Zcash Price Hits 4-Month Peak as Overbought Risks Surface

- ZEC surged 16% in a week, clearing $56 resistance and reaching new highs at $61.89.

- RSI reading at 69.93 shows Zcash entering overbought levels with risk of a near-term correction.

- On-chain data highlights shorts at risk with a possible squeeze likely above the $61.92 level.

Amid a shaky week for top cryptocurrencies, privacy token Zcash (ZEC) has broken away from the pack with a decisive rally. The coin surged to a four-month peak of $61.89, securing over 10% growth in just 24 hours and standing more than 16% higher on the week.

Zcash Price Action: ZEC Breaks Out of an Ascending Triangle

On September 22, Zcash (ZEC) fell to lows of $46.95 as broader market weakness weighed on bullish momentum. Yet renewed attention on privacy coins helped the token stage a sharp comeback.

The move mirrors a rally seen in May, when ZEC tested the same area but failed to advance, sliding to $34.52. That decline set the stage for an ascending triangle pattern, a bullish structure that has now resolved to the upside. At press time, however, the token faces fresh resistance near $62, a price level last touched in early January.

Momentum signals suggest caution. The Relative Strength Index (RSI) stands at 69.93, just shy of the overbought 70 threshold. While the indicator points higher, it also hints at limited room for further gains before a pullback or period of consolidation, as traders may begin locking in profits.

Murrey Math Lines reinforce the same caution. ZEC has already cleared the 7/8 line at $59.38, a level typically viewed as unstable and prone to reversals. Price strength above this zone highlights bullish energy but also marks overheated conditions.

The next key test lies at the 8/8 line near $62.96, regarded as ultimate resistance within the Murrey Math framework. Failure to build momentum above this level could trigger a near-term retracement, with traders expected to reassess positions and search for fresh support levels.

ZEC’s Key Levels to Watch

If the correction continues in the near term, Zcash (ZEC) is expected to retest the 6/8 pivot at $56.88, aligning with the former $54–$56 resistance band. This area now serves as immediate support and could shape the next move. A successful defence of this zone may form a classic breakout-and-retest pattern, often viewed as a bullish continuation signal and a potential long entry point.

In such a case, ZEC could build momentum beyond the $62 ceiling, with possible targets stretching toward $70 or even $80, levels last approached in December. On the flip side, a more profound pullback may drag the token toward the 78.60% Fibonacci retracement at $52.09, which represents the final layer of potential support.

A breakdown below this level would pierce the ascending triangle’s support line, undermining the bullish outlook. Such a move could expose the 50% Fibonacci level near $45.70, resetting the market structure entirely in favour of the bears.

Related: XRP Faces Pressure as Descending Triangle Shapes Market Outlook

On-Chain Metrics Reveal Pressure Building Against Shorts

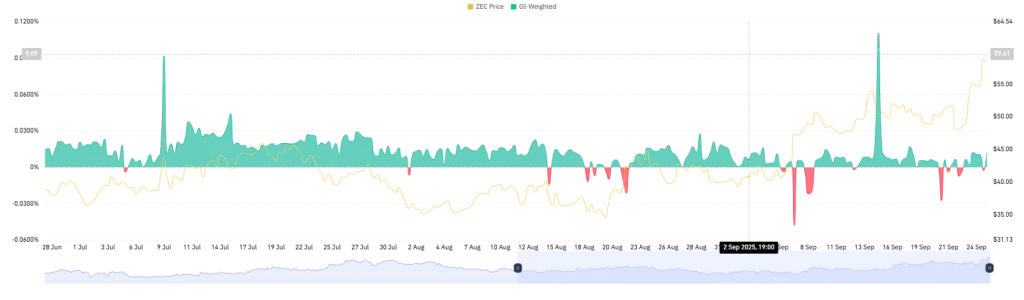

On-chain signals currently lean bullish. ZEC’s open-interest weighted funding rate sits at +0.0120%, showing that long traders are paying shorts to maintain positions. This reflects a firm conviction among buyers who expect the rally to continue.

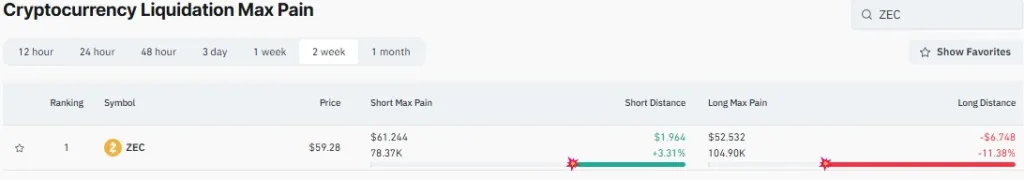

Liquidation data adds another layer to this view. The max pain chart reveals that shorts are more vulnerable than longs. A move to $61.92, just 3.31% above the current price, could wipe out 78.37K in short positions.

By contrast, long liquidations would require a much deeper decline of 11.38% to $52.53, totalling 104.90K in positions. This imbalance suggests conditions are primed for a potential short squeeze, one that could accelerate ZEC’s upward trajectory if buyers maintain control.

Conclusion

Zcash’s recent breakout has placed the token at a pivotal crossroads. While bullish sentiment and on-chain data highlight firm buying conviction, technical signals warn of overbought conditions and the possibility of a short-term correction.

Key support levels will determine whether momentum cools or builds further. If buyers defend these zones, ZEC could consolidate before mounting another leg higher, potentially reclaiming levels near $70 or beyond.