WLFI Breaks Out of Falling Wedge, Positions for 22% Push to $0.17

- WLFI confirms a breakout after two weeks of narrowing movement and rising buy pressure.

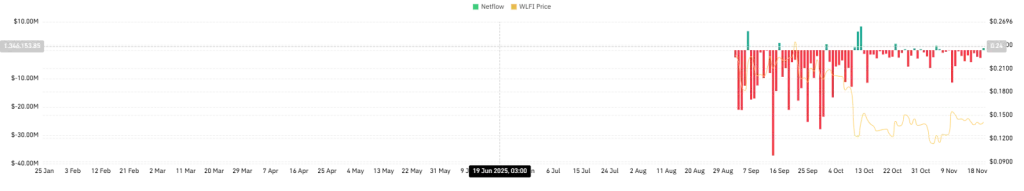

- Over $37M exits exchanges as holders shift tokens into private storage for safety.

- WLFI continues reallocations as users finalize recovery steps after early breaches.

WLFI has confirmed a decisive breakout from a falling wedge that has shaped its market structure since November 10, when the token last touched the $0.17 area. The pattern tightened for nearly two weeks as the price moved lower between converging trendlines.

Fresh buyer strength has now lifted WLFI above the wedge’s upper boundary, signaling a shift in momentum and presenting the first solid bullish setup since the early November drop. The breakout places WLFI on the upper side of the pattern and confirms an upside validation. This marks the first clear reversal signal after an extended period of confined trading.

Fibonacci Levels Now Shape the Next Targets

The path ahead comes from the retracement levels measured from the November high. Three steps stand out on the chart. The first is the 61.8% level around $0.147. Traders often watch this line closely because it tends to decide whether a rebound has real strength or not.

A move past that barrier turns attention to the 78.2% level near $0.159, which has the next cluster of resistance. The final checkpoint is the 100% retracement at $0.173. That level matches the November peak and lines up with a projected move of about 22% from current prices.

It also marks the top of the entire wedge formation, completing the reversal if reached. Momentum signals further support the setup. The Relative Strength Index (RSI) at 52 is rising and remains well below overbought territory.

This indicates room for continued upside before momentum becomes stretched and strengthens expectations for a move toward the outlined Fibonacci levels.

Exchange Outflows Add to the Bullish Setup

Market data shows a second development. CoinGlass reports more than $37 million in WLFI outflows from exchanges in the past two weeks. Large movements like this often mean holders are moving tokens to private wallets rather than leaving them on trading platforms.

It usually signals accumulation or long-term positioning rather than a rush to sell. Persistent outflows during early breakout periods often strengthen the case for a recovery, especially when the technicals already point in that direction.

Related: PI Price Spikes 12% as Pi Network Confirms Full MiCA Compliance

WLFI Shares Update on Early Wallet Compromises

The market rally comes as the team behind World Liberty Financial handled its first security issue since launch. According to reports, a small group of wallets was compromised before the platform went live. The breach came from phishing attempts and exposed recovery phrases, not from any flaw in WLFI’s contracts or systems.

As a precaution, WLFI froze the impacted wallets in September and began verifying rightful ownership. Users were asked to complete updated KYC checks and submit new wallet addresses to support safe reallocations.

Moreover, engineers created and tested new contract logic for the transfers, and the team confirmed that verified users have begun receiving their recovered funds. However, wallets belonging to users who have not yet taken part remain frozen until the process is completed.

WLFI described the gradual rollout as a safety-first measure meant to ensure accurate recovery of funds. The update aims to restore confidence after weeks of restricted account access, especially as the incident stemmed from third-party vulnerabilities rather than issues within the project’s own systems.