DeFi Development Corp. Expands Solana with DFDV UK Launch

- DeFi Development Corp. launches DFDV UK, expanding Solana-focused treasury vehicles globally.

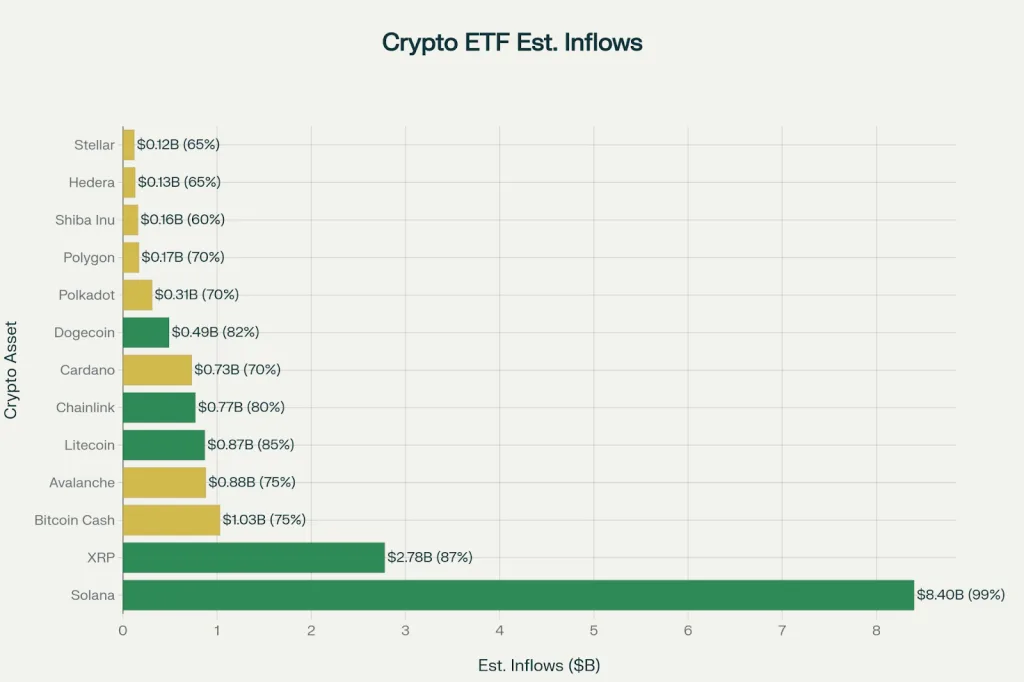

- Asset managers race to launch Solana ETFs, with $8B in potential inflows upon SEC approval.

- Solana’s rise in ETFs and treasury vehicles positions it alongside Bitcoin and Ethereum.

DeFi Development Corp. (DFDV), a prominent Solana-focused treasury firm, is making a bold move into international markets. On Friday, the firm announced the creation of DFDV UK, its first UK subsidiary. This expansion marks a critical moment in Solana’s journey as it shifts from being a blockchain innovation to a recognized asset class.

DFDV UK, which claims to be the first Solana-focused public treasury vehicle in the UK, was formed through the acquisition of Cykel AI, a company listed on the London Stock Market. DeFi Development Corp. holds a 45% equity stake in the new firm, with local management and board members holding the remainder. The acquisition signals the firm’s commitment to expanding Solana-focused treasury vehicles globally, with five more vehicles in development.

DFDV’s UK Expansion and the Rise of Solana as a Global Investment Asset

The expansion into the UK is part of DeFi Development Corp’s Treasury Accelerator strategy. The strategy aims to build Solana-based treasury vehicles across the globe. Founded earlier this year by former Kraken employees, DeFi Development Corp. buys and stakes Solana’s native token, SOL, and other related tokens, like Dogwifhat. The company also offers validator services, including those for Kraken.

CEO Joseph Onorati emphasized that the UK launch is crucial for the firm’s goal of boosting its Solana per share (SPS) metric. This metric tracks the company’s stock performance in relation to the price of SOL. The global expansion is part of a larger trend: Solana’s shift from a performance blockchain into a significant, investable asset class.

Solana ETF Race Intensifies as Major Firms Seek SEC Approval

Meanwhile, the battle for the first Solana-based spot exchange-traded fund (ETF) is heating up. Various asset management giants such as VanEck, Franklin Templeton, and Fidelity are striving to implement Solana ETFs in the market. On August 29, these companies filed updated filings with the SEC.

The competition captures a rising trend of Solana gaining institutional-grade recognition. ETF issuers would be working with SEC responses, rebuilding the channel taken by Bitcoin and Ethereum ETFs. More than 16 Solana-based ETFs are awaiting approval, and many expect SEC approval by mid-October.

Analysts regard the chance of Solana ETFs being approved by the SEC as exceeding more than 90%. This growing optimism has fueled strong investor interest, with projections suggesting that Solana ETFs could attract as much as $8 billion once trading begins.

The REXShares Solana Staking ETF, which debuted in July, has already received strong inflows. On August 29, the fund made an addition of $11 million, bringing its assets under management to a total of $200 million for the first time.

Related: BlackRock Avoids XRP, Solana ETFs Amid Unclear Rules

According to Bloomberg analyst Eric Balchunas, REX is reforming the fund to be a registered investment company. Such a step will make tax efficiency and competitiveness better as soon as spot Solana ETFs are allowed.

The expansion of DeFi Development Corp.’s global treasury and the race for Solana ETF approval highlight a clear trend. Solana is evolving into a pillar of institutional finance, alongside Bitcoin and Ethereum.