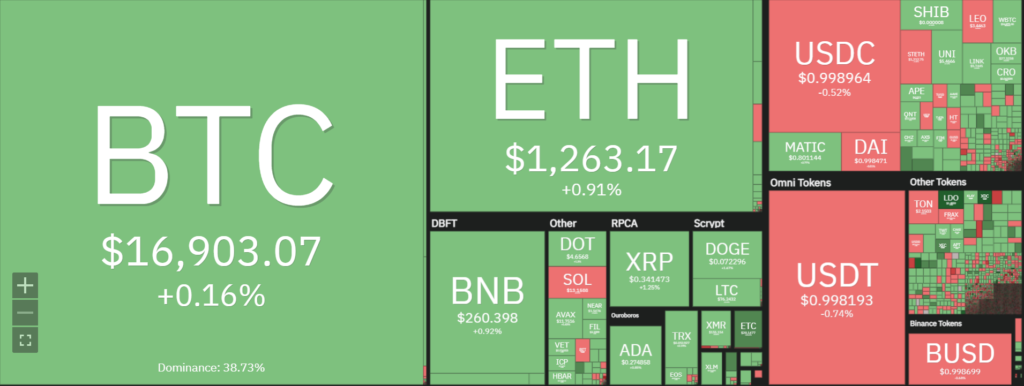

The cryptocurrency space remains muted, with Bitcoin continuing to trade inside a narrow range. The crypto investors may be taking a cautious approach due to rumors about Huobi’s insolvency, which the company’s representative said were untrue.

Altcoins such as Ethereum, Ripple and Chainlink have been experiencing similar trends. Despite the trading range-bound state, there has been an increase in volume, indicating investors are taking a deeper interest in these projects.

Ethereum’s value has remained stagnant, floating between $1,150 and $1,352 as investors consider the ETH rate and derivatives of staked Ether once the upcoming upgrade allows withdrawals for stakes with the upcoming Shanghai upgrade taking place on March 2023, a profitable opportunity for Ether is in sight.

Withdrawals from Ethereum staking contracts that were locked until now will soon be enabled, which should significantly reduce the risk associated with investing in ETH.

Bitcoin Price Analysis

On January 6th, Bitcoin’s price plummeted below its Moving Averages, as evidenced by the long tail of the candlestick showing that buyers were making purchases at lower levels. It is possible that bulls will make a final effort to push BTC prices above $17,061 in order to avoid further losses.

The daily chart of Bitcoin shows that the cryptocurrency has been trading in a range between $16,800 and $16,400 for nearly two weeks. This indicates that there is currently not enough buying interest to push the price above or below this level

However, if BTC breaks out from its current range then it may be able to reach its previous high of $19,500. If bulls succeed in doing so then they will also be able to flip the overhead resistance levels into support, which is essential for any upward move.

Ethereum Price Analysis

The daily chart of Ethereum shows that the coin has been trading in a range between $1,150 and $1,352 for the past few days. This indicates that investors have not been able to take advantage of any buying opportunity as there is a lack of buying pressure behind ETH.

Moreover, if ETH price falls below the lower end of this range then it may find support at the next major support level of $1,050. It is also possible that buyers will make one final attempt to push ETH prices above $1,352 and if they succeed in doing so, then it could lead to a further increase in Ethereum’s value.

The altcoins have made slight movements up and down but have not been able to break out of their current range-bound market. The top ten altcoins are exhibiting a similar range-bound pattern. This indicates that investors are not able to take advantage of any buying opportunity and at the same time, they are also unable to capitalize on any potential selling opportunity as well.

In conclusion, it is important for bulls to maintain the requisite energy needed for transforming overhead resistance levels into support in order for Bitcoin and Altcoins to make any significant gains. It appears that the market is waiting for a catalyst to thrust it into a new trading range before bears can capitalize on any potential selling opportunity.