XRP Set for Institutional Surge as Spot ETF Nears Regulatory Approval

- XRP spot ETF may launch within two weeks, signaling a major shift in U.S. regulation.

- Canary Capital’s S-1 update clears the last hurdles for the XRP ETF to enter the U.S. market.

- Analysts anticipate $1B inflows as XRP ETF draws rising interest from Wall Street investors.

The long wait for a spot XRP exchange-traded fund (ETF) appears to be nearing an end. According to Nate Geraci, President of NovaDius and a long-time ETF analyst, the first XRP-backed funds could launch within two weeks, a move that could open the door for deep institutional participation in the cryptocurrency market.

Geraci said the expected debut represents the “final nail in the coffin of the previous anti-crypto” era, noting how drastically the regulatory tone in the United States has changed over the past few years.

Ripple’s Legal Win Clears the Last Obstacle

For years, XRP’s future was uncertain. The U.S. Securities and Exchange Commission (SEC) had accused Ripple Labs of selling unregistered securities, a case that dragged on for five years and clouded the asset’s outlook. When the dispute ended three months ago, Ripple emerged with clarity and confidence, and the path to an ETF suddenly opened.

With the lawsuit settled, XRP’s standing shifted from a question mark to a qualified asset in the eyes of regulators and fund managers. Analysts say this transition could mark one of the most significant steps toward mainstream financial acceptance for any digital asset since Bitcoin’s approval in 2024.

Canary Capital’s Filing Starts the Countdown

Momentum accelerated this week after Canary Capital filed an updated S-1 registration statement with the SEC for its spot XRP ETF. The firm removed the “delaying amendment,” a procedural clause that usually postpones an ETF’s activation until the issuer confirms readiness.

Without it, a 20-day window begins, meaning the fund could start trading as early as November 13, unless the SEC or Nasdaq intervenes. Canary used the same filing strategy for its SOL, HBAR, and LTC ETFs, all of which launched successfully after similar amendments were withdrawn. Market observers view this as a clear indication that XRP’s ETF approval may follow a similar pattern.

According to reports, SEC Chair Paul Atkins has taken a pragmatic stance on fast-tracking pending ETF applications during the ongoing government shutdown. Canary’s readiness, covering custody, market-making, and compliance requirements, leaves few reasons for further delay.

Analysts Expect Strong Demand from Institutions

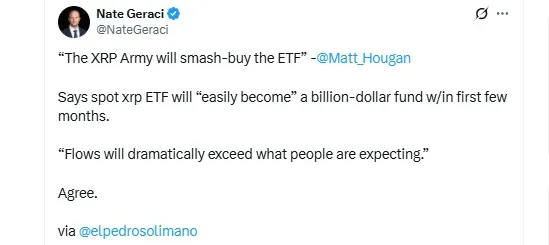

The prospect of a live XRP ETF has electrified both retail and institutional investors. Matt Hougan, Chief Investment Officer at Bitwise, predicted that the “XRP Army will smash-buy the ETF,” suggesting that it could cross $1 billion in inflows within its first few months.

Besides, technical analyst Javon Marks echoed the excitement with a fresh outlook on XRP’s price behavior. He pointed to a repeating pattern similar to 2017, when XRP jumped from $0.49 to $3.35, a gain of more than 570%, while Bitcoin lagged behind. Marks now believes XRP could outperform Bitcoin by over 600% if the ETF drives a new wave of liquidity into the market.

Still, some analysts warn that history might rhyme with the “buy the rumor, sell the news” reactions that followed both Bitcoin and Ethereum ETF launches earlier this year, when both assets briefly dipped after strong pre-launch rallies.

Related: Zcash Breaks 7-Year Record Amid Renewed Investor Hype

XRP Holds Firm Amid Market Uncertainty

According to CoinMarketCap, XRP traded near $2.42, down 5% in 24 hours and 20% over the month, yet trading volume surged by 88% to $3.78 billion. The token’s market capitalization sits at $144.9 billion, maintaining a top position despite market-wide pullbacks.

The broader crypto market has also shown strain, falling over 3% from $3.72 trillion to $3.61 trillion, reflecting caution as investors watch the Federal Reserve’s next rate decision. Analysts suggest that the surge in XRP’s trading activity signals rotation, investors taking profits while positioning for the ETF’s potential green light.

If the expected approval arrives on schedule, XRP could stand alongside Bitcoin and Ethereum as one of the few cryptocurrencies with a fully regulated U.S. spot ETF. For many on Wall Street, that moment would not only mark a milestone for XRP but also confirm how far the digital asset industry has matured in just a few years.