Solana Price Rebounds as SOL ETF Sees $9M Inflow, Key Levels to Watch

- Solana jumps 8% above $150 as traders return after a sharp drop to a four-month low.

- SOL ETF records a $9.7M inflow, surpassing Bitcoin and Ethereum spot ETFs in momentum.

- Support at $145–$155 holds firm as bulls target $171 and $189 resistance levels ahead.

Solana has bounced back strongly after a volatile start to the week. The token gained more than 8%, reclaiming the $150 level after sliding to a four-month low near $145 on Monday. That dip reflected the wider weakness across digital assets, but Solana’s swift recovery has reignited optimism among traders.

At the time of writing, SOL trades near $159, up about 3% in the past 24 hours, pushing its market capitalization above $87 billion. This makes it one of the best-performing large-cap assets this week, comfortably outpacing both Bitcoin and Ethereum.

The broader crypto market has also steadied, adding 1.57% to reach a total capitalization of $3.43 trillion. Even so, sentiment remains restrained. The Fear and Greed Index is still pinned around 24, a reminder that traders remain cautious after last week’s sell-off. Whether this rebound signals a sustained recovery or just a short-term bounce remains to be seen.

Technical Structure Shows Early Strength

From a technical perspective, Solana’s chart shows a pattern worth watching. The token has carved out an ascending broadening wedge, often a signal of building volatility before a major move.

According to the token’s daily chart analysis, buyers stepped in near the $145–$155 band, an area that’s acted as support for months, and ignited a bullish trend reversal. If that support holds, the next test comes at roughly $171, the 23.6% Fibonacci level.

A clean break there could open the door toward the $178–$189 range, which aligns with the 38.6% retracement and the zone where sellers last regained control. Besides, the RSI, currently sitting near 33, has turned upward from oversold territory, implying that bulls may have more room to run before the market overheats.

At the same time, exchange data shows nearly 24 million SOL leaving trading platforms over the past day, an outflow that usually points to investors moving holdings off exchanges and into storage. That pattern tends to reduce sell-side pressure and supports the case for a short-term price lift if demand stays steady.

SOL ETF Inflows Outshine Bitcoin and Ethereum

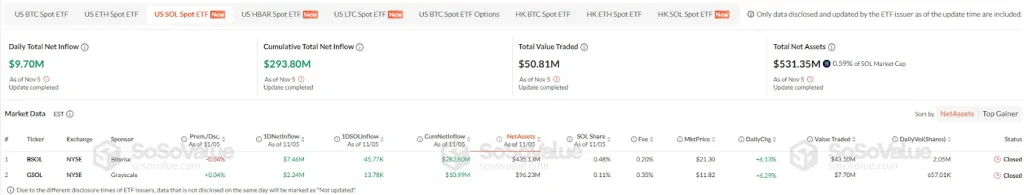

Adding to the momentum is a surge of activity in Solana’s U.S. spot exchange-traded funds. Fresh data from SoSoValue shows the SOL ETF logged a $9.7 million net inflow on November 5, outpacing every major crypto fund, including those tied to Bitcoin and Ethereum.

The contrast is striking. Bitcoin spot ETFs saw a combined $137 million in outflows that same day, while Ethereum ETFs lost $118.58 million. Investors appear to be rotating capital toward Solana, drawn by its speed, efficiency, and expanding DeFi footprint.

Since launching, Solana’s ETFs have accumulated $293.8 million in total inflows, with $531 million in net assets, about 0.6% of Solana’s market cap. Bitwise’s BSOL led with $7.46 million in daily inflows, followed by Grayscale’s GSOL at $2.24 million.

Meanwhile, BlackRock’s IBIT Bitcoin ETF reported a sharp $375 million outflow, its steepest in weeks, and the ETHA Ethereum fund lost $146 million. The divergence underscores a shifting tide: institutions are starting to view Solana as more than just a high-beta altcoin.

Related: Bitcoin Rebounds, Uplifting Major Altcoins—Is the Bull Run Back?

Outlook: Cautious Optimism Prevails

Still, the road ahead isn’t without hurdles. Solana continues to trade beneath its 50-day and 200-day moving averages, keeping the longer-term trend tilted to the downside. Moreover, the token is down about 17% for the week and more than 30% for the month.

Volume data backs up the mixed picture: the recent green candles have come with lighter trading activity than the heavy red bars seen during last week’s sell-off. That imbalance suggests sellers haven’t fully retreated, even as the tone turns positive. For bulls, maintaining the $145 floor will be key; slipping below it could invite renewed pressure.

Even so, the combination of technical rebound, exchange outflows, and strong ETF inflows provides Solana with a credible base for potential continuation. If momentum is sustained above the $145–$155 support band, traders will be watching the $171 and $189 resistance zones for signs of confirmation.

For now, Solana’s recovery stands as one of the more compelling stories in the digital asset space, a reflection of how investor confidence in the network’s fundamentals and ETF traction may help it hold the line amid a still-uncertain market.