Can VIRTUAL Hit $2? Bullish Patterns Signal a Strong Upside Move

- VIRTUAL climbs 30% from September lows as strong $1 support fuels a sustained bullish recovery.

- Protocol upgrade directs 15% of supply toward liquidity, governance, and community reward growth.

- On-chain data highlights looming short squeeze with VIRTUAL eyeing a bullish path toward $2.

Since the beginning of September, the VIRTUAL token has been on a bullish streak. According to TradingView, the altcoin had found support around the $1.00 mark, which halted further declines and initiated a bullish reversal rally.

As of press time, the token hovers within the $1.30 price range, marking an 11% uptick in the last 24 hours and over 30% from September’s low. Following this bullish surge, a large number of VIRTUAL short position holders have been rekt, amassing $325.99K compared to the $190.96K worth of positions in long holders.

Such a scenario hints that a short squeeze is ongoing, forcing short sellers to cover their positions and further driving up the price of the token. Market experts are also optimistic regarding the VIRTUAL’s bullish sentiment as they side with the possibility of a continued upward trend in the near future.

However, the real question is, will these bullish sentiments be sustainable in the long run and push VIRTUAL to new highs?

Key Reasons VIRTUAL Holds a Bullish Edge

On August 18, Virtual’s Protocol released its Genesis platform upgrade, which added three staking tiers of 21K, 42K, and 100K $VIRTUAL. The project sets aside 15% of the total supply to strengthen the ecosystem, with 7% going to the community, 6% set aside for liquidity, and 2% reserved for veVIRTUAL holders.

The upgrade is meant to encourage people to hold onto their coins for a long time and take part in governance, while also easing supply pressure. Liquidity funding helps trading go more smoothly, and veVIRTUAL rewards link stakeholder incentives directly to the growth of the protocol. Historically, such incentive-based upgrades have triggered fresh demand as investors position early to capture benefits, pointing to possible short-term buying pressure.

Analyst World of Charts projected a positive outlook for VIRTUAL following a confirmed breakout above its horizontal resistance area. According to the analysis, the breakout confirms a reversal from recent consolidation, signaling renewed momentum.

Source: X

The analyst emphasized the importance of maintaining support above the $1.16–$1.18 zone, warning that a drop below could invalidate the bullish setup. Additionally, VIRTUAL is forming a falling wedge pattern on higher timeframes.

According to TradingView’s daily chart, the token’s price action has been hovering within this pattern since its peak around $2.58 in May. Now, the token is hedging toward the wedge’s resistance trendline, which has capped its bullish sentiment. This setup hints at growing short-term bullish momentum.

Source: TradingView

Assuming a breakout above occurs, the altcoin could witness its price surge toward $1.50, an area that coincides with the 50% Fib level and could act as a short-term hurdle. A breakout above this could push VIRTUAL towards the $1.60-$2.00 price range, which aligns with World of Chart’s projections of a 30%+ increase in price. On the other hand, failure to breach the resistance trendline could cause the token to retrace toward the $1.00 support range before attempting another bullish reversal rally.

Related: Worldcoin’s WLD Soars 40% as Bullish Breakout Signals $2 Target Ahead

On-Chain Data Hints at VIRTUAL Short Squeeze Ahead

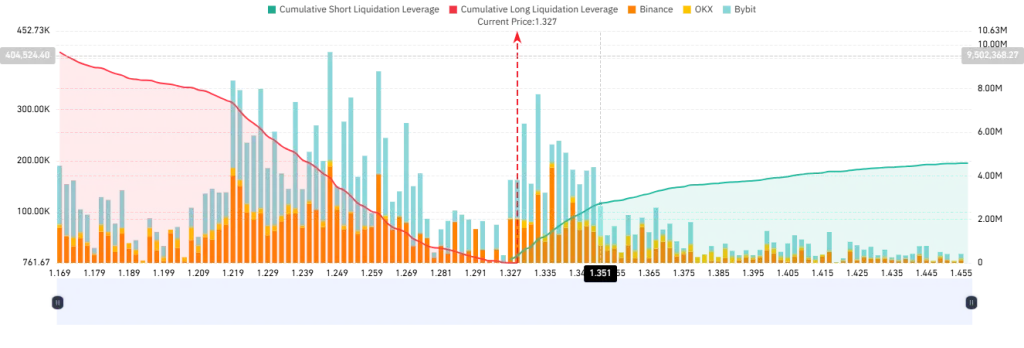

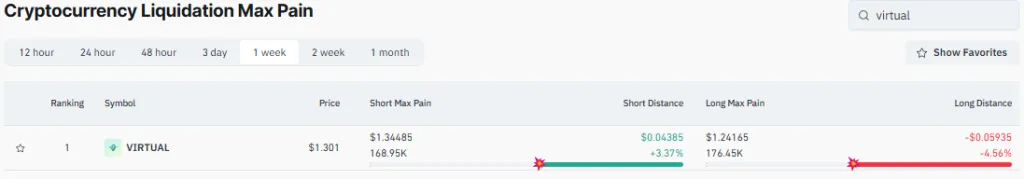

According to the VIRTUAL Exchange Liquidation Map, the token is on the verge of experiencing a short squeeze in the near future. The chart shows the cryptocurrency trading around $1.32, with short positions worth $2.61 million sitting just above it at the $1.349 level.

Source: Coinglass

Besides, the Liquidation Max Pain chart shows that short traders are facing maximum pain at $1.34485, just 3.37% above the current price. Long traders, on the other hand, face the most pain at $1.24165, which is almost 4.56% lower, giving them more time before the risk of liquidation rises.

Source: Coinglass

This imbalance suggests that VIRTUAL is closer to commencing short liquidations, which could speed up buying momentum if the price goes up.

Conclusion

VIRTUAL’s recent price action, protocol upgrades, and on-chain data highlight a strong bullish outlook supported by both technical and fundamental factors. While short squeezes and chart patterns signal immediate upside potential, sustainability will depend on whether the token can maintain key support levels and overcome resistance barriers.