Fetch.ai and Ocean Rift Deepen as Binance Alters Token Rules

- Sheikh accused Ocean of minting millions of OCEAN tokens before merging with Fetch.ai.

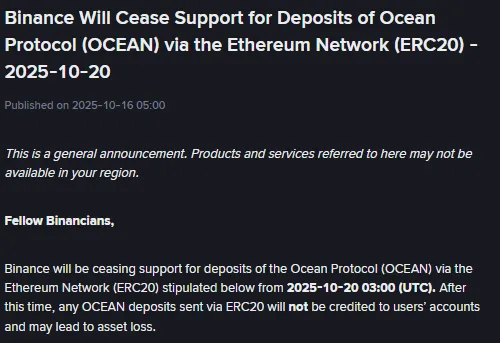

- Binance halted OCEAN ERC-20 deposits after growing uncertainty in the ASI Alliance.

- The feud exposed weak governance and raised concerns about token security and trust.

A dispute between Fetch.ai CEO Humayun Sheikh and the Ocean Protocol Foundation has escalated into legal threats and exchange restrictions. Binance, with $18.3 billion in daily trading volume, announced changes in handling OCEAN token deposits as tensions intensified between the two blockchain entities.

The conflict traces back to the 2024 formation of the Artificial Superintelligence (ASI) Alliance. The initiative brought together Fetch.ai, Ocean Protocol, and SingularityNET to unify their tokens under one ecosystem. Sheikh later claimed on X that Ocean Protocol minted hundreds of millions of OCEAN tokens before the merger and exchanged part of them for Fetch.ai’s FET.

He alleged that these tokens were transferred to exchanges and market makers without prior notice. According to Sheik, Ocean minted 719 million OCEAN tokens in 2023. Of those, 661 million were swapped for 286 million FET tokens in July 2025.

Binance Restricts Deposits as Accusations Intensify

As the feud gained momentum, Binance announced that it would cease supporting OCEAN deposits through the Ethereum ERC-20 network, effective October 20. The exchange said deposits made via this network after that date would not be credited and could result in fund losses.

Source: Binance

While Binance did not directly reference the dispute, the timing prompted speculation about its connection to the controversy. Sheik described Binance’s move as a sign that the exchange was responding to growing community concerns over Ocean’s alleged transfers.

He elaborated that he was going to support class-action lawsuits financially in several countries to make them accountable. Sheikh shook up the investigation of token swaps by Binance, GSR, and ExaGroup and suggested the collection of evidence by the holders who were affected by possible losses.

Sheikh presented a blockchain analysis proving that between the 3rd and the 14th of July 2025, more than 76 million FET tokens were transferred to various wallets. The study included 21 million tokens sent to Binance and an address linked to GSR, which received 55 million tokens.

Another 13.5 million FET were allegedly forced into a wallet funded by ExaGroup, with about 200 million later distributed across several Gnosis Safe wallets. Sheikh claimed most of these tokens eventually reached Binance.

Related: TRNR Launches Smart Fitness with $500M in Fetch.ai Token Support

Ocean Responds and Ends Alliance Role

In a post on X, Ocean Protocol called Sheik’s claims “baseless” and “damaging.” The team said its treasury remained secure and that it had offered to share results from an independent review once available. Ocean added that legal restrictions prevented the release of full details but said it intended to publish neutral findings.

The Ocean Protocol Foundation confirmed that it had resigned from all director and membership roles from Singapore-based Superintelligence Alliance Ltd., ending its collaboration with Fetch.ai and SingularityNET. The foundation’s statement hinted at deeper internal tensions, saying, “We are, however, constrained from sharing the truth and facts at the moment.”

Moreover, the disaster brought up the issue of how governance was done in the ASI Alliance and also the safety of the assets of token holders.

According to the merger agreement, OCEAN token holders were given a fixed rate for exchanging their tokens for FET, which was later referred to as ASI. This particular condition, together with Fetch.ai’s recent token issuance, resulted in allocating extra coins and thus negatively impacting the market performance.