Trump and Xi Trim Tariffs, Crypto Market Reacts

- Trump and Xi’s tariff cuts and trade pledges ease tensions and support market recovery.

- China pauses rare earth export curbs for one year, resuming vital global supply chains.

- Crypto market rebounds 1% as trade optimism halts recent volatility from Fed rate issues.

U.S. President Donald Trump and Chinese President Xi Jinping met in Busan, South Korea, on Thursday, their first face-to-face talks since 2019. The leaders agreed to lower U.S. tariffs on Chinese goods and address fentanyl trafficking, rare earth exports, and agricultural trade. The meeting concluded with commitments aimed at easing trade tensions and stabilizing global markets.

Highlights of the U.S.-China Talks

Trump announced that overall U.S. tariffs on Chinese imports would fall from 57% to 47%. He also revealed that fentanyl-related tariffs would be cut to 10% in exchange for Beijing’s pledge to limit the flow of the synthetic opioid into the United States.

According to Trump, Xi “will work very hard to stop the flow” of fentanyl, which is the leading cause of overdose deaths in America. The Chinese government confirmed that it would suspend newly introduced export controls on rare earth elements for one year.

These elements are vital for manufacturing electric vehicles, defense systems, and advanced electronics. China’s commerce ministry said both countries also reached an understanding on expanding agricultural trade and cooperation on fentanyl enforcement.

Trump described the meeting as “an amazing one,” calling it a “12 out of 10” during remarks aboard Air Force One. The session, held on the sidelines of the Asia-Pacific Economic Cooperation (APEC) summit, lasted more than 90 minutes. Both leaders emphasized the importance of maintaining stable trade relations and continued dialogue in the coming months.

Tariff Reductions and Trade Commitments

The tariff rollback followed months of speculation over whether the United States would increase trade penalties against China. Trump said Beijing had agreed to resume large-scale purchases of U.S. soybeans “starting immediately,” reaffirming a key demand of American farmers. China had already begun buying U.S. soybean cargoes earlier in the week.

During the meeting, Xi described periodic tensions between the two nations as “normal,” emphasizing that China’s development goals do not conflict with America’s ambitions. Trump, meanwhile, avoided direct comment on easing port fees on Chinese vessels or export restrictions on U.S. technology, which are contentious topics in ongoing negotiations.

The White House indicated that Thursday’s talks were the first of several planned meetings between Trump and Xi. Trump confirmed that he would visit China in April, followed by Xi’s reciprocal trip to the United States. Despite progress on trade, discussions over Nvidia’s high-end AI chips and Taiwan were notably absent. Trump said Nvidia’s negotiations with China were “a matter for the company to handle.”

Related: Trump Media and Crypto.com Launch Truth Predict on Truth Social

Impacts on the Crypto World

The diplomatic meeting between the United States and China arrived as global markets struggled to stabilize following the Federal Reserve’s recent rate decision. Earlier in the week, Fed Chair Jerome Powell said another rate cut in December was “far from guaranteed,” citing data delays caused by the ongoing U.S. government shutdown. His remarks led to volatility across financial and digital asset markets.

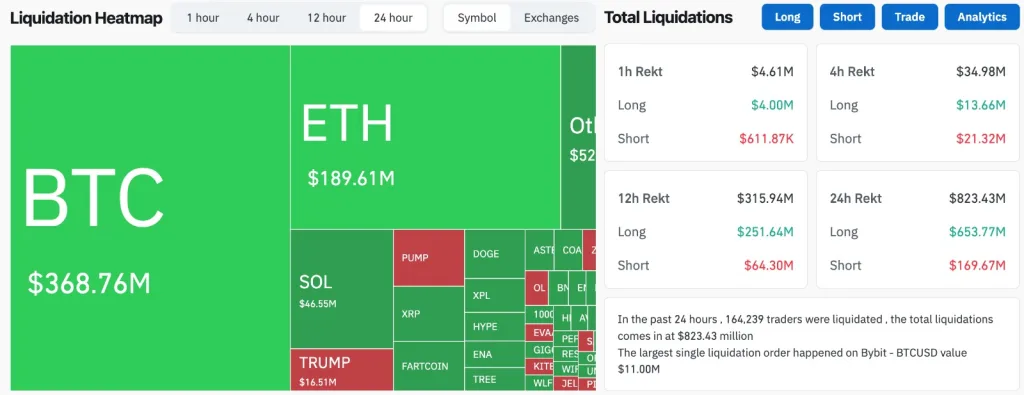

According to CoinGlass data, $823.03 million in crypto positions were liquidated within 24 hours of Powell’s statement. Long positions accounted for $653.48 million of the total, while shorts made up $163 million.

However, market sentiment began to recover after the Trump-Xi announcement, which investors viewed as a sign of easing global tension. In the hour following the meeting, liquidations reached $223.76 million, led by $157.39 million in long positions.

Source: Coinglass

Bitcoin, Ethereum, and XRP rebounded to trade above $110,000, $3,900, and $2.58, respectively. The total crypto market capitalization is at $3.73 trillion, up by 1% at press time. Analysts attributed the rebound to renewed optimism that improved U.S.-China trade relations could stabilize liquidity conditions.

The trade breakthrough also coincided with China’s agreement to maintain rare earth exports, which are essential to the semiconductor and technology sectors. This decision, together with tariff relief, could indirectly support the digital asset industry by boosting investor confidence in broader risk markets.

Trump’s tariff cuts and Xi’s pledges are a rare cooperation between the two economic powers. Their agreement to coordinate on fentanyl control, agriculture, and rare earths showed a mutual interest in restoring predictability to global trade. The measured response from global markets, however, showed ongoing caution about how lasting the truce will be and its wider financial implications.

The easing of trade barriers and stabilization of supply chains suggest potential relief for risk assets, including cryptocurrencies. The renewed diplomatic channel between Washington and Beijing offers a foundation for steadier market sentiment, especially as the crypto sector continues to react swiftly to macroeconomic changes.