Filecoin Surges 60% as DePIN Growth Fuels Massive Rally

- Filecoin surges over 60% in 24 hours as investors flock to DePIN and blockchain projects.

- New GSR Foundation partnership strengthens push for decentralized data infrastructure.

- Trading volume skyrockets 981% to $1.69B, making Filecoin one of the week’s top gainers.

Filecoin price exploded by more than 60% in the past 24 hours, reaching $2.21 at press time. The decentralized storage token surged as investors turned their attention to the growing DePIN infrastructure and enterprise blockchain integrations. The sharp rally marked one of the most notable comebacks among major cryptocurrencies this week.

The token gained 47% in 7 days, while trading volume jumped 981% to $1.68 billion, based on CoinMarketCap data. The surge showed optimism in decentralized physical infrastructure networks, which stayed active despite the weak market.

Strategic Alliance Boosts Filecoin Amid Market Weakness

The Filecoin Foundation collaborated with the GSR Foundation to fund decentralized storage projects in the areas of art, science, and human rights. The partnership would establish a strong digital data infrastructure. The announcement was accompanied by technical and on-chain data of Filecoin shifting positively, which strengthened confidence in the market.

As Filecoin surged, the rest of the crypto market fell. Bitcoin fell to below $102,000, and Ethereum fell to below $3,300. Strength, however, was exhibited in other projects of DePIN. With Arweave increasing by approximately 38% in the same period, the sector has shown strength relative to the broader market trend.

Filecoin Signals Strong Bullish Momentum After Breakout

Technically, Filecoin indicated a bullish breakout. The token shot almost 63% intra-day, hitting a high of $2.36 before declining. The $2.07 level marked the key support area. Holding this level could pave the way toward $2.40 to $2.50 resistance. A close above $2.07 would validate ongoing momentum. Any fall below $1.90 might result in a short-term correction toward $1.70 before another attempt higher.

Momentum indicators also confirmed strong buying pressure. The MACD line stood at -0.023, well above the signal line at -0.097, indicating a bullish momentum, and the expanding green histogram bars confirm the strength of the bulls. The Relative Strength Index climbed to 66, indicating healthy buying interest without showing signs of immediate overbought conditions.

Related: Real-Time Mapping Upgrade for Lyft via Bee Maps Network

Filecoin Trading Volume and Open Interest Surge

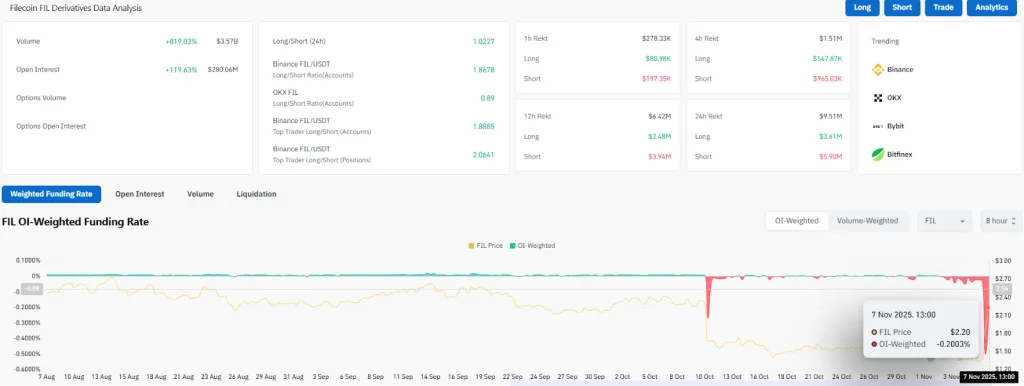

CoinGlass data also shows that the trading volume of Filecoin surged 819.03% to $3.57 billion. Open Interest also increased by 119.63% to $280.06 million. The increase in both indicators indicated a revived interest in speculation and an influx of leveraged positions.

The OI-weighted funding rate stood at -0.2003, implying that a significant number of traders were still short, although the price was rising. This arrangement suggested a short squeeze could occur if an upward trend persisted.

According to liquidation data, a total of $9.51 million in positions were wiped out in 24 hours. There were long liquidations of $3.61 million and short liquidations of $5.90 million. The increased short liquidation figure affirmed that bearish traders have been taken by surprise, which added to the upside surge.

If Filecoin holds above $2.00, it may gain momentum toward $2.50 in the short term. It is critical to hold above the breakout level to preserve trend structure. A decisive break above $2.50 may open the door to a push to $3.00, subject to market sentiment and sector strength.

The growth of Filecoin made it one of the most successful players in the DePIN ecosystem. The price moves were consistent with the growth of institutional activity and the revived hope in decentralized data protocols. Filecoin demonstrated that utility-based networks could perform better in less certain times, despite market caution.