Schwab Reports Crypto ETFs Match Bonds in Investor Interest

- A Schwab survey finds 45% of investors plan to invest in crypto ETFs, matching bond ETFs.

- Millennials lead crypto ETF interest with 57% planning to invest, while Boomers lag behind.

- Survey says low cost and accessibility are driving ETF growth across generations of investors.

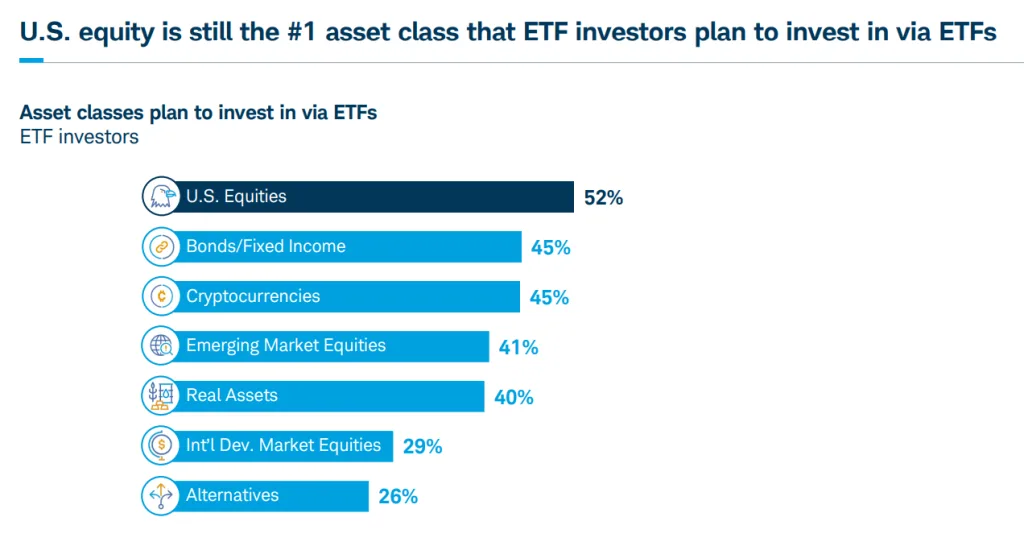

Crypto exchange-traded funds (ETFs) are rapidly rising in popularity, matching traditional bond ETFs in investor interest, according to a new survey by Schwab Asset Management. The findings show how quickly digital assets are gaining legitimacy among mainstream investors.

The “ETFs and Beyond” report, released on Thursday, surveyed 2,000 individual investors across the United States. Nearly half of respondents, or 45%, said they plan to invest in a crypto ETF. That figure ties crypto ETFs with bond ETFs, a surprising result given the size and maturity of the bond market.

Millennials Lead the Crypto ETF Surge

The survey revealed a clear generational divide. Millennials, those born between 1981 and 1996, showed the highest enthusiasm for crypto ETFs. About 57% of them plan to invest in such funds.

Gen X investors, born between 1965 and 1980, followed with 41% expressing interest. Baby Boomers were much less interested. It appears that older investors are adopting crypto ETFs more slowly, as only 15% of respondents stated they intended to invest in them.

Bloomberg ETF analyst Eric Balchunas described the results as “shocking.” He noted that crypto ETFs account for just 1% of total ETF assets under management, while bonds represent about 17%. Yet investor interest appears nearly equal between the two.

Balchunas said the overall tone of the survey was optimistic. “Basically everyone is planning to increase ETF usage,” he wrote, emphasizing that younger investors are driving the trend.

The findings point to a long-term change in investors’ perceptions of digital assets. Younger generations seem more at ease combining traditional investment methods with exposure to cryptocurrencies. This pattern could expand the role of digital assets within mainstream portfolios.

Accessibility and Low Costs Fuel ETF Growth

According to the Schwab report, the main factors influencing investors’ preference for ETFs are their low costs and ease of access. Nearly 94% of respondents said ETFs help them keep investment costs low. ETFs are also seen by many as a way to explore particular industries or niche markets.

About half of the respondents strongly agreed that ETFs allow them to invest in targeted strategies separate from their long-term holdings. They also said ETFs make it easier to access alternative or specialized asset classes.

David Botset, managing director at Schwab Asset Management, said the investing world is undergoing a major transformation. He said individual investors are gaining access to new asset classes, investing strategies, and vehicles.

Botset added that ETF investors are at the forefront of this evolution. He noted that ETFs now outnumber individual stocks in the U.S. market. Many investors use them not only for core portfolio positions but also for exploring new opportunities.

Balchunas echoed that point in his analysis. He highlighted how ETFs are attracting capital from multiple sources, even from direct indexing, which was once seen as a potential competitor to ETFs. “Interesting how many dif pools ETFs can draw from,” he said.

Related: Bitcoin and Ethereum ETFs Suffer Millions In Outflows

ETFs Poised for Continued Expansion

The survey also suggests that ETF adoption will keep growing. Younger investors are already heavy users, and each generation plans to increase ETF usage. Gen X investors are expected to make the biggest leap, according to Balchunas.

While the overall ETF market continues to grow, the sharp rise in crypto ETF interest stands out. The equal footing with bond ETFs marks a major milestone for digital assets. The findings underscore how investor attitudes toward crypto are shifting from speculation to integration.