ARK Invest Bets on Ethereum, Acquires Bitmine in $174M Shift

- ARK Invest reallocates $174M from Bitcoin-linked assets to Ethereum-focused Bitmine.

- Bitmine acquisition positions ARK to benefit from Ethereum’s DeFi and NFT dominance.

- Strategic shift reflects growing institutional confidence in Ethereum’s long-term growth.

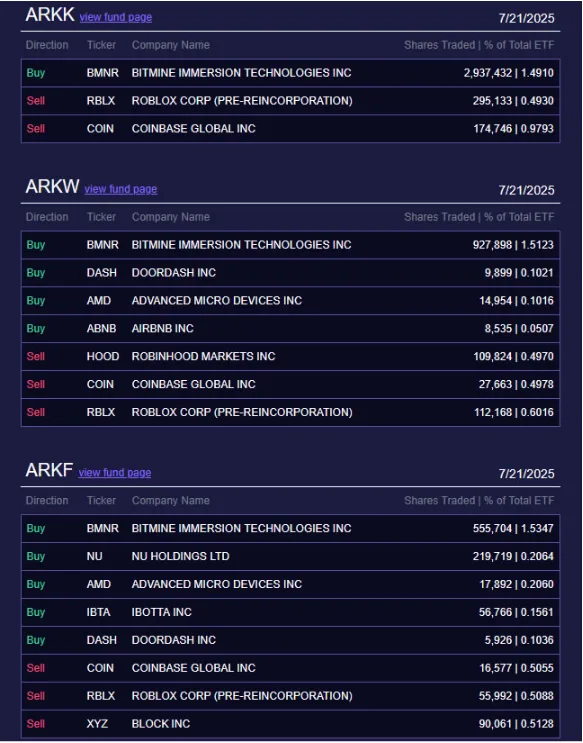

ARK Invest, under the leadership of Cathie Wood, has adjusted its portfolio by divesting from prominent Bitcoin-related holdings. The firm sold 218,986 shares of Coinbase, valued at approximately $90.5 million, from its ETFs. ARK has also sold 463,293 shares of the game Roblox, worth about $57.7 million. The move is in line with the institutional trend within the growing use of Ethereum’s smart contracts and decentralized finance.

The firm also divested 225,742 shares of its ARK 21Shares Bitcoin ETF (ARKB), valued at $8.7 million on July 16. This transaction marks ARK’s largest single-day share sale of ARKB since its June stock split. The sale followed ARKB’s rise to near-record highs, with the fund peaking at $39.3 post-split. Despite the size in volume, the sale’s dollar value was smaller than previous disposals, such as April’s $12 million ARKB offload.

Investment in Ethereum-Focused Bitmine

Following these divestments, ARK acquired a 1.5% stake in Bitmine, a firm specializing in Ethereum treasury management. This investment totals approximately $174 million across its ETFs, indicating a strategic realignment. Bitmine’s operations focus on Ethereum’s financial infrastructure, offering exposure to decentralized finance and blockchain services. This move positions ARK to benefit from the expanding Ethereum ecosystem.

Ethereum’s integration into financial services and growing adoption among institutions have boosted investor interest. Bitmine’s expertise in Ethereum treasury management provides ARK a targeted pathway into this ecosystem. As Ethereum remains central to decentralized applications and NFT infrastructure, its role in digital asset markets continues to grow. ARK’s investment reflects confidence in Ethereum’s potential over more established Bitcoin-related assets.

Ethereum Adoption and Broader Implications

Ethereum remains popular in both the business world and the field of finance. The flexibility of the network allows it to support smart contracts and DeFi services, and a variety of tokenized services. The institutional level demand for Ethereum assets is increasing because of its flexibility and technical abilities. Given that Ethereum has found its place in blockchain infrastructure, exposed blocks have precipitated more capital inflows.

The relocation of ARK accentuates this trend as it shifted its capital to a company that is deeply entrenched in Ethereum. Such investment in the Bitmine stocks shows strategic positioning on the long-term value and network effect of Ethereum. Its scalability and the ability to support various financial instruments make the Ethereum network attractive to progressive investors. The portfolio transition made by ARK can also be explained by the desire to diversify crypto investment outside of Bitcoin.

Related: Ark Invest Offloads $43.8M in Coinbase Shares Amid Rally

Ongoing Portfolio Adjustments

In addition to Bitmine and Ethereum, ARK made other changes through its ETF investments. ARK Next Generation Internet ETF (ARKW) also sold 34,207 shares of Coinbase and obtained funds of $13.3 million. It is the next in a chain of COIN share decreases by ARK, with past sales topping $4 million in the ARKK ETF (ARKK). The decline in COIN is based on the fact that Coinbase is still associated with Bitcoin trading volumes and volatility.

The other transactions include the sale of 58,504 Robinhood shares at a price of $5.6 million and the sale of 24,780 block shares, totaling $ 1.7 million. These changes indicate the active management of this exposure in terms of crypto and tech-related stocks at ARK.