Bitcoin and Ethereum Rebound as Global Crypto Market Recovers to $3.91 Trillion

- Global crypto market rebounds to $3.9T after heavy losses driven by US-China trade tensions.

- BTC and ETH show cautious recovery following widespread liquidations and panic selling.

- Over 1.6M traders liquidated on Friday as $19.1B crash signals deep stress in crypto markets.

The global crypto market showed cautious recovery on Monday after heavy losses last week. Market capitalization reached $3.91 trillion, up 4.6% from Sunday but still 6% lower than pre-crash levels. The rebound came after widespread liquidations and panic selling triggered by trade tensions between the United States and China.

On Friday, the US stock market recorded its sharpest fall since April before regaining partial ground on Monday. The crypto sell-off began as a reaction to new tariff announcements and quickly worsened. Margin calls and stop-loss orders created a cascade that deepened losses across major digital assets.

Bitcoin and Ethereum Rebound After $19B Crypto Shakeout

As of press time, Bitcoin is trading near $115,000, recovering from a brief plunge below $105,000. Ethereum also rebounded, rising 8.6% to $4,130 after falling close to $3,500 during the sell-off. Both assets showed resilience but remained far from recent highs.

On Monday, the Fear and Greed Index was at 38, a level that indicated fear, but higher than 24 on Sunday, which represented extreme fear. This was a modestly positive shift in sentiment after a weekend of intense market pressure. Fear levels last reached similar heights in April, when trade tariff news had global markets reeling at the time.

According to Coinglass, more than 1.6 million traders were liquidated on Friday. One-day liquidations totaled $19.1 billion. Such big liquidations could be the sign of a market bottom, but they also usually take weeks to stabilize. Historical data from past declines indicate that recoveries have varied between weeks and months.

Analyst Ted stated that Bitcoin has already recovered the $113,500 support, which he said in itself was a positive development. The next hurdle is around the resistance level of $117,500. A move above this level could bring prices closer to the all-time high that they set last week.

Related: Crypto Crash Triggers $19B Liquidation in Just 24 Hours, Here’s Why

Whales Accumulate as Short-Term Ethereum Holders Turn Cautious

Ethereum’s rebound appears to be driven by big investors. According to Santiment, big wallets have accumulated roughly 80,000 ETH since Oct. 11, raising their combined total from 100.28M to 100.36M. This $330 million build-up is an example of increasing confidence and accumulation from long-term holders since the recent bear market.

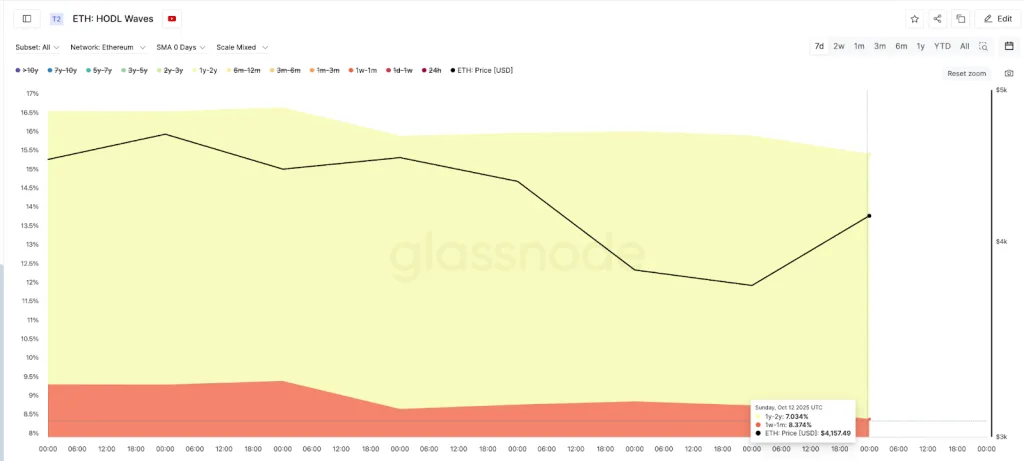

According to Glassnode’s HODL Waves, short-term 1-week to 1-month participants decreased their stake from 8.84% to just 8.37%, a more timid approach. Even those who plan to hold for the medium term (Mid-term owners in the 1-year to 2-year time frame) experienced a fall from 7.16% to 7.03% after recent market declines.

The recovery of Ethereum is also following suit with the appreciation of Bitcoin. The token’s next potential target is around $4,600, an important technical level that traders are watching. Investors, meanwhile, are watching liquidity and trading volume for signs of confirmation behind the strength.

As of Monday night, Bitcoin and Ethereum continued to trade steadily within narrow ranges. Investors remain cautious while watching geopolitical developments and equity market performance. For now, the crypto market shows gradual stabilization but no clear signal of a sustained rally ahead.