XRP Price Holds Firm Above $2.00 as Weekly Selling Pressure Builds

- The XRP price holds above the $2.00 mark as selling pressure builds after a failed breakout.

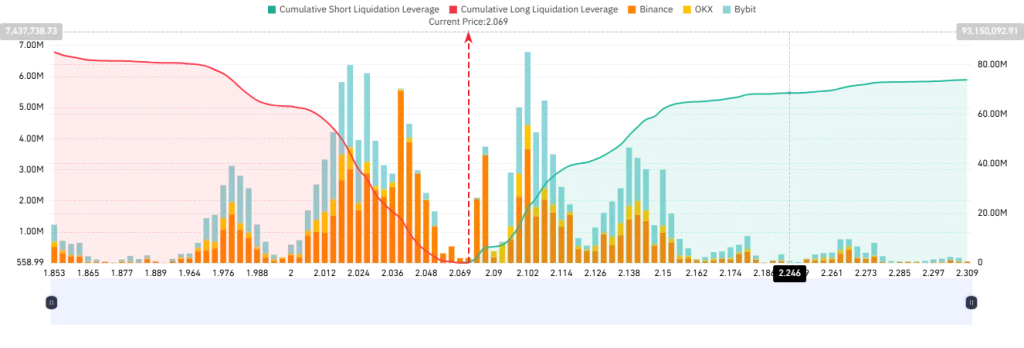

- XRP’s long and short leverage liquidations remain balanced, keeping price movement constrained.

- The token’s major resistance near $2.40 blocks upside, while support forms at key moving averages.

The XRP price is still holding above the $2.00 line after a rough stretch that forced the market to reassess its footing. The token has slipped over the past week, yet buyers continue to cluster around a level that has become something of a battleground.

The floor has not broken, suggesting traders are not ready to abandon the broader structure. The retreat followed a sharp rally that kicked off late last week and stretched into Monday. And, the XRP price jumped more than 30% during that window, briefly tapping the $2.40 region before momentum faded.

That rally, however, was built on a well-defined base. For nearly two weeks before that surge, the token sat quietly in a $1.84 to $1.72 pocket. That stretch acted as a staging zone, with steady exchange outflows hinting that longer-horizon holders were content to accumulate while volatility cooled.

Rally Meets Long-Term Resistance

The advance stalled near $2.40 after XRP encountered a descending resistance trendline that has capped upside attempts since mid-July of 2025. That same trendline marked the area where the altcoin reached its yearly high near $3.66.

Failure to break through the resistance triggered a swift 16% correction, sending the token back toward the $2.00 area. As the decline settled, the token managed to find its footing along the 20-day and 50-day moving averages.

Source: TradingView

Those levels didn’t reverse the trend, but they slowed the loss and helped stabilize the token’s price around the $2.07 region as of press time. This zone signals an inch up of roughly 2% over the last day, though sentiment remains tense after a week marked by a 13% pullback and continued resistance at the 23.60% Fibonacci mark.

On-Chain Trends Point to Calmer Underpinnings

From an on-chain perspective, market-wide aggression has cooled. Indicators tied to liquidation pressure show a relatively even split between long and short exposure near current levels.

Roughly $73 million in short exposure would be at risk if the price climbs above $2.30, with a dense cluster near $2.10. On the other hand, long positions total about $84 million at $1.85, including a sizeable block around the $2.02 level.

Source: CoinGlass

When leverage piles up so tightly on both sides, breakouts tend to be harder to sustain, often resulting in hesitation rather than a clean move. Meanwhile, momentum readings reflect the same indecision. The RSI has held near 52, doesn’t dictate a bullish or bearish story. It implies that the token is drifting in a middle lane with little urgency from either camp.

Related: PEPE Price Falls 14% in a Week After Stalling 20-Week

Pressure Points Ahead That Could Decide XRP’s Trajectory

However, for the market to regain upward traction, the XRP token needs to reclaim the 23.60% Fibonacci level and break through the multi-month descending trendline. Until then, every rally attempt faces the same ceiling.

Similarly, if the token loses the moving-average support instead, focus will likely return to the historical demand zone between $1.84 and $1.72, an area that previously steadied the market during broader uncertainty. For now, the XRP price remains anchored above $2.00, keeping traders fixated on what comes first: a break above resistance or a slip back toward its old support band.