Pump.fun Overtakes Hyperliquid with $1B in Memecoin Trading

- Pump.fun surpassed $1B in daily trading volume, signaling the rise of memecoins in DeFi.

- TVL at $334 million marks Pump.fun’s shift toward sustainable growth, moving past speculation.

- With a buyback program and creator rewards, Pump.fun focuses on long-term value over hype.

Solana-based memecoin launchpad Pump.fun broke a significant milestone, surpassing $1 billion in daily trading volume. This surge in activity reflects a broader trend in the memecoin sector, showing how culture, creator incentives, and community energy dominate decentralized finance (DeFi).

Pump.fun processed $942 million in transactions, which soared to $1.02 billion the following day. This surge coincided with the memecoin sector’s overall rise, which saw its market capitalization spike to $83 billion, reaching a 30-day high. As of now, the sector’s value stands at $76 billion, continuing to outperform expectations.

Pump.fun’s TVL Reaches New Peak

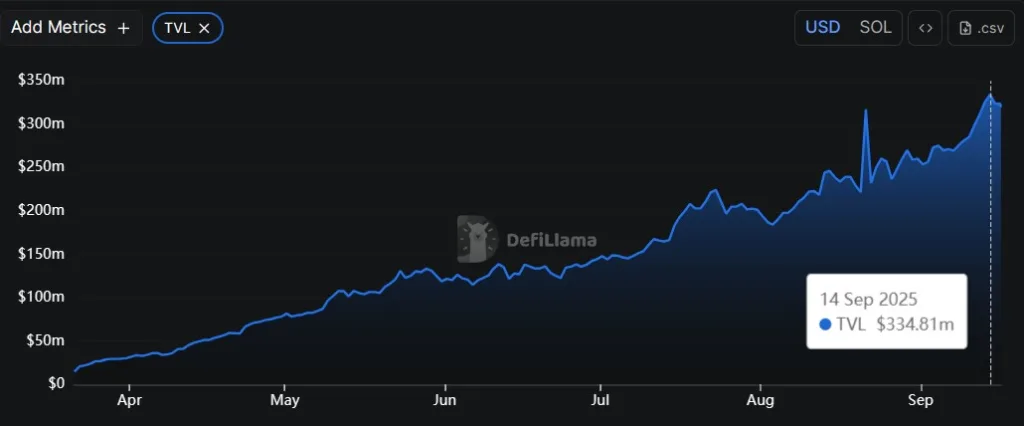

Pump.fun’s rise has also been reflected in its total value locked (TVL), a critical metric for DeFi platforms. According to data from DefiLlama, Pump.fun’s TVL hit a new peak of $334.81 million on Sunday, marking a milestone in the platform’s growth, emphasizing a shift towards value creation beyond mere speculative trading.

Source: DefiLlama

The platform generated $3.06 million per day, which is by far the third-largest contributor to DeFi protocols, behind Tether and Circle. Interestingly, even in the wake of the spectacular run, Hyperliquid is ahead of Pump.fun in the 7-day and 30-day revenue categories.

Released in 2024, Pump.fun enables easy deployment of memecoins via an easy-to-use interface. The platform garners revenue based on creating tokens, providing liquidity, and trading volumes. This model has enabled it to gain huge value within a few years, given that it emphasizes community-based initiatives.

Further, the platform has developed its creator ecosystem by assigning creators rewards (mostly first-time users) totalling $4 million on Monday. This emphasis on compensating the creators demonstrates how Pump.fun thinks about building a community-based platform, which values incentives rather than higher-order financial engineering.

Related: Pump.fun Revenue Soars to $800M as Heaven’s LIGHT Pushes $2B

Strategic Buyback Program Fuels Revenue Resurgence

The highest revenue of Pump.fun was roughly in excess of $6.7 million, but it dropped remarkably by over 96% in August, raising concerns over its revenue model. However, the platform had regained its footing in the crypto space through strategic decisions.

Among those moves is the aggressive buyback initiative implemented by Pump.fun itself on its native PUMP token. Since its opening in July, the platform has bought back 97.9 million tokens, shrinking the supply in the market by 6.69%. This has been one of the major efforts that have been used in stabilizing the platform and making it grow.

The buyback policy, assigning 100% of the platform’s revenue to token purchases, is a bold step. It highlights the dedication of Pump.fun towards its future sustainability and user utility, despite the speculative markets of memecoin trading. This strategy could also indicate that the platform is projecting into what is beyond the immediate profitability that could be linked to memecoins.

The success of Pump.fun brings up a crucial issue in the DeFi domain in terms of establishing sustainable protocol power. The platform’s surge has been spectacular, yet it still needs to demonstrate its sustainability, and this could be handled by maintaining its momentum.