XRP Surges 7% After Long Lull as New Ripple-Focused ETFs Hit the Market

- XRP hit $2.29 after reclaiming the $2.06–$2.18 support with 51% volume growth.

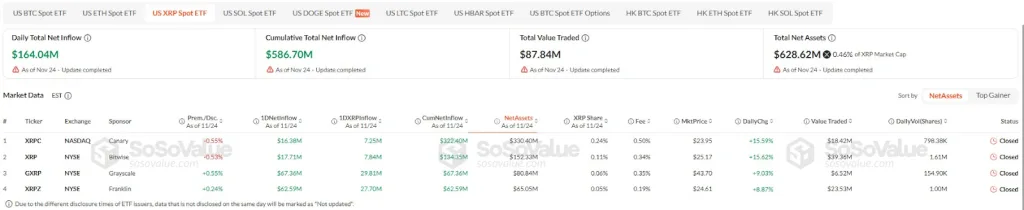

- Four XRP ETFs drew $164.04 million in one day and lifted total inflows to $586.70 million.

- GXRP and XRPZ led with $67.4M and $62.6M as XRP trades near a $132.53B valuation.

XRP staged a sharp rebound over the past 24 hours, rising 7%, as a wave of new Ripple-focused exchange-traded funds (ETFs) opened new regulated pathways for institutional exposure. The price rose to a high of $2.28 before declining to $2.19. The advance marked one of XRP’s strongest single-day recoveries this month following weeks of muted price action.

Momentum began building early as steady buying pressure carried XRP toward the $2.18 support-turned-resistance zone, a level traders had closely monitored throughout last week. At 17:00 UTC, a burst of ETF-related volume flooded the market, sending the token through the barrier and lifting prices to $2.21 before a further upswing topped out at $2.28.

The push followed a two-day bullish streak recorded on November 23 and 24, when XRP reclaimed the $2 mark. As of press time, XRP trades near $2.19 with a $132.53B market cap and $6.33B in 24-hour trading volume, representing a 51% increase.

Pure-Spot XRP ETFs Trigger Major Institutional Rotation

XRP’s renewed momentum coincided with a series of ETF launches that opened deeper regulated exposure in the United States. On NYSE Arca, Grayscale’s GXRP and Franklin Templeton’s XRPZ made their market debuts, marking a milestone for institutional access to the asset.

GXRP, which converted from a closed-end trust into an ETF, reported $67.4 million in net inflows on launch. Franklin Templeton’s XRPZ attracted $62.6 million. Additional inflows came from Canary Capital’s XRPC ($16.4M) and Bitwise’s XRP fund ($17.7M), bringing total category inflows to $164.04 million for the day.

Since their introduction on November 13, pure spot XRP ETFs have accumulated $586.70 million in total net inflows and have not recorded a single day of outflows. This performance stands out in contrast to the broader crypto ETF landscape, which recently faced multi-billion-dollar net withdrawals.

Technical Indicators Signal Strength After Reclaiming Key Support

XRP’s latest advance reestablished the $2.06–$2.18 support zone, a region that traders identify as a short-term confirmation of renewed upside momentum. Besides, the Relative Strength Index (RSI) currently sits at 48, rising from oversold conditions earlier in the week.

While still below the neutral 50 threshold, the upward trajectory indicates strengthening buyer control and room for continued expansion if the index approaches the 60 level.

The immediate test now sits at the $2.28 resistance, which aligns with the 38.60% Fibonacci retracement level. A confirmed break above this region could open the path toward the $2.43–$2.59 range.

Related: Monad’s MON Jumps to an ATH of $0.038 After Crashing to an ATL of $0.020

Key Levels to Watch as XRP Builds Momentum

Analysts note that maintaining price stability above the $2.06–$2.18 base is essential for preserving the current bullish structure. A loss of this zone may expose XRP to a move back toward the $2.00 area, a retest that would challenge the strength of the recent uptrend. For now, inflow data remains the defining force.

With regulated ETF access expanding and fresh capital entering the market, XRP has reemerged as one of the few large-cap tokens posting gains amid a period of wider market cooling.