Bitcoin Drops Below $90K as Schiff and Winklevoss Clash Again

- Bitcoin sinks below $90,000 while Schiff questions the entire digital gold idea.

- Winklevoss claims the pullback forms a strong base that favors future strength.

- Whales and ETFs absorb heavy BTC selloffs, with an analyst saying prices would be far lower without them.

Bitcoin’s dip below $90,000 has revived a sharp divide across markets as bulls regroup and bears intensify criticism. The move comes during a period where the asset remains one of Wall Street’s most polarizing instruments. The angle driving the current debate suggests the decline feels like a seasonal retreat before another charge, as Cameron Winklevoss claims Bitcoin is battle-ready.

At the same time, Peter Schiff signals defeat from the sidelines. Bitcoin’s drop has drawn new scrutiny, raised key questions about its store-of-value narrative, and pushed both camps to defend their positions.

Schiff Renews Criticism as Bitcoin Falls Toward Key Levels

Peter Schiff argues Bitcoin’s recent weakness represents more than a short-term correction. He noted on X that Bitcoin is down 28.5% from its peak. He also said the asset has lost nearly 40% when measured in gold. Schiff stated that gold remains above $4,000 while Bitcoin struggles to hold near $93,000. He claimed this gap challenges Bitcoin’s long-standing digital-gold narrative.

Schiff added that the divergence questions its reliability as a deflation hedge. He recently targeted Strategy, saying its model relies on volatile gains instead of stable operations. He described that model as “a fraud” and warned that it could face pressure during deeper downturns. His assessment pointed to risks tied to liquidity, regulation, and macro conditions. The warnings fueled broader caution among traders already watching their relative strength.

Despite this, the criticism sparked renewed pushback from Bitcoin supporters who framed the decline as expected. Can Bitcoin’s current weakness be read as a structural decline, or does it resemble another reset before renewed demand forms?

Winklevoss Twins Counter With Long-Term Bullish Outlook

The Winklevoss twins remain among the most vocal proponents of Bitcoin’s long-term potential. They recently predicted Bitcoin could reach $1,000,000 within a decade. Cameron Winklevoss said the dip under $90,000 may be the last chance to buy at that level. He argued that the move reflects consolidation rather than failure.

He posted that Bitcoin is preparing for another supply-driven advance. Charts show the asset pulling back after issuance compression, a pattern seen in earlier cycles. These moves often preceded major recoveries in previous market phases. His comments directly opposed Schiff’s warnings and framed the decline as tactical.

The remarks followed Gemini’s public debut on Nasdaq under the ticker GEMI. Gemini Space Station priced its IPO at $28 and opened at $37.01. The move valued the company at roughly $4.4 billion. The listing added fresh visibility to the twins’ broader participation in the crypto sector.

Related: Peter Schiff Warns Gold Surge Could Trigger Bitcoin Sell-Off

Accumulation Data Points to Deep-Pocketed Support

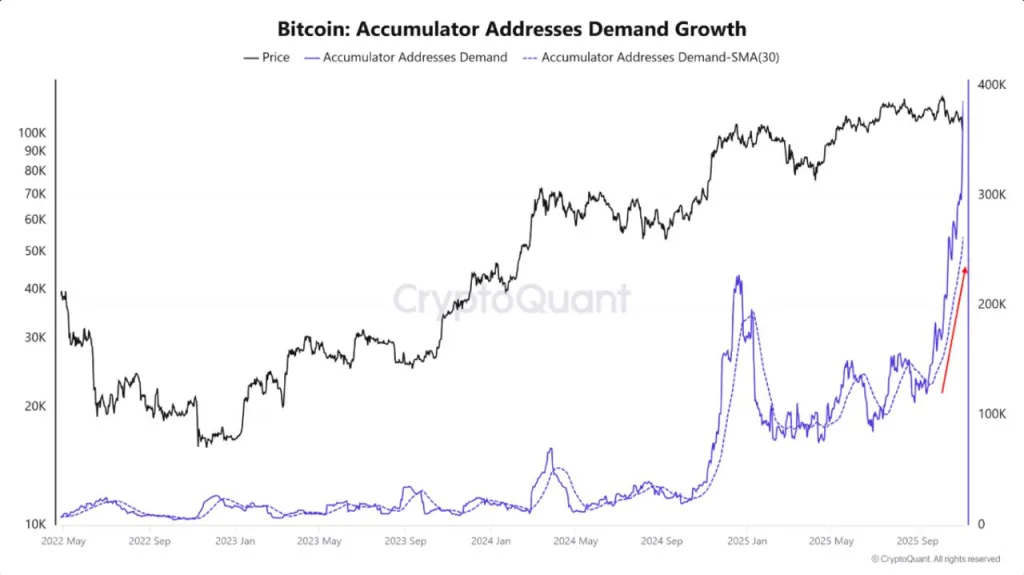

On-chain analyst CryptoSeth shared a chart showing steep growth in demand for their accumulator address. The chart from CryptoQuant recorded a strong rise in long-term buying activity. These moves appeared as Bitcoin traded below $90,000.

CryptoSeth said whales and ETFs are absorbing heavy selling pressure. He stated Bitcoin “would be much lower if there were no takers.” His comment pointed to steady demand from large wallets and institutional products during the downturn.

The chart’s trend aligned with earlier cycles where accumulation surged during pullbacks. These periods often formed bases before later rallies. Investor activity continued rising through the recent decline, suggesting long-term interest remained present despite short-term volatility. As buying strengthened, the data supported the view that the pullback mirrors consolidation rather than structural breakdown.