Worldcoin’s WLD Soars 40% as Bullish Breakout Signals $2 Target Ahead

- WLD surges 40% to $1.26 after breaking resistance as traders eye new momentum levels.

- Open interest hits $489.81M, signaling firm conviction as bullish traders hold positions.

- RSI at 70.26 and price above Bollinger Bands points to likely cooling in the near term.

The Sam Altman-linked WLD token has taken center stage in the crypto market, soaring more than 20% in a single day and 40% over the past week. At press time, the coin is trading at $1.26, its highest price in a month. The surge reflects growing investor attention as Worldcoin unveils a major technological upgrade.

The project’s new anonymized multi-party computation (APMC) system is at the heart of the rally. Built as an open-source, quantum-secure framework, APMC safeguards numerical code fragments tied to Orb-verified World ID holders.

Powered by NVIDIA H100 GPUs, the system can process an extraordinary 50 million uniqueness checks every second, underscoring its speed and scale. What makes this rollout stand out is its global collaboration.

Price Action: WLD Breaks Key Resistance, Eyes Higher Levels

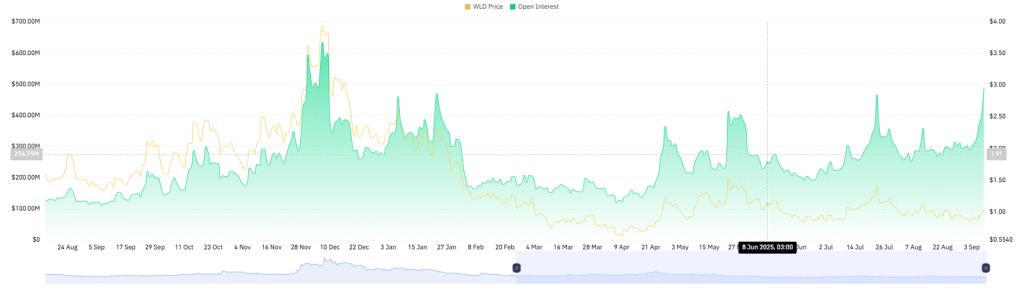

Following the positive mood in the WLD price movement, the token has smashed through a multi-month resistance trendline. This marks the first decisive bullish break since December. The action indicates a resurgence of market sentiment and opens the possibility of additional upside.

WLD is currently aiming at the $1.42 mark, which is in line with the Fibonacci retracement of 23.60%. This tier is the immediate obstacle to further profits. Beyond that, the range $1.51 to $1.68 is becoming a key area of concern to traders.

This area has repeatedly acted as both support and resistance, making it a focal point for momentum. A sustained push above this range could validate the bullish structure and open the path toward the $2 mark and beyond.

Still, the bullish outlook depends on market conviction. A pullback could see the token retest the former resistance trendline as new support. Should this level fail to hold against this selling pressure, the whole structure will weaken, bringing lower support near $1 back into the picture.

Derivatives Data Confirms Bullish Trader Conviction

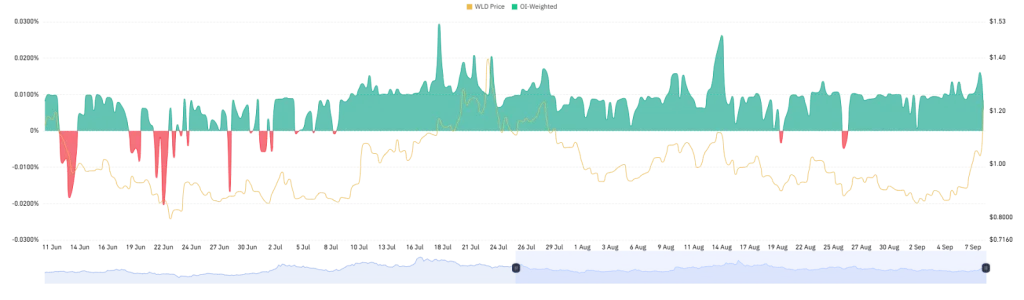

On-chain analysis suggests that the WLD market still reflects strong bullish momentum, with trader confidence reflected in the derivatives’ data. Since early July, the OI-weighted funding rate for the token has remained in the green zone.

This hints that long holders are consistently paying a premium to short sellers to maintain their positions—a clear sign of conviction. Open interest further supports this view, climbing to a 10-month high at about $489.81 million.

Instead of exiting with profits, traders are keeping their positions active, highlighting belief in further upside potential. Liquidation data contributes to the optimistic image. In the last 24 hours, short liquidations of up to $4.32 million have been swept over, as opposed to $1.63 million in long liquidations.

This imbalance highlights a short squeeze effect, compelling bearish traders to cover their losses and creating more buying pressure in the process.

Related: SHIB Faces Decisive Support Zone With 17X Rally on the Horizon

Overbought Signals Point to Possible Consolidation

Although the WLD price action is optimistic, the token indicators currently indicate overbought conditions. An example is Bollinger Bands, which indicate that the cryptocurrency has been driven significantly above the indicator’s top band at $1.12.

This means the token is exhibiting increased volatility, implying that the upward momentum might be extended in the short term. Such a sharp deviation from the mean usually leads to consolidation or a corrective pullback as the market tries to stabilize.

The Relative Strength Index (RSI) at 70.26 justifies this perception. This indicates excessive purchasing power and a minimal possibility of further upsurge unless there is some cooling off.

Past tops in the chart represent corresponding levels of RSI that caused pullbacks before the trend resumed. These signs, when combined, are an indicator that momentum is high, but a near-term pause or a retracement is most likely as traders consider profit-taking opportunities.

Conclusion

The recent breakout of WLD, combined with strong derivative data and overbought technical signals, shows both the potential and risks posed by its current trajectory. The token has, by innovative technology and market hype, gained considerable attention from traders and institutions alike.

The momentum is strong, but technical indicators recommend caution; consolidation or pullbacks are bound to happen. WLD’s overall performance highlights the growing importance it holds within the new wave of digital assets.