XRP Breaks Resistance, Eyes $3.60 as SEC Ruling Approaches

- XRP sees $6.27 billion in trading volume, as SEC ETF decision deadlines near for the token.

- With 15 XRP ETF applications under review, there’s a 93% chance of approval by year-end.

- Strong technical indicators suggest bullish momentum for XRP, with a breakout pattern forming.

XRP is holding steady at $3.18, marking a 4.14% increase over the last 24 hours. The cryptocurrency’s daily trading volume stands at $6.29 billion. As the third-largest cryptocurrency by market cap, XRP is showing resilience as it approaches a critical period. With SEC deadlines for spot XRP ETF applications scheduled between October 18-25, the coming weeks could prove pivotal.

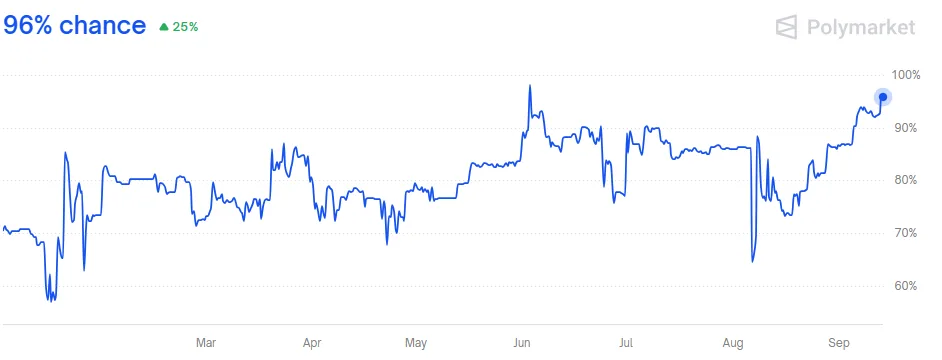

The SEC has delayed decisions on multiple spot XRP ETF applications, including the Franklin XRP ETF, filed in March. The final decision on Franklin is scheduled for November 14, but most other filings are expected in October. Reportedly, there are 15 XRP ETF applications under review, with Polymarket indicating a 96% probability of approval by year-end.

Source: Polymarket

Approval of an XRP ETF could accelerate institutional adoption and introduce new liquidity to the market. This scenario would likely mirror Ethereum’s path to ETF approval, where market sentiment remained strong despite delays. A successful XRP ETF launch could have a dramatic effect on the broader cryptocurrency landscape.

Rising Altcoin Demand Positions XRP for Potential Price Surge

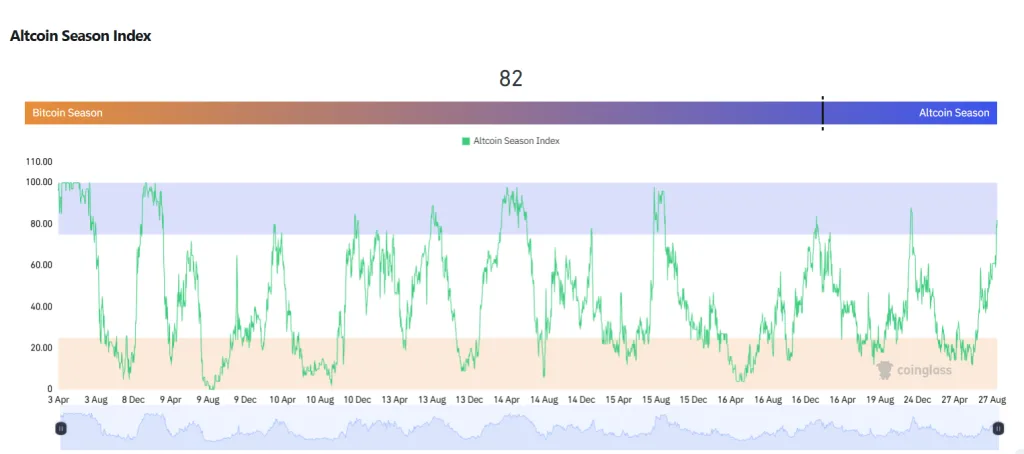

The Altcoin Season Index currently sits at 82, indicating that capital is flowing into non-Bitcoin assets. This trend could work in XRP’s favor if positive developments occur in October. As more attention shifts to altcoins, XRP is well-positioned to benefit from any good news during this period.

Source: Coinglass

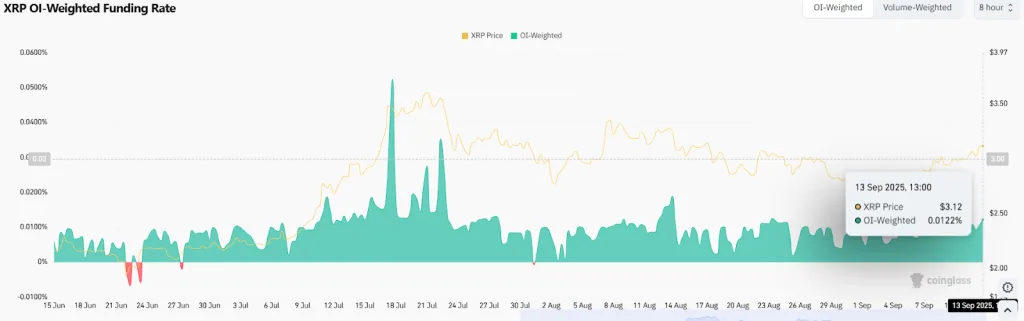

On-chain and derivative data show increased demand for XRP. Futures Open Interest (OI) has risen to $8.51 billion this week, as compared to $7.37 billion the week before. Although still lower than July, at 10.94 billion, this gradual but continued upward trend is evidence of a growing belief in the future of XRP. Interest rates have also increased, and now stand at 0.0122% on Saturday. These signals suggest that there might be a significant price change of XRP.

Related: Amplify Files for First XRP Option Income ETF With the SEC

Source: Coinglass

XRP Shows Strong Bullish Momentum as Key Resistance Nears

XRP’s technical indicators reinforce the positive outlook for a bull run. The 50-period moving average sits at $2.76, above the 100-period at $2.50 and the 200-period at $2.76. This crossover suggests that short-term momentum is surpassing longer-term trends, which is a positive sign for the asset. This optimistic view is supported by the MACD (Moving Average Convergence Divergence) indicator. The blue MACD line has a value of 0.04124, and the Signal line (orange) has a value of 0.02252.

Source: TradingView

Resistance at $3.05 was earlier mentioned by analyst Ali Martinez as a critical point to XRP. In the case sellers sustain this, the price might decline to 2.80, which has been the trend since August. Nonetheless, a sustained breakout could push XRP to $3.60, which is near its all-time high of $3.65.

Source: X

Over the past seven days, XRP has risen more than 14%, surpassing resistance. Despite occasional whale movements selling over 120 million XRP, the market remains healthy. Analysts are optimistic, particularly given XRP’s performance against Bitcoin.

The XRP/BTC daily symmetrical triangle breakout is regarded as one of the critical developments, with traders keeping an eye on the price range. Meanwhile, if the ETF gains approval, the meme coin could experience a significant boost, which will in turn make a drastic shift in the cryptocurrency space.