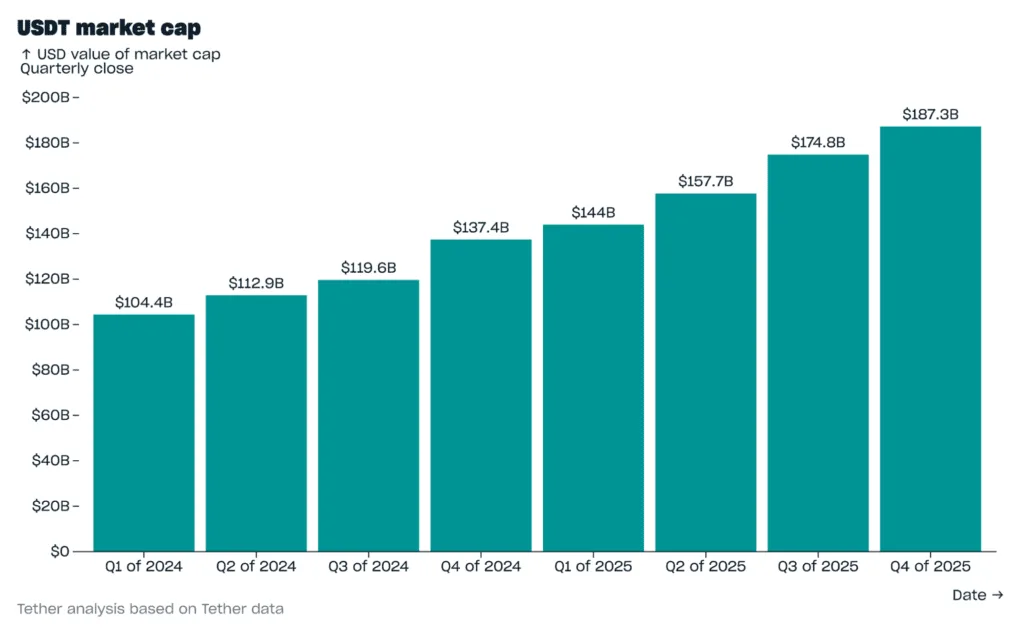

Tether’s flagship stablecoin USDT ended 2025 at an unprecedented $187 billion in market capitalization, a size that now looms over every corner of the digital-asset landscape. The figure landed at a time when capital across the rest of the market seemed to move in the opposite direction. Traders who once favored high-beta exposure grew noticeably cautious, yet they did not withdraw entirely.

Instead, they parked funds in what amounts to crypto’s most liquid waiting room. This shift sharpened in the weeks after the October liquidation episode, when price action remained unstable, and sentiment thinned out. Even so, stablecoin circulation pushed higher. The pattern puzzled some analysts at first. But as numbers settled, it became harder to ignore: liquidity was gathering, not fleeing.

Liquidity Growth Amid Risk Aversion

By early February 2026, Tether’s circulating supply crossed $187 billion, reinforcing its position as the sector’s primary settlement token. Industry desks described the rise less as a rotation out of crypto and more as a pause, an extended one. Much of this liquidity appeared content to stay in stable form while traders assessed a market that had yet to find a firm footing.

Source: Tether

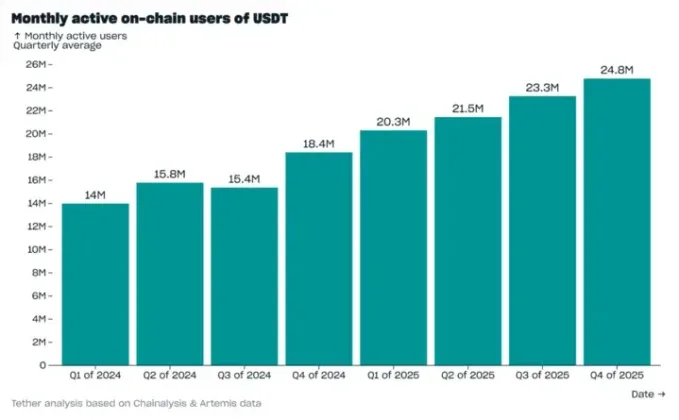

Tether also closed the year with its strongest stretch of user activity on record. Per reports, its Q4 market report showed roughly 24.8 million monthly active users, marking a steep climb from early 2024. That growth pushed USDT’s share of monthly active stablecoin users to 68.4%, an unusually wide spread during a period when participation across many trading venues drifted lower.

Source: Tether

The consistency of those increases, though, stood out. Liquidity was uneven almost everywhere else, yet USDT’s traffic kept advancing quarter after quarter. Even in a contracting market, demand for a stable unit of account held firm.

ETF Outflows Reveal a Cautious Market

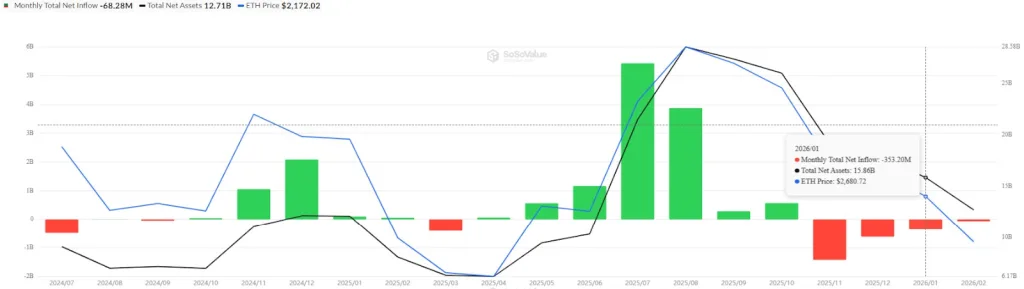

The backdrop for this expansion was anything but favorable for risk assets. U.S. spot Bitcoin ETFs recorded more than $1.61 billion in net outflows last month, according to flow trackers, while Ethereum products saw more than $353.20 million leave over the same period.

Source: SoSoValue

The retreat didn’t end there. February began with additional losses, about $255.07 million from Bitcoin ETFs and $68.28 million from Ethereum vehicles. The contrast was hard to miss. Stablecoins were swelling while regulated investment products shrank.

Source: SoSoValue

Yet investors were not exiting the industry outright. They simply moved capital to a position where they could respond quickly if conditions shifted. Consequently, the rhythm of flows suggested hesitation rather than surrender.

Related: Vitalik Buterin Warns Ethereum Builders Against Clone Chains

User Activity Expands Despite Market Stress

On-chain data pointed to a user base that did not meaningfully shrink, even as speculative volume cooled. Analysts reported that activity in USDT resembled functional usage, payments, transfers, and hedging, rather than short bursts tied to arbitrage cycles.

The sequence of growth, coming after repeated liquidity shocks, gave the token an outsized role in stabilizing market activity through late 2025. Meanwhile, this rise unfolded while regulatory debate sharpened. In Washington, the GENIUS Act remained the central reference point in discussions over how stablecoin issuers should operate.

New York officials, however, took a more confrontational stance. A letter signed by Attorney General Letitia James and four district attorneys, including Manhattan’s Alvin Bragg, warned that the measure risked granting legitimacy without matching safeguards.

Their concern focused on consumer protection and oversight gaps linked to illicit finance and fraud. The timing of the criticism ensured the regulatory conversation would shadow the sector just as its largest token reached a new scale.