Zcash Steadies at $500 While Mixed Institutional Data Clouds Outlook

- ZEC holds above $500 as price rebounds toward $514 after steep losses, signaling recovery.

- Grayscale’s ETF bid splits sentiment while Reliance Global commits its full treasury to ZEC.

- On-chain data shows strong accumulation with $168M leaving exchanges across ten days.

Zcash found itself trading around $500 zone this week after a sharp slide from over $700. The level has acted like a floor several times this month, and once again, the market treated it that way. Buyers stepped up, nudging ZEC toward the $514 area, roughly a 3% lift from the previous day.

The bounce has not convinced everyone, though. Trading volume dipped to around $1.02 billion over the same period, roughly 4% lower, suggesting that enthusiasm remains muted and the market is trying to make sense of conflicting signals.

Conflicting Institutional Moves Shape Outlook

ETF Debate Puts the Spotlight Back on Zcash’s Identity

Grayscale’s latest move stirred the most discussion. The firm filed on November 26 to convert its long-running Zcash Trust into an ETF. The trust holds more than 394,000 ZEC, about 2.4% of the token’s circulating supply, valued at close to $197 million.

The filing landed with a thud in some corners of the community. Supporters said an ETF could make ZEC easier to access for institutions, but critics argued that the whole idea works against Zcash’s foundation.

Eric Van Tassel, an avid crypto investor, called the idea “a Trojan horse” and said an asset “is no longer decentralized” once an ETF comes into play. The price barely moved on the news, adding just 0.7%. That muted reaction reflected what the debate looked like: uncertainty over regulation mixed with concerns about how a privacy-focused asset fits into the ETF world at all.

A Different Signal From Corporate Treasuries

While the ETF filing caused hesitation, a separate development painted the opposite picture. Reliance Global Group announced that it had moved its entire digital asset treasury into ZEC.

The switch came after a full review by its Crypto Advisory Board, which concluded that Zcash’s architecture, privacy capabilities, and compatibility with compliance frameworks made it the strongest long-term option.

The firm’s chairman and CEO, Ezra Beyman, said the privacy structure and flexibility aligned better with the company’s long-term vision than staying diversified. Reliance joined a small but growing group of companies, such as Leap Therapeutics and Cypherpunk Technologies, that have taken similar positions.

This kind of move tightens available supply and gives ZEC a separate, steady form of institutional interest, even as the ETF conversation continues to dominate the narrative.

Technical Picture Points to a Narrow Channel

At press time, ZEC is trading inside a symmetrical triangle, with buyers defending the lower boundary at $500. A short-term barrier has formed at $548, lined up with the 38.20% Fibonacci retracement. Clearing that point would be an early sign that the reversal has real traction.

Above that, the roadmap leads to the 50% Fibonacci level at $586 and the 78.60% level around $679. However, if the downside wins, the long-term support trendline and the $500 base are the next areas of interest. A break below both would send attention toward the next support pocket at $424.

From a technical standpoint, the RSI is currently at 43, reflecting bearish conditions. However, stronger buying pressure could lift it toward the neutral 50 level and potentially into the bullish zone near 60.

Related: ENA Price Rebounds on Rising Accumulation: Is a Break Toward $0.40 Next?

On-Chain Flows Add Another Layer to the Mix

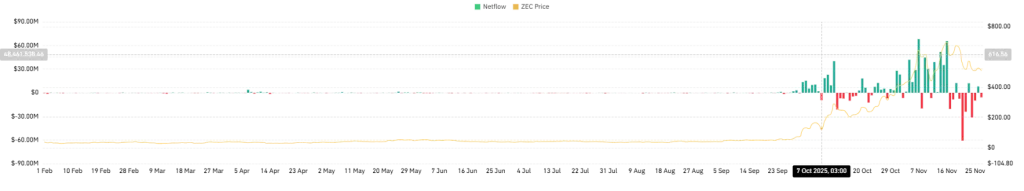

On the other hand, exchange flow data shows a large accumulation pattern over the past ten days. According to ZEC’s spot net flow chart, only three days logged inflows, adding up to $31 million.

The other seven days saw more than $168 million in outflows, suggesting traders are moving ZEC off exchanges rather than preparing to sell. That slow, steady drawdown in exchange balances often mirrors confidence in a token’s longer-term outlook.

Combined with the corporate treasury focus and the firm footing at $500, on-chain behavior leans slightly to the positive side. But with the ETF debate still unresolved, the market is left balancing enthusiasm and caution in equal measure.