WLFI Rockets to $6B as Burn Proposal Sparks Debate

- WLFI entered the market with a $6B debut and $1B trading activity on top exchanges.

- A proposal to use all protocol fees for token burning gained strong community support.

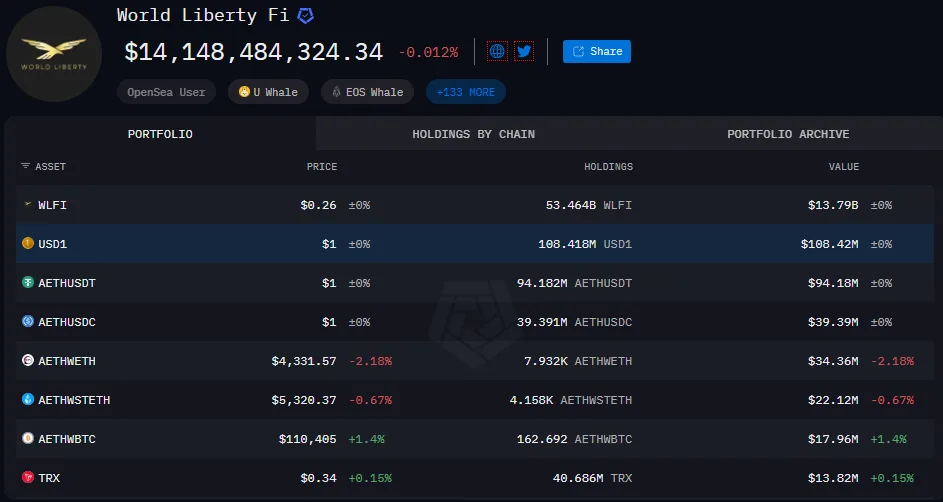

- Data shows WLFI dominates a $5.72B portfolio with stablecoins and Ethereum reserves.

The launch of World Liberty Financial instantly propelled it into the top 25 cryptocurrencies by market cap. On September 1, 2025, WLFI began trading on Binance, OKX, and Bybit. Within hours, trading volume surpassed $1 billion, while valuations touched $6 billion. Reports indicated that the Trump family controlled nearly 25% of the supply, pushing their holdings into multi-billion-dollar territory. Yet, while they initially showed momentum, governance debates surrounding an all-in burn program revealed risks.

The All-In Burn Proposal

The WLFI governance team proposed that all fees from the liquidity pools should be exclusively used for the buyback and subsequent burn of the WLFI tokens. This program would incentivize trading activity.

WLFI tokens would be purchased from the sellers using the liquidity generated on Ethereum, BNB Chain, and Solana. Those tokens would then be sent to a burn address, permanently removing them from circulation.

WLFI ambassador “Tespmoore” explained, “The proposal favors going all-in on burning, instead of splitting between treasury operations and burn.” He further noted that a 50/50 option was considered but not chosen. The official proposal stated the plan would shift ownership toward long-term holders while reducing idle supply. Comments from governance forums illustrated community support, with most of the respondents giving support to the burn strategy to manage circulating tokens.

This plan could expand over time. The framework can offer more buyback sources in future protocol revenues. This connection between activity and scarcity is one of the means by which WLFI attempts to transform the discourse of oversupply issues into one of controlled reduction.

Community and Alternative Proposals

Alongside the official burn plan, a separate community-driven proposal surfaced. This project proposes locking 80% of WLFI tokens to staking pools, which are rewarded from the 20% reserve. There were supporters who said it would transform idle supply into productive assets. The idea perceived was that by decreasing the circulation of tokens in the market, the selling pressure would be decreased.

But opponents called it redistribution instead of sustainable yield production. This proposal did not catch on as compared to the official burn plan. Debates in forums went on, but the majority of the focus was still on the approved buyback mechanism. The WLFI governance model is struggling to balance long-term and short-term objectives, and the outlined deviation provides further evidence of this issue.

Justin Sun, the founder of Tron, publicly backed WLFI on X, calling it one of the largest and most significant projects in crypto. He further stated that they have no plans to sell their unlocked tokens, strengthening the trust of a high-profile person.

Related: Trump-Linked WLFI Tops $5.7B in Volume, $1B OI With Unlock Event Looming

Portfolio Positioning and Political Context

The data from Arkham Intelligence gave a clearer picture. For one, WLFI’s portfolio assets total $14.1 billion. Of that, $13.79 billion is in WLFI assets. Stablecoins, like USD1, USDT, and USDC, tallied up to $240 million. Positions tied to Ethereum, such as staked ETH, wrapped ETH, and ETH/BTC amounts, totaled nearly $80 million, while TRX added another $13.8 million.

WLFI is in a unique position at the junction of populist politics, DeFi governance, and token engineering. As a Trump-linked asset, it benefits from the pull of political branding but also faces heightened regulatory scrutiny. On the most fundamental level, the project is confronted with one question: will a politically charged token be able to survive speculative dumping and governance pressure, or will its structure expose the vulnerability of hype-driven assets?