Bitcoin Sheds Over $53K in 120 Days: What’s Next for BTC?

- Bitcoin loses over $53K in four months as U.S. stocks trade near record highs.

- Selling pushes Bitcoin price into the key $72K to $76K support area that traders watch.

- Social data shows fear rising as traders discuss deeper drops toward $50K levels.

Bitcoin has spent the past four months grinding lower, shedding more than $53K since its record run near $126K in October. The slide has wiped roughly $1.1 trillion from its market value and dragged the asset about 42% off its peak. The move stands in sharp contrast to U.S. equity benchmarks, which have barely drifted from their highs.

And while stocks have kept their footing, crypto markets continue to absorb pressure with little sign of relief. One such, Ethereum, has fared even worse in percentage terms, down about 56% from its top. However, the S&P 500 is only about 1.5% off its high, the Nasdaq 3.6%, and the Russell 2000 is roughly 4.2%.

That gap has widened as Bitcoin’s decline accelerated through winter, drawing fresh debate over whether this downturn reflects structural weakness or simply an overheated market cooling off after a historic top.

BTC’s Price Action: Breakdown After the High

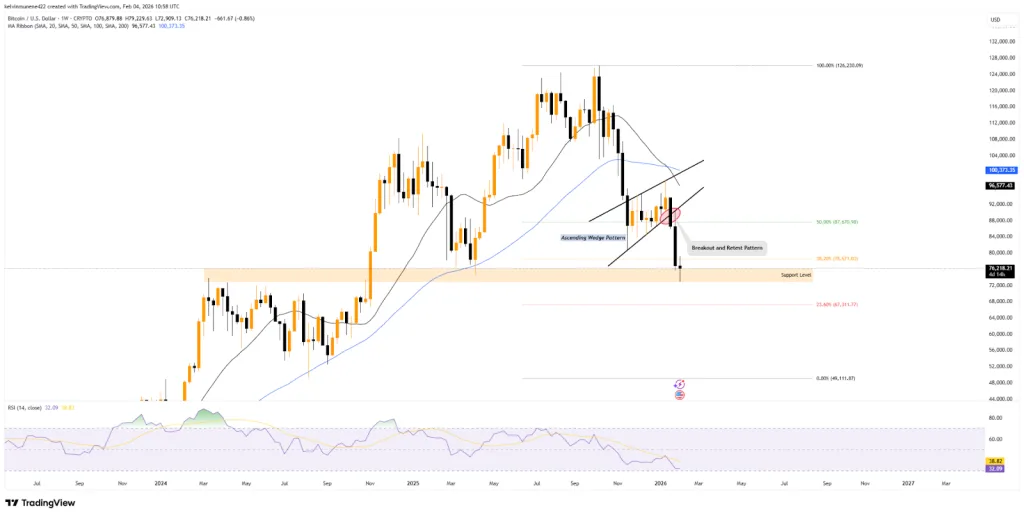

Bitcoin’s reversal took shape slowly at first. Weekly candles began printing lower highs soon after the October peak, eventually forming an ascending wedge, usually a fragile pattern when momentum fades. It did not take long for support to crack.

Once that lower boundary gave way, the selloff steepened into a 19% drop that left the market searching for footing. The pattern’s unwinding fit neatly into the broader sequence: exhaustion at the peak, a brief attempt to stabilize, and then a sharp reset as liquidity thinned.

Each rebound attempt since then has stalled beneath prior resistance, reinforcing the broader downtrend rather than challenging it. The downturn eventually pushed Bitcoin into a familiar band between $72K and $76K. That stretch has acted as a buffer in previous pullbacks, and once again it has slowed the descent.

Source: TradingView

As of the latest readings, Bitcoin traded near $76,013, barely higher on the day but still anchored within the zone that traders watch most closely. Meanwhile, momentum signals remain heavy, though there are signs of fatigue.

The relative strength index has slipped toward oversold territory on the weekly chart, not as a forecast but as a marker of how one-sided recent trading has been. Historically, such readings have aligned with periods of consolidation rather than immediate trend shifts, but the metric at least confirms that sellers have dominated the tape for weeks.

Sentiment Shifts Toward Fear

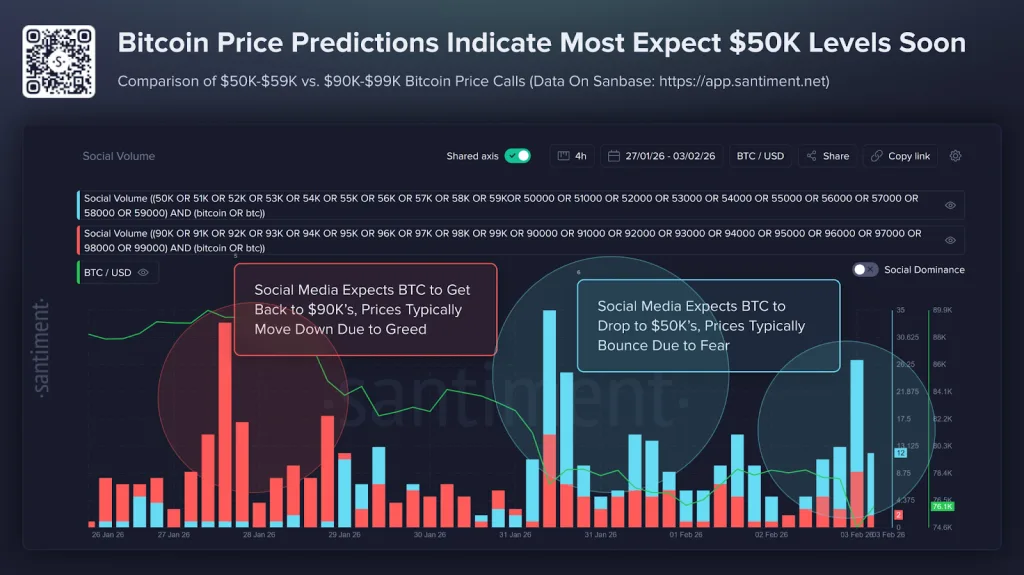

On the other hand, social data shows the mood shifting as well. Santiment tracked a surge in conversations centered on price targets in the $50,000–$59,000 range, while talk of returns to the $90,000–$99,000 area has thinned out.

Source: X

According to the X post, fear now outweighs the confident tone that surrounded the market only a few months ago. The analytics firm noted that crowd expectations often lean in the wrong direction during strong trends, though that tendency does not carry predictive weight on its own.

The jump in lower-price mentions came as the Bitcoin price posted its weakest weekly close since the correction began. Social dominance data also reflected a widening focus on downside scenarios, especially during the final days of January and into early February.

Related: PENGU Stabilizes Amid Bear Pressure: Bounce or Breakdown?

Divergence From Traditional Markets

Overall, the disconnect between Bitcoin and major U.S. indexes remains one of the more striking elements of the current environment. With equities holding firm, crypto’s underperformance has stemmed more from internal positioning, leverage resets, and shifting liquidity than from broader macro pressure.

For now, however, Bitcoin sits at the edge of its support band, digesting a four-month decline that reshaped the market’s tone. The path from here depends less on hopes for a sharp rebound and more on whether this zone can keep absorbing stress in the weeks ahead.