Zcash Breaks 7-Year Record Amid Renewed Investor Hype

- ZEC hits seven-year highs with $7B market cap before easing to $6.34B amid cooldown.

- Zcash halving is now projected for 2028, where mining rewards will be reduced by half again.

- Naval and Hayes spark a ZEC rally, driving social buzz and a massive futures squeeze.

Zcash has burst back into the spotlight, climbing to levels not seen in seven years while most of the market drifted lower. The privacy-driven cryptocurrency, known by its ticker ZEC, leaped 18.9% on Saturday to reach a peak of $448 before falling to below $400.

On the same day, data from CoinGecko showed daily trading activity above $1.38 billion and a total value of $7.16 billion, giving Zcash one of the most impressive turnarounds in the sector. Its October performance has stood out even more sharply.

However, the euphoria has since cooled. As of press time, ZEC has dipped about 7% in the past 24 hours, now trading around $387. Its market capitalization currently stands at $6.34 billion, with daily trading volumes down to roughly $982 million. Even with the pullback, Zcash has still soared about 192% in one month.

The rally has revived interest in the project’s halving cycle, a mechanism that slows the creation of new coins. However, rumors suggesting a November halving proved inaccurate. Data from ASICMinerValue indicates that the next supply cut is expected to occur in late 2028, when the block reward will decrease from 1.5625 ZEC to 0.78125 ZEC. That built-in reduction is central to Zcash’s scarcity model and long-term value case.

Chart Signals Show Strength but Warn of Volatility

On the technical front, ZEC’s chart now displays a rising broadening wedge, a pattern formed by two diverging trendlines pointing upward. Such structures typically indicate heavier price swings ahead.

Recently, the token briefly touched $448, marking its best level since 2018, before facing resistance along the upper boundary of that wedge. Consequently, a correction unfolded, and the token revisited the $390-$371 support level, aligning with the 50-day moving average and the 78.6% Fibonacci retracement level, which is near $378.

So far, the 50-day EMA has consistently held as a cushion during pullbacks. Maintaining that level could keep Zcash on a steady upward path heading into 2026. Besides, the RSI, hovering around 50, has drifted down from overbought territory, suggesting cooling momentum rather than outright reversal.

Related: Bitcoin and Ethereum Harshest Monthly and Quarterly Losses Since 2018

High-Profile Voices Ignite Investor Interest

On October 1, Crypto investor Naval stated ZEC “insurance against Bitcoin.” BitMEX co-founder Arthur Hayes predicted a possible $10,000 valuation. Those statements caused the price of the coin to surge and sparked increased conversation on trading platforms and social media, drawing new participants into the market.

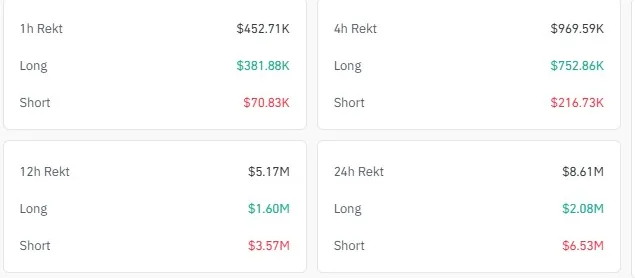

The excitement was further amplified by liquidations in the futures market. Figures from CoinGlass show roughly $8.6 million in ZEC contracts wiped out on Saturday, including $6.5 million in short bets. That short squeeze forced sellers to buy back positions, driving the price even higher.

Retail Momentum and the Return of the Privacy Debate

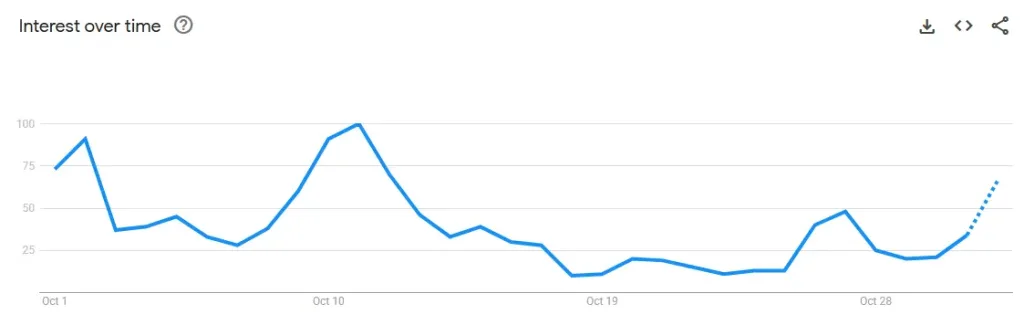

Retail traders soon joined the wave. Search data from Google shows a sharp rise in queries for “Zcash” throughout October—evidence of the FOMO that often precedes significant retail inflows.

The renewed attention comes as discussions over digital privacy grow louder. Zcash’s model—offering optional transaction shielding—gives users a balance between transparency and discretion, a topic gaining traction as regulators debate blockchain oversight.

Even as the broader market contracts, Zcash’s controlled issuance and revived visibility have turned it into one of the most talked-about tokens of 2025. While near-term volatility is expected, its recent rally highlights how assets with distinct fundamentals can still outperform during market stress.