Monad’s MON Jumps to an ATH of $0.038 After Crashing to an ATL of $0.020

- MON jumped to an ATH of $0.038 after dipping to $0.020 as buyers stepped in after its mainnet debut.

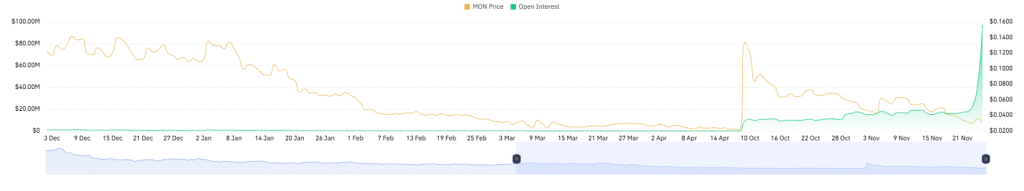

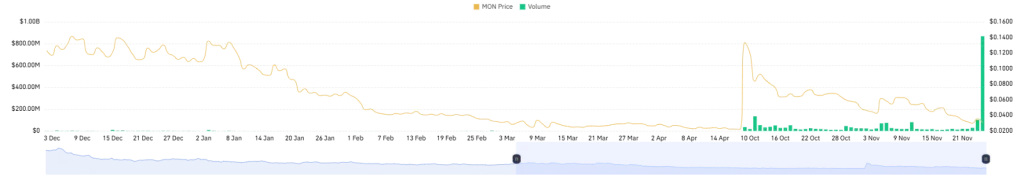

- Futures trading volume soared past $850M, while open interest hit a record $100.45M.

- Staking yields near 16%, and major exchange listings kept demand strong through volatility.

Monad’s MON token staged one of the most abrupt turnarounds in the market this week, climbing to an all-time high only hours after collapsing to its deepest low since launch. The drop took MON to roughly $0.020, and within hours, buyers pushed the token to an ATH of $0.038, according to CoinMarketCap.

By press time, MON traded around $0.03306, showing a firm 14% daily gain and a market valuation near $360 million. The recovery unfolded alongside a dramatic spike in trading activity, hinting at renewed interest following the debut of Monad’s mainnet.

Why is MON’s Price Up Today?

Mainnet Activation Fuels Early Network Confidence

The sharp rebound followed the launch of the Monad mainnet on November 24, a moment many in the developer community had been anticipating. According to reports, the chain aims to deliver 10,000 transactions per second while keeping fees low and maintaining compatibility with the Ethereum Virtual Machine.

More than 100 projects are already in various stages of development on the network, including integrations with Uniswap, MetaMask, and USDC. The activation offered the first real demonstration of Monad’s long-promised performance roadmap.

With staking introduced early and yields hovering around 15–16% APR, holders gained an immediate reason to keep MON in circulation. Builders, validators, and early adopters began interacting with the chain in the first 48 hours, creating momentum that likely played a role in MON’s rapid return from its low.

Public Sale Demand, Exchange Listings, and Heavy Intraday Flows

A second major factor in the token’s rebound was the momentum carried over from its Coinbase public sale, which drew 85,820 participants and raised $269 million at a sale price of $0.025 per token.

Besides, listings on more than 25 exchanges added deep liquidity, pushing combined trading volumes past $450 million shortly after launch. This broad market access allowed MON to absorb the early sell-off and recover quickly.

Although its fully diluted valuation was near $2.5 billion at launch, which prompted discussion about long-term sustainability, the heavy and persistent trading showed that most participants chose engagement rather than retreat.

Airdrop Distribution and Locked Supply Ease Early Sell Pressure

The token’s launch also involved a large airdrop, with 76,000 wallets claiming 3.33 billion MON, worth roughly $105 million at initial prices. Some holders sold immediately, yet the market absorbed the supply without destabilizing the token’s rebound. One reason may be the project’s long vesting timeline: 50.6% of MON’s total supply remains locked until 2026.

This locked structure kept the circulating supply tighter than many airdrop-driven launches, limiting downward pressure at a moment of heightened volatility. Early users who received allocations also appeared to engage more with the ecosystem than with day-one trading, reducing the risk of a severe sell cascade.

Related: SHIB Bounces Back From a 10% Fall: Will This Recovery Last?

Derivatives Market Shows Strong Positioning by Long Traders

On the other hand, on-chain derivatives data revealed a surge of speculative interest that accompanied MON’s rebound. As of press time, MON’s open interest soared to $100.45 million. Such sentiments typically suggest that market participants are opening or maintaining positions rather than closing them, a signal often associated with expectations for near-term movement.

Futures trading volume also hit record levels, reaching over $850 million. The surge underscored the scale of speculative participation in MON following its extreme price swing.

Funding rates reinforced the trend. The weighted funding rate moved into positive territory at +0.2901%, showing that long-position traders were paying a premium to short sellers to keep contracts open. This reflects a market skewed toward bullish positioning as MON stabilizes.

In summary, MON’s recovery unfolded on the back of heavy trading activity, rising on-chain positioning, and strong interest around its new mainnet. With much of its supply locked and liquidity still expanding, the token’s rebound shows that investors remain engaged, watching closely as the ecosystem builds out in the weeks ahead.