Crypto Crash Triggers $19B Liquidation in Just 24 Hours, Here’s Why

- Crypto crash wipes out $19B in a day as 1.6M traders suffer record liquidations.

- Bitcoin, Ethereum, and Solana plunge sharply as long positions face huge losses.

- Trump’s 100% tariffs on China spark panic, deepening the global crypto market selloff.

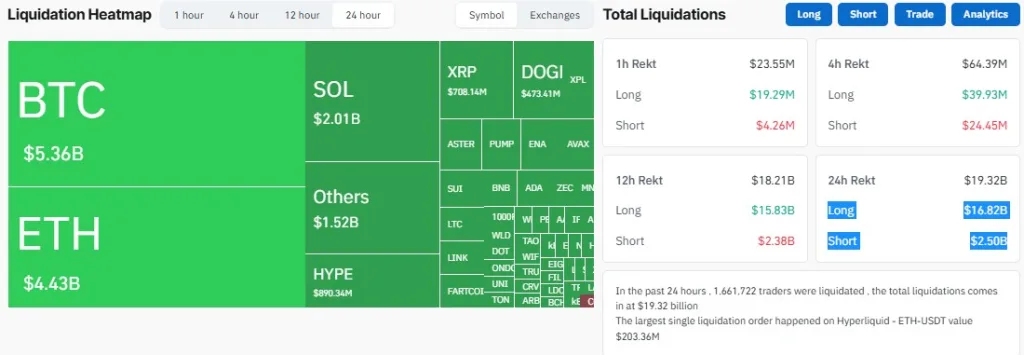

The cryptocurrency market experienced one of its most severe corrections in history, with over $19.3 billion in positions liquidated within a single day. Data from CoinGlass revealed that nearly 1.66 million traders were wiped out in 24-hours, marking the largest liquidation event in crypto history.

Bitcoin and Ethereum bore the brunt of the selloff, resulting in a sharp decline. The sudden move triggered widespread panic among leveraged traders and raised a bigger question: Is this the end of the three-year bull cycle, or just another deep correction before the next climb?

Historic Liquidations Sweep Through Major Tokens

Data from CoinGlass shows that Bitcoin (BTC) led the losses with over $5.36 billion liquidated, followed by Ethereum (ETH) at $4.43 billion and Solana (SOL) with $2.01 billion. Other tokens weren’t spared either; XRP ($708 million), DOGI ($473 million), and HYPE ($890 million) all faced heavy hits as markets plunged without warning.

Of the total $19.32 billion, roughly $16.82 billion came from long positions, while $2.50 billion was from shorts, confirming a major long squeeze. The most significant single liquidation occurred on Hyperliquid, where an ETH-USDT position worth $203.36 million was wiped out in a matter of seconds.

CoinGlass added that the figure might be even higher, since Binance, the biggest global exchange, often reports liquidation data later than others.

Bitcoin and Ethereum Prices Recoil After Sharp Fall

The selloff triggered panic among leveraged traders. Bitcoin plunged more than 15% to around $102K before rebounding above $111K as of press time. The drop forced many long holders to close their losing positions, which accelerated the downward move as selling pressure intensified.

Ethereum suffered an even deeper cut, falling 20% to about $3,510 before recovering to levels above $3,700. Besides, the overall crypto market cap briefly dipped to $3.87 trillion, signaling one of the most severe deleveraging phases in recent years.

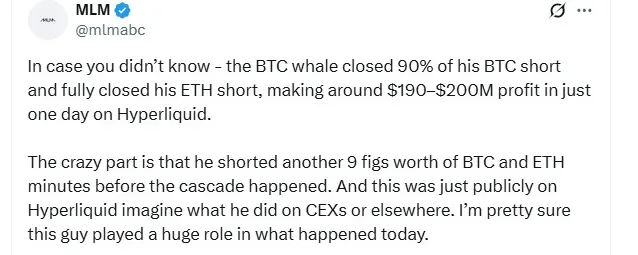

Yet while most reeled from losses, a few found opportunity in the turmoil. Analyst mlmabc pointed out one whale who reportedly pocketed between $190 million and $200 million on the Hyperliquid exchange. The trader is said to have closed 90% of his Bitcoin short and fully exited his Ethereum short just before the rebound.

What caught the market’s attention was his timing. Moments before the cascade, he reportedly opened new nine-figure shorts on both Bitcoin and Ethereum. Many in the community now believe those well-timed positions may have played a part in deepening the selloff.

Related: Bitcoin Crashes 17% As Crypto Market Loses $19 Billion

Experts’ Take

Seasoned traders compared this meltdown with earlier shocks, and the difference is staggering. Market analyst Ash Crypto noted that the current event marks the largest liquidation in crypto history, with $19.16 billion wiped out, nearly 20 times the scale of the March 2020 COVID crash, which saw $1.2 billion in liquidations, and far surpassing the $1.6 billion wiped out during the FTX collapse.

Arthur Hayes, BitMEX co-founder, explained that the sharp declines in many altcoins were driven by major centralized exchanges automatically liquidating collateral linked to cross-margined positions. He added that this flush might actually help reset the market, allowing undervalued assets to find stronger hands. “Congrats to all the stink bidders,” he quipped, suggesting bargain hunters benefited from the sudden crash.

The Trigger Behind the Record Liquidation

The selloff gathered pace after a surprise move by U.S. President Donald J. Trump, who announced sweeping 100% tariffs on all Chinese imports and new export limits on critical software, effective November 1, 2025.

The decision came after Beijing unveiled a broad trade measure of its own, vowing to impose large-scale export restrictions on nearly every product it produces, and even on some it doesn’t. Trump, in a post shared on Truth social media, blasted the move as “a moral disgrace” in international trade, promising that Washington would respond decisively to protect American industries.

Markets reacted immediately. Tech stocks were hit hardest as traders priced in a potential new trade war between the world’s two largest economies. The Nasdaq dropped 3.6%, while the S&P 500 slid 2.7% and the Dow Jones Industrial Average fell 1.9%, marking their sharpest declines since April.